Last updated: July 27, 2025

Introduction

Tobramycin, an aminoglycoside antibiotic discovered in the 1960s, remains a critical agent in the management of severe bacterial infections, particularly those caused by Gram-negative organisms. Its established efficacy in conditions such as cystic fibrosis-associated Pseudomonas aeruginosa infections and hospital-acquired pneumonia sustains its relevance amid evolving antimicrobial resistance concerns. This analysis evaluates current market dynamics, future demand, competitive landscape, and price trajectories for tobramycin, offering strategic insights for pharmaceutical stakeholders and investors.

Market Overview

Current Market Size and Segments

The global antibiotic market was valued at approximately $50 billion USD in 2022, with aminoglycosides—including tobramycin—comprising a significant subset. Tobramycin specifically mainly targets hospital and specialty care settings, owing to its intravenous (IV) and inhalation formulations. The inhaled form, notably Tobramycin Inhalation Solution (TOBI), addresses cystic fibrosis-related Pseudomonas infections, representing a lucrative niche with dedicated patient populations.

In 2022, the inhaled tobramycin segment accounted for roughly 35-40% of the tobramycin market, driven by chronic usage in cystic fibrosis. The remaining market is split between IV formulations for serious systemic infections and compounded topical applications. Overall, the direct-to-consumer and outpatient segments show steady growth, bolstered by advances in drug delivery systems.

Global Demand Drivers

- Prevalence of Cystic Fibrosis: With approximately 70,000 individuals living with cystic fibrosis worldwide, demand for inhaled tobramycin remains robust, particularly in North America and Europe (Cystic Fibrosis Foundation, 2022).

- Hospital-Acquired Infections (HAIs): The enduring necessity for effective Gram-negative coverage sustains IV tobramycin usage. The rising incidence of HAIs and antimicrobial resistance (AMR) propels demand for potent antibiotics with proven efficacy.

- Antimicrobial Resistance (AMR): The escalation of multidrug-resistant organisms (MDROs) reinforces the importance of aminoglycosides like tobramycin, although resistance trends pose challenges.

Market Challenges

- Resistance Development: Emergence of tobramycin-resistant strains constrains its utility, prompting reliance on newer agents and combination therapies.

- Toxicity Concerns: Nephrotoxicity and ototoxicity limit dosage and duration, influencing prescribing patterns.

- Generic Competition: Numerous generic formulations erode margins, though branded inhaled formulations maintain premium pricing due to specialized delivery systems.

Competitive Landscape

Key Players and Product Portfolio

- Novartis and Chiesi dominate the inhaled tobramycin market, with products like TOBI and its generic equivalents.

- Fresenius Kabi and MediGene AG produce IV formulations mainly for hospitals.

- Biosimilar and generic entrants intensify competition, especially in the IV segment, driving price compression.

Regulatory Environment

- Regulatory agencies (FDA, EMA) impose stringent standards for inhaled antibiotics, with approvals contingent on demonstrating safety and efficacy.

- Pending or recent approvals of biosimilars or generic versions could alter market dynamics, impacting prices and margins.

Market Size and Price Projections

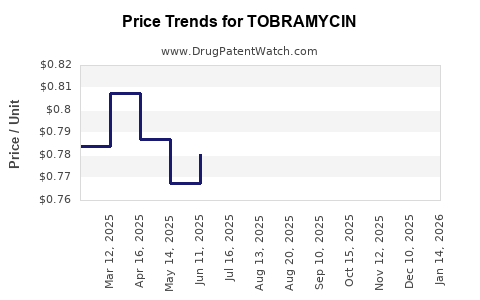

Historical Pricing Trends

- The brand-name inhalation formulations of tobramycin have historically commanded premium prices, ranging from $300 to $600 per 300 mg vial, depending on the region and healthcare setting (IQVIA, 2022).

- Generic IV formulations have seen prices drop by approximately 40-50% over the past decade due to market competition, averaging approximately $2-4 per 80 mg vial in high-income markets.

Future Demand and Growth Trajectory

- The global cystic fibrosis population is projected to grow at a CAGR of 4.8% through 2030, correlating with increased inhaled tobramycin demand.

- The hospital segment is expected to expand driven by rising antimicrobial resistance, with tobramycin maintaining a key role in empiric therapy.

- The global antibiotic market growth is projected at 3.1% CAGR from 2023 to 2030, with aminoglycosides like tobramycin maintaining a steady share.

Price Projections (2023-2030)

-

Inhaled Tobramycin:

- Short-term (2023-2025): Prices are expected to plateau or marginally decline due to generic competition. Premium inhalation formulations may see a slight erosion (~5-10%), but brand loyalty and chronic therapy regimens support stability.

- Long-term (2026-2030): With increased biosimilar entrants and potential new inhalation technologies, prices could decline by up to 20-30%. Innovator brands may adopt value-based pricing, maintaining margins through improved delivery systems.

-

IV Tobramycin:

- Short-term: Prices are stabilizing due to high generic penetration.

- Long-term: Mild decline of 10-15% driven by biosimilars and hospital procurement negotiations.

Price Drivers and Impediments

Drivers:

- Increasing demand for inhaled formulations in cystic fibrosis management.

- Rising prevalence of antimicrobial-resistant infections requiring aminoglycoside therapy.

- Limited alternative therapies with comparable efficacy in specific niches.

Impediments:

- Antimicrobial stewardship regulations restricting usage.

- Development of resistance reducing the formulary relevance.

- Price sensitivity in emerging markets constraining premium pricing.

Regulatory and Market Access Outlook

- Advancements in inhalation device technology and formulations are likely to extend patent life and sustain premium prices temporarily.

- Health authority policies emphasizing antimicrobial stewardship may restrict use, impacting volume but not necessarily prices.

- Payment models favoring cost-effectiveness could favor generic formulations, pressuring branded product pricing.

Key Market Trends and Strategic Considerations

- Innovation in Delivery Systems: Companies investing in inhalation device improvements and sustained-release formulations could command higher EBP (economic benefit per dose).

- Expansion in Emerging Markets: Growing healthcare expenditure and rising cystic fibrosis awareness support penetration, though pricing parity may be moderated by local affordability constraints.

- Combination Therapy Development: Combining tobramycin with other antimicrobials may create new market segments and elevate demand.

Conclusion

The tobramycin market demonstrates resilience rooted in niche therapeutic applications, especially in cystic fibrosis. While generic competition and stewardship policies exert downward pressure, innovative formulations, improved delivery mechanisms, and expanding indications support sustained demand. Price trajectories suggest modest decline in the short term, with potential stabilization or marginal erosion over the next decade. Stakeholders must balance innovation, market access strategies, and stewardship adherence to capitalize on this enduring antibiotic asset.

Key Takeaways

- Demand Stability: The growing cystic fibrosis population and rising antimicrobial resistance ensure consistent demand for inhaled tobramycin.

- Pricing Dynamics: Premium prices persist for branded inhaled formulations; generics dominate IV segments, driving prices downward.

- Competitive Landscape: Biosimilars and generics threaten brand margins; innovation in delivery systems can create premium opportunities.

- Market Outlook: Moderate decline in prices expected; sustained demand through technological differentiation and niche applications.

- Strategic Focus: Emphasize R&D in delivery systems, expand into emerging markets thoughtfully, and adhere to stewardship policies to optimize market positioning.

FAQs

Q1: How will antimicrobial resistance affect the future demand for tobramycin?

A: Rising resistance may initially restrict use, but it could also bolster demand in resistant infections where tobramycin remains effective. Resistance development underscores the need for stewardship and may accelerate innovation in formulations.

Q2: Are biosimilars likely to replace branded inhaled tobramycin?

A: Biosimilars could increase competition and reduce prices. However, brand loyalty, delivery device advantages, and regulatory hurdles may slow their full market adoption.

Q3: What upcoming innovations could influence tobramycin pricing?

A: Advances in inhalation technology (e.g., nanoparticle carriers, sustained-release formulations) could sustain premium pricing by improving efficacy, convenience, and safety.

Q4: How significant is the role of emerging markets in the tobramycin market?

A: Emerging markets present growth opportunities driven by increasing healthcare access and cystic fibrosis awareness, though pricing sensitivity may limit premium pricing strategies.

Q5: What strategic considerations should pharmaceutical companies prioritize?

A: Focus on innovation in delivery methods, build access in emerging markets, maintain stewardship compliance, and differentiate through clinical benefits to sustain or grow market share.

References

[1] Cystic Fibrosis Foundation. (2022). Annual Data Report.

[2] IQVIA. (2022). Global Market Analysis of Antibiotics.

[3] ResearchAndMarkets. (2023). Antimicrobial Market Forecast.