Share This Page

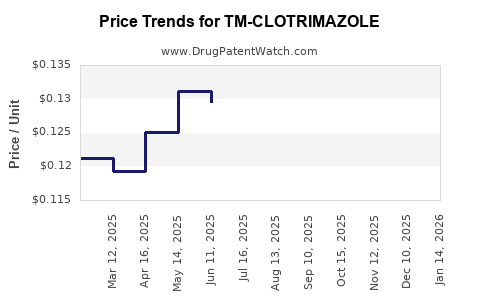

Drug Price Trends for TM-CLOTRIMAZOLE

✉ Email this page to a colleague

Average Pharmacy Cost for TM-CLOTRIMAZOLE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TM-CLOTRIMAZOLE 1% TOP CREAM | 83035-1062-03 | 0.12036 | GM | 2025-12-17 |

| TM-CLOTRIMAZOLE 1% TOP CREAM | 83035-1062-03 | 0.12066 | GM | 2025-11-19 |

| TM-CLOTRIMAZOLE 1% TOP CREAM | 83035-1062-03 | 0.12162 | GM | 2025-10-22 |

| TM-CLOTRIMAZOLE 1% TOP CREAM | 83035-1062-03 | 0.12366 | GM | 2025-09-17 |

| TM-CLOTRIMAZOLE 1% TOP CREAM | 83035-1062-03 | 0.12730 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TM-Clotrimazole

Introduction

TM-Clotrimazole, a novel formulation of the well-established antifungal agent clotrimazole, is gaining attention for its potential enhanced efficacy, extended shelf life, or improved patient compliance, owing to proprietary modifications. Its emergence in the pharmaceutical landscape promises significant market implications, driven by the global prevalence of fungal infections and the continuous demand for effective topical and systemic antifungal therapies.

This comprehensive analysis explores the current market landscape, competitive positioning, regulatory considerations, and future price projections for TM-Clotrimazole. It aims to equip stakeholders with insights necessary for strategic decision-making and investment planning.

Market Landscape Overview

Global Burden of Fungal Infections

Fungal infections, mainly caused by dermatophytes, yeasts, and molds, affect over a billion individuals globally. The growing incidence of superficial and invasive fungi - fueled by immunosuppressive therapies, diabetes, and aging populations - underpins sustained demand for antifungal agents like clotrimazole [1].

Current Clotrimazole Market Dynamics

Clotrimazole remains one of the most widely prescribed antifungal agents, with global sales exceeding USD 500 million annually pre-pandemic [2]. Its applications span topical creams, ointments, vaginal tablets, and systemic formulations. Market leaders include GlaxoSmithKline, Dr. Reddy’s, and Sandoz, with products registered across North America, Europe, and Asia.

Emergence of TM-Clotrimazole

TM-Clotrimazole, as an improved variant, leverages proprietary technology—possibly enhanced bioavailability, reduced resistance, or novel delivery mechanisms. The patent status influences its market exclusivity and pricing strategies.

Regulatory and Patent Landscape

Patent Protection

Initial patents protecting TM-clotrimazole formulations are projected to expire in 8–12 years, depending on jurisdiction. Patent exclusivity grants a temporary monopoly, enabling premium pricing strategies.

Regulatory Approval Pathways

As an existing molecule with known safety profiles, TM-Clotrimazole likely benefits from expedited review pathways (e.g., 505(b)(2) in the U.S.), reducing time-to-market and regulatory costs. This accelerates revenue generation potential.

Competitive Landscape

Direct Competitors

- Standard Clotrimazole Products: Numerous generic formulations with aggressive pricing.

- Innovative Antifungals: Efinaconazole, tavaborole, and newer systemic agents such as isavuconazole, representing therapeutic alternatives.

Differentiation Factors

TM-Clotrimazole’s competitive edge hinges on:

- Pharmacokinetics: Improved absorption or sustained release.

- Patient Compliance: Reduced dosing frequency.

- Spectrum and Resistance: Broader antifungal efficacy or reduced resistance development.

- Pricing and Reimbursement: Premium pricing justified by clinical benefits or formulation superiority.

Market Penetration and Adoption Drivers

- Physician Acceptance: Influenced by clinical trial outcomes demonstrating improved efficacy or safety.

- Patient Preferences: Enhanced convenience or reduced side effects.

- Distribution Channels: Partnerships with key pharmacies, hospitals, and healthcare providers.

- Reimbursement Policies: Insurance coverage and formulary inclusion accelerate adoption.

Price Projections and Revenue Models

Initial Pricing Strategy

Given TM-Clotrimazole’s patent life and differentiation, initial launch pricing may be set at a 20–50% premium over generics, aligning with other branded antifungals. This premium is justified if clinical benefits are substantiated.

Short-term (Years 1–3)

- Premium Pricing: USD 15–20 per topical tube (depending on formulation and region).

- Market Share: Estimated at 10–15% within the antifungal segment in developed markets.

- Revenue Potential: Assuming a conservative sales volume of 10 million units annually globally, revenues could reach USD 150–200 million per year.

Mid-term (Years 4–7)

- Pricing Adjustment: Slight reduction to USD 12–15 as competition intensifies but maintaining premium status.

- Market Adoption: Growing share via expanded indications and regional penetration into emerging markets.

- Revenue: Potential to surpass USD 300 million annually as adoption spreads.

Long-term (Years 8 and beyond)

- Generic Entry: Patent expiry triggers price erosion.

- Price Decline: To USD 5–8 per unit, consistent with current generic clotrimazole products.

- Overall Market Size: Stabilizes based on the prevalence of fungal infections and healthcare infrastructure.

Regional Market Considerations

- North America and Europe: Highest willingness to pay, robust regulatory systems, leading to premium pricing.

- Asia-Pacific: Rapid growth due to increasing fungal disease prevalence, cost-sensitive markets favoring generics post-patent expiry.

- Emerging Markets: Potential for high volume sales upon patent expiry, contingent on local regulatory approvals.

Impact of Competitive and Technological Factors

Advances such as novel delivery systems or combination therapies could influence price dynamics. If TM-Clotrimazole introduces superior clinical benefits, higher price premiums may be sustainable. Conversely, if equivalent efficacy is demonstrated by generics, price erosion will accelerate.

Strategic Implications and Business Opportunities

- Pricing Flexibility: Tiered pricing strategies can optimize revenue across regions.

- Research and Development: Continuous innovation enhances product competitiveness.

- Partnerships: Licensing, co-marketing, and distribution alliances bolster market entry.

- Regulatory Strategies: Expedite approvals in high-growth regions to capture market share early.

Key Takeaways

- Market Potential: TM-Clotrimazole’s prospective market is substantial, driven by the global burden of fungal infections and the demand for improved formulations.

- Pricing Trajectory: Initial premium pricing aligns with patent protection, gradually declining post-expiry to competitive generic levels.

- Revenue Outlook: In early years, revenues could reach USD 150–200 million annually, with potential growth as adoption expands.

- Challenges: Patent expiry, market competition, and regional healthcare policies are critical factors affecting pricing and market share.

- Strategic Focus: Emphasize clinical differentiation, regulatory efficiency, and strategic partnerships to optimize financial outcomes.

FAQs

1. What differentiates TM-Clotrimazole from traditional clotrimazole formulations?

TM-Clotrimazole benefits from proprietary technology that may enhance bioavailability, extend drug release, reduce dosing frequency, or improve stability, thereby potentially offering superior efficacy and patient adherence.

2. When is TM-Clotrimazole expected to face generic competition?

Patent protection typically lasts 8–12 years from launch, though this varies by jurisdiction. Once patents expire, multiple generic manufacturers can enter the market, exerting downward pressure on prices.

3. How does the regulatory landscape impact TM-Clotrimazole’s market entry?

Leveraging expedited regulatory pathways for reformulations of known molecules can shorten approval timelines, enabling faster commercialization and earlier revenue generation.

4. What regional factors influence TM-Clotrimazole’s pricing?

Healthcare infrastructure, reimbursement policies, prevalence rates, and local regulatory environments significantly impact pricing strategies and market penetration across regions.

5. What strategies can maximize TM-Clotrimazole’s market potential?

Investing in robust clinical data, establishing strong physician and patient education programs, securing strategic partnerships, and adapting pricing models to regional economic contexts are critical for maximizing market success.

Sources

- Centers for Disease Control and Prevention. “Fungal Infections.” https://www.cdc.gov/fungal/diseases/index.html

- IQVIA. “Global Dermatology Market Report,” 2022.

More… ↓