Last updated: July 27, 2025

Introduction

Tiotropium, a long-acting anticholinergic bronchodilator, is integral in managing chronic obstructive pulmonary disease (COPD) and asthma. The drug’s efficacy in reducing exacerbations and improving lung function has established it as a staple in respiratory therapeutics. As the pharmaceutical landscape evolves, understanding market dynamics and pricing trends for Tiotropium becomes paramount for stakeholders ranging from manufacturers to healthcare providers. This analysis explores current market conditions, competitive landscape, regulatory influences, and provides price projections grounded in industry trends and economic factors.

Market Overview

Global Market Size and Growth Trajectory

The global Tiotropium market was valued at approximately USD 2.1 billion in 2022, with a compound annual growth rate (CAGR) projected at around 5.1% through 2030.[1] This growth is driven by rising COPD prevalence, especially in aging populations across North America, Europe, and Asia-Pacific, coupled with increased awareness and diagnosis of respiratory conditions.

Regional Market Insights

-

North America: Dominates the market, accounting for over 40% of global revenue, owing to high COPD prevalence (approximately 16 million Americans affected, per CDC), advanced healthcare infrastructure, and favorable reimbursement policies.

-

Europe: The second-largest segment; high COPD burden and strong adoption of inhaled therapies contribute to sustained demand.

-

Asia-Pacific: Fastest-growing region, with expanding healthcare access and increasing disease awareness, projected to outpace other regions in market expansion.

Key Market Drivers

- Rising prevalence of COPD (expected to affect over 200 million globally by 2030).

- Acceptance of inhaled long-acting anticholinergics as first-line therapy.

- Increasing geriatric population susceptible to respiratory diseases.

- Patent expirations leading to generic entry, increasing accessibility.

Market Challenges

- Patent expirations of original formulations (notably derived from the Spiriva brand by Boehringer Ingelheim) have led to a surge in generic competition, exerting price pressures.

- Stringent regulatory pathways for biosimilars and generics could influence market entry and pricing.

Competitive Landscape

Major Players

- Boehringer Ingelheim: Original patent holder for Spiriva (Tiotropium bromide), maintaining significant market share through brand loyalty and established distribution channels.

- Teva Pharmaceuticals: Generic producer post-patent expiry, offering lower-cost alternatives.

- Mylan (now part of Viatris): Competitor with generic formulations.

- Other regional players: Emerging manufacturers in developing countries providing affordable options.

Product Variants

- HandiHaler: Original inhaler device associated with Spiriva.

- Respimat: Soft mist inhaler providing enhanced delivery and patient compliance.

- Generic equivalents: Lower-cost versions available since patent expiry, with varying device formats.

Pricing Strategies

Brand-name products tend to command premium prices, while generics and biosimilars aim to capture cost-sensitive segments, exerting downward pressure on overall market prices.

Regulatory Environment

Patent Landscape

- Boehringer Ingelheim’s patent for Spiriva expired in key markets between 2010-2015, paving the way for generics.

- Patent litigations and patent extensions continue in multiple jurisdictions, impacting market entry timelines.

Reimbursement and Policy

- Coverage decisions by agencies like CMS in the US and NICE in the UK influence pricing and access.

- Emphasis on cost-efficient COPD management accelerates adoption of generic Tiotropium.

Pricing Trends and Projections

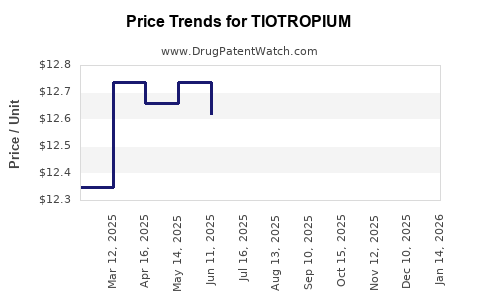

Historical Price Patterns

- Brand-Name Tiotropium (Spirova): Historically priced at USD 300-350 per inhaler (30-day supply).

- Generic Versions: Entered the market between USD 100-150 per inhaler, representing a 40-50% reduction in cost.

- Pricing erosion: Ongoing due to increased generic competition and market saturation.

Projected Price Developments (2023-2030)

-

Short-term (2023-2025): Prices for brand-name products will stabilize owing to brand loyalty, expect gradual declines (~5% annually) due to biosimilar entry.

-

Mid-term (2025-2027): Generic market proliferation will intensify, accelerating price reductions to approximately 10-15% annually, further lowering costs to USD 70-100 per inhaler in mature markets.

-

Long-term (2028-2030): Prices could plateau at lower bounds (~USD 50-80), particularly in regions with aggressive price negotiations and government-mandated price controls.

-

Impact of biosimilars and innovative delivery devices may further influence price dynamics through competitive differentiation.

Factors Influencing Price Trends

- Market saturation: Increased availability of generics leads to aggressive discounting to capture market share.

- Pricing regulation: Governments' price caps and reimbursement policies will continue to exert downward pressures.

- Technological innovations: Improved inhaler devices and formulations (e.g., digital inhalers) could add premium value, potentially stabilizing prices in specific segments.

- Manufacturing costs and raw material prices: Fluctuations affect baseline costs, influencing final prices.

Key Market Opportunities and Risks

Opportunities

- Emerging markets: Rapid adoption due to cost sensitivity offers growth opportunities.

- Combination therapies: Fixed-dose combinations with LABAs or ICS expand market potential.

- Digital health integration: Incorporation of digital tracking may justify premium pricing.

Risks

- Patent litigation delays: Potential to postpone generic entry and affect pricing strategies.

- Regulatory hurdles: Stringent approval processes may hinder rapid product launches.

- Market saturation: Excess supply could depress prices further.

Conclusion

Tiotropium remains a critical therapeutic agent for COPD management, with its market characterized by steady growth, increasing competition, and evolving regulatory and pricing landscapes. The expiration of patents and rise of generic alternatives have led to significant price reductions, with forecasts indicating continued downward pressure over the next decade. Stakeholders should monitor regional regulatory policies, technological innovations, and market dynamics to optimize pricing strategies and market penetration.

Key Takeaways

- The global Tiotropium market is poised for sustained growth via regional expansion, particularly in Asia-Pacific and emerging markets.

- Patent expirations have spurred a wave of generics, significantly reducing prices and intensifying competition.

- Short-term prices for brand-name Tiotropium will stabilize but decline gradually; generics will lead the price reduction trajectory.

- Long-term projections suggest inhaler devices' technological advancements and digital health integration may create niche premium markets.

- Regulatory policies and government interventions will remain pivotal in shaping future pricing strategies.

FAQs

Q1: How will patent expirations affect Tiotropium pricing?

A1: Patent expirations opened the market to generic manufacturers, leading to immediate price reductions of up to 40-50%, with ongoing declines as competition intensifies.

Q2: Are generic Tiotropium formulations therapeutically equivalent to brand-name versions?

A2: Yes. Regulatory agencies require generics to demonstrate bioequivalence and therapeutic comparability to the originator.

Q3: What factors could disrupt current price projections?

A3: Regulatory changes, supply chain disruptions, patent litigations, or breakthroughs in delivery technologies could alter pricing trends.

Q4: Which regions offer the highest growth potential for Tiotropium?

A4: Asia-Pacific and Latin America, driven by expanding markets, increasing COPD prevalence, and improving healthcare infrastructures.

Q5: How might the use of digital inhalers influence Tiotropium’s market?

A5: Digital inhalers could command premium prices through enhanced patient adherence tracking and personalized therapy, although initial costs may be higher.

References

[1] Grand View Research. “Tiotropium Market Size, Share & Trends Analysis Report.” 2023.