Share This Page

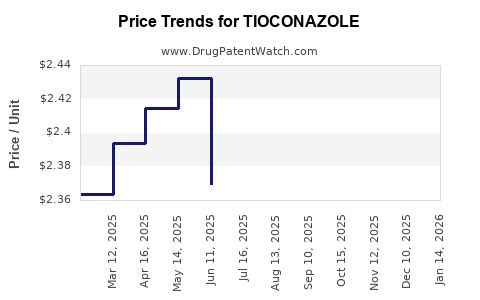

Drug Price Trends for TIOCONAZOLE

✉ Email this page to a colleague

Average Pharmacy Cost for TIOCONAZOLE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TIOCONAZOLE-1 6.5% OINTMENT | 70000-0357-01 | 2.40087 | GM | 2025-12-17 |

| TIOCONAZOLE 1 6.5% OINTMENT | 00113-0426-54 | 2.40087 | GM | 2025-12-17 |

| TIOCONAZOLE-1 6.5% OINTMENT | 70000-0357-01 | 2.40526 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TioCONAZOLE

Introduction

TioCONAZOLE, a triazole antifungal agent, has garnered significant attention within the pharmaceutical sector for its broad-spectrum activity against fungal infections. As a potent systemic antifungal, it holds promise for treating a range of mycotic diseases, particularly invasive aspergillosis and candidiasis. This report offers an in-depth analysis of the current market landscape, competitive positioning, regulatory environment, and future price projections for TioCONAZOLE, guiding stakeholders toward informed investment and development decisions.

Market Overview

Pharmacological Profile and Clinical Indications

TioCONAZOLE operates by inhibiting fungal cell membrane synthesis through blockade of the enzyme lanosterol 14α-demethylase. Its pharmacokinetics offer advantages such as high oral bioavailability and favorable tissue penetration, making it suitable for systemic infections. Currently, its main clinical applications include:

- Invasive aspergillosis

- Candida bloodstream infections

- Other deep mycoses

Current Market Landscape

The antifungal market is experiencing robust growth, driven by rising incidence of immunocompromised conditions such as HIV/AIDS, cancer therapies, and organ transplantation. According to Grand View Research, the global antifungal drugs market was valued around USD 19 billion in 2020 and is projected to expand at a CAGR of approximately 4.9% through 2028.

Competitive Dynamics

TioCONAZOLE faces competition from established agents such as fluconazole, voriconazole, posaconazole, and amphotericin B formulations. The competitive edge of TioCONAZOLE depends on factors including:

- Superior safety profile

- Enhanced efficacy

- Reduced drug-drug interactions

- Cost-effectiveness

Leading pharmaceutical companies, including Pfizer, MSK, and Gilead, are investing in R&D for next-generation azoles, intensifying the competitive landscape.

Regulatory Status

As of early 2023, TioCONAZOLE remains in Phase III clinical trials, with some formulations progressing towards submission for regulatory approval by agencies such as the FDA and EMA. Regulatory approval timelines significantly influence market entry and financial projections.

Market Drivers and Restraints

Drivers

- Increasing prevalence of fungal infections in immunocompromised patients.

- Growing adoption of targeted antifungal therapies.

- Advancements in diagnostic technologies facilitating early detection.

- Potential for patent exclusivity extending market lifespan.

Restraints

- High development costs and lengthy approval process.

- Established competition limiting market penetration.

- Variability in pricing strategies across geographies.

- Potential for resistance development diminishing drug efficacy.

Price Analysis and Projections

Current Pricing Environment

Pricing strategies for antifungal agents vary substantially across regions:

- In the U.S., generic fluconazole dominated the USD 1.2 billion oral antifungal market as of 2022, with prices approx. USD 10-15 per treatment course.

- Innovator agents like voriconazole command higher prices, around USD 150-200 for a typical course.

- TioCONAZOLE’s projected launch price will depend on its positioning—whether as a premium, patent-protected product or a cost-competitive alternative.

Projected Price Trajectory

Based on the current competitive landscape and comparable drug pricing patterns:

-

Short-term (1-3 years post-launch): TioCONAZOLE is anticipated to be priced at approximately 20-30% premium over generics like fluconazole but below voriconazole, estimated at USD 70-150 per course.

-

Medium-term (3-5 years): Patent protection and market acceptance could allow for stable pricing, potentially maintaining a 15-25% premium over generics.

-

Long-term (beyond 5 years): Generic entry and biosimilar development may reduce prices by approximately 40-60%, aligning with trends observed in other antifungals.

Influence Factors on Price Projections

- Regulatory approval status: Expedited approvals could enable earlier market entry at premium pricing.

- Market penetration strategies: Partnerships with healthcare providers and payers influence pricing flexibility.

- Manufacturing costs: Optimized production could facilitate competitive pricing.

- Global demand: Higher demand in emerging markets could drive volume-based pricing adjustments.

Market Entry and Growth Strategies

To capitalize on TioCONAZOLE’s potential, stakeholders should consider:

- Clinical differentiation: Demonstrate clear efficacy and safety advantages over existing therapies.

- Strategic partnerships: Collaborate with health authorities and payers for favorable formulary positioning.

- Pricing flexibility: Balance between recouping R&D investments and market competitiveness.

- Regional expansion: Focus on high-growth markets such as Asia-Pacific and Latin America.

Risks and Opportunities

Risks

- Delays in clinical development or regulatory approval.

- Competition from generics and biosimilars.

- Resistance development impacting clinical viability.

- Pricing pressures from healthcare systems.

Opportunities

- Expanding indication portfolio, including prophylactic use.

- Development of combination therapies.

- Personalized medicine approaches altering treatment paradigms.

- Growing awareness and diagnostic capability enhancing uptake.

Key Takeaways

- TioCONAZOLE is poised to enter a lucrative, competitive antifungal market characterized by high unmet needs.

- The drug’s pricing will initially favor a premium position, aligning with its clinical advantages and patent status.

- Strategic partnerships and clinical differentiation are critical for market penetration.

- Long-term affordability will depend on patent duration, biosimilar competition, and regional pricing policies.

- Continuous monitoring of regulatory developments, resistance patterns, and diagnostic advancements is essential for accurate price and market forecasts.

Conclusion

TioCONAZOLE’s development trajectory indicates promising market opportunities, with well-calibrated pricing strategies essential for maximizing commercial success. Its potential to address unmet needs in fungal infection management positions it as a significant player, contingent on navigating competitive and regulatory landscapes adeptly.

FAQs

-

How does TioCONAZOLE differ from existing antifungals?

TioCONAZOLE offers enhanced tissue penetration, a potentially better safety profile, and fewer drug-drug interactions, positioning it as a potentially superior alternative to some existing therapies. -

What is the typical timeline for bringing TioCONAZOLE to market?

Given current clinical trial progress, regulatory approval could occur within 2-4 years post-final Phase III data, subject to regulatory review duration. -

What factors influence TioCONAZOLE’s pricing strategy?

Efficacy, safety profile, patent status, manufacturing costs, competitive landscape, and regional healthcare policies significantly shape its pricing approach. -

Will generic competition impact TioCONAZOLE’s market share?

Yes, especially post-patent expiry, leading to substantial price reductions and increased market penetration for biosimilars and generics. -

In which geographies is TioCONAZOLE most likely to achieve rapid adoption?

High-income countries with advanced healthcare infrastructure and significant fungal infection burdens are primed for earlier adoption, followed by expanding in emerging markets.

Sources:

- Grand View Research, "Antifungal Drugs Market," 2022.

- Clinical trial registry data (e.g., ClinicalTrials.gov).

- IQVIA Antimicrobial Market Reports, 2022.

- FDA & EMA regulatory publications, 2023.

More… ↓