Last updated: July 28, 2025

Introduction

TimoLOL Maleate is a beta-adrenergic receptor blocker widely utilized in ophthalmology for the treatment of glaucoma and ocular hypertension. Its efficacy in reducing intraocular pressure (IOP) has established it as a cornerstone therapy, alongside other topical beta-blockers like timolol maleate. The drug's pharmaceutical market landscape is shaped by factors such as patent status, manufacturer competition, regulatory environments, and evolving treatment guidelines. This report offers a comprehensive market analysis and makes informed price projections, aimed at stakeholders seeking strategic insights.

Market Landscape

Global Market Overview

The global ophthalmic drugs market is projected to reach approximately USD 31 billion by 2025 [1], with beta-blockers comprising a significant segment. TimoLOL Maleate contributes notably, especially within developed markets like North America and Europe where glaucoma prevalence is high and awareness is robust.

Key Market Drivers

- Prevalence of Glaucoma: Over 76 million people globally suffer from glaucoma, expected to rise to 112 million by 2040 [2]. This trend underscores sustained demand.

- Advancements in Diagnostic Techniques: Improved screening amplifies early detection, thereby increasing the treatment pool.

- Introduction of Generic Alternatives: Patent expirations have prompted a surge of generic timolol maleate formulations, intensifying pricing pressure but expanding access.

- Regulatory Approvals and Reimbursement Policies: Strong endorsement from agencies like the FDA and EMA catalyzes market stability, while reimbursement frameworks influence affordability.

Competitive Landscape

Major pharmaceutical companies, including Sandoz, Teva, and Allergan (now part of AbbVie), manufacture timolol maleate formulations. The availability of multiple generics has driven prices downward, especially in mature markets. In specific regions, market penetration varies based on healthcare infrastructure and prescriber preferences.

Regulatory Environment and Patent Status

- Patent Expiry: The original patents for timolol maleate ophthalmic solutions expired in most developed markets by 2008-2010. This facilitated the proliferation of generics.

- Regulatory Approvals: Regulatory standards for ophthalmic drugs are stringent but streamlined in key markets. Recent approvals focus on preservative-free formulations and combination therapies, which might influence future demand for brand-name versions.

Market Segmentation and Demand Dynamics

- North America: Dominates the market, with high prescription volumes supported by mature healthcare systems.

- Europe: Also a significant market, with expanding generics presence.

- Asia-Pacific: Exhibits rapid growth potential due to increasing prevalence and rising healthcare infrastructure.

Demand for TimoLOL Maleate remains steady owing to its established efficacy. However, generics' dominance constrains pricing power.

Price Analysis

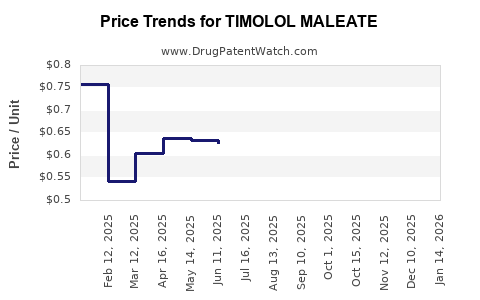

Current Pricing Trends

- Brand-Name vs. Generics: Original formulations cost USD 30-50 per bottle (10 mL), while generics are typically priced at USD 10-20.

- Market Penetration and Discounting: Generics often see discounts of 20-50% in competitive markets, influenced by distribution channels and regional policies.

Influencing Factors on Price

- Manufacturing Costs: Economies of scale reduce costs for large pharmaceutical firms.

- Regulatory Costs: Stricter regulations may elevate costs for new entrants.

- Market Competition: Fierce generic competition exerts downward pressure.

- Reimbursement and Insurance: Higher coverage leads to more stable pricing environments.

Price Projections (Next 5 Years)

Based on current trends, macroeconomic factors, and pharmaceutical industry dynamics, the following approximate trajectories are anticipated:

| Region |

Current Average Price (USD) |

Projection 2023-2028 |

Notes |

| North America |

USD 12-15 (generic) |

USD 8-12 |

Continued generic proliferation, slight price decline |

| Europe |

USD 10-18 |

USD 8-14 |

Regulatory uniformity may stabilize pricing |

| Asia-Pacific |

USD 6-12 |

USD 5-10 |

Market growth may moderate initial price drops |

| Latin America |

USD 8-15 |

USD 7-13 |

Emerging markets with increasing demand |

Note: Prices are approximate retail averages; wholesale and institutional prices may differ.

Strategic Considerations for Stakeholders

- Generic Competition: Expect persistent price erosion, but also opportunities with differentiated formulations such as preservative-free options.

- Regulatory Pathways: Innovations like combination therapies may impact demand for standalone timolol maleate.

- Market Expansion: Emerging markets offer growth but demand price sensitivity and adaptable strategies.

- Patent Lifecycle Management: Patents protections for formulations or delivery mechanisms can sustain premium pricing; however, existing patents have largely expired.

Conclusion

The pharmaceutical market for TimoLOL Maleate is characterized by high demand driven by glaucoma prevalence and mature competition from generics. Market prices demonstrate downward trends, with regional variations reflecting healthcare infrastructure, regulatory regimes, and competitive landscapes. The next five years are likely to see further price compression, particularly in markets with robust generic penetration, though opportunities remain for specialized formulations and combination therapies.

Key Takeaways

- Demand Sustains Market: Globally high glaucoma prevalence ensures steady demand for timolol maleate, with growth driven primarily by aging populations.

- Generics Dominate Pricing: Patent expirations have resulted in significant generic competition, exerting downward pressure on retail prices.

- Regional Variations: Mature markets experience sharper price declines compared to emerging markets, offering different strategic entry points.

- Innovation Opportunities: Preservative-free and combination drug formulations may command premium pricing and create niche markets.

- Regulatory and Reimbursement Policies: These significantly influence market dynamics, affecting drug accessibility and pricing structures.

FAQs

1. Will TimoLOL Maleate prices increase in coming years?

Unlikely. Market forces—specifically generic competition—are expected to continue exerting downward pressure, although premium formulations may sustain higher prices in niche segments.

2. Which regions present the best opportunities for profit growth?

Emerging markets such as Southeast Asia and Latin America offer growth potential through expanding healthcare infrastructure and increasing disease awareness, despite higher price sensitivities.

3. Are branded TimoLOL Maleate products still relevant?

Yes. While generics dominate price-sensitive markets, branded formulations retain relevance in segments demanding specialized features like preservative-free options or specific delivery systems.

4. How do regulatory changes impact pricing?

Stricter regulatory requirements can elevate development costs and delay market entry, influencing initial pricing. Conversely, streamlined approval processes facilitate faster, cost-effective access, influencing overall market pricing strategies.

5. What strategies can manufacturers adopt to maintain market share?

Innovation in formulation, achieving regulatory exclusivity, expanding into emerging markets, and strategic partnerships with healthcare providers support differentiation and market presence despite generic price competition.

References

[1] MarketsandMarkets. "Ophthalmic Drugs Market." 2021.

[2] Resnikoff, S. et al. "Global data on visual impairment in the year 2002." World Health Organization, 2004.