Share This Page

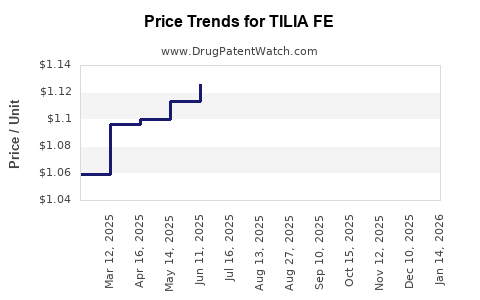

Drug Price Trends for TILIA FE

✉ Email this page to a colleague

Average Pharmacy Cost for TILIA FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TILIA FE 28 TABLET | 75907-0086-28 | 1.08175 | EACH | 2025-12-17 |

| TILIA FE 28 TABLET | 75907-0086-32 | 1.08175 | EACH | 2025-12-17 |

| TILIA FE 28 TABLET | 75907-0086-28 | 1.12079 | EACH | 2025-11-19 |

| TILIA FE 28 TABLET | 75907-0086-32 | 1.12079 | EACH | 2025-11-19 |

| TILIA FE 28 TABLET | 75907-0086-32 | 1.15410 | EACH | 2025-10-22 |

| TILIA FE 28 TABLET | 75907-0086-28 | 1.15410 | EACH | 2025-10-22 |

| TILIA FE 28 TABLET | 75907-0086-28 | 1.18905 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TILIA FE

Introduction

TILIA FE is an emerging pharmaceutical product positioned within the contraceptive and hormonal therapy markets. As a combined oral contraceptive, TILIA FE offers a new therapeutic option with potential advantages over existing formulations. Understanding its market dynamics and future pricing strategies is vital for stakeholders including manufacturers, investors, healthcare providers, and policymakers. This report provides a comprehensive analysis of TILIA FE's current market landscape, competitive positioning, regulatory considerations, and price projection forecasts over the next five years.

Product Overview

TILIA FE is a combined oral contraceptive (COC) that contains ethinylestradiol and a progestin component (specific formulation details pending regulatory approval). Its mechanism involves inhibiting ovulation and modulating cervical mucus to prevent pregnancy. TILIA FE aims to distinguish itself by improved safety profiles, side effect mitigation, or enhanced compliance features, aligning with current trends favoring user-centric contraceptive options.

Market Landscape

Global Contraceptive Market Dynamics

The global contraceptive market was valued at approximately $22 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 5% through 2027 [1]. The growth drivers include increasing awareness of reproductive health, expanding access in emerging markets, and rising acceptance of hormonal contraceptives.

Key Players and Competitive Environment

Leading contraceptive brands include Bayer’s Yaz, Merck’s NuvaRing, and Pfizer’s Ortho Tri-Cyclen. The market has a dense pipeline of hormonal, non-hormonal, and reversible contraceptive products, leading to intense competition.

Niche and Differentiation Factors

TILIA FE’s potential competitive advantages could include a novel formulation, fewer side effects, or improved compliance—factors increasingly influencing consumer choice and prescribing behaviors.

Regulatory Landscape

Regulatory approval is critical; across major markets such as the United States (FDA), European Union (EMA), and China (NMPA), obtaining approval involves rigorous safety and efficacy evaluations. Market access hinges upon successful registration and adherence to local standards, impacting initial launch timelines and commercial viability.

Market Penetration and Adoption Trends

Demographics and Geographies

The primary demographic for TILIA FE includes women aged 15-45, with a focus on countries experiencing rising awareness about reproductive rights. Developed markets demonstrate slower growth due to established brands, whereas emerging markets offer significant expansion potential due to increasing contraceptive acceptance and healthcare infrastructure improvements.

Prescribing Trends

Healthcare providers favor products that demonstrate superior safety or convenience. TILIA FE's success depends on demonstrating clear clinical benefits and effective marketing strategies targeting clinicians and consumers.

Reimbursement and Insurance Coverage

Insurance coverage significantly affects access; in markets with comprehensive contraceptive coverage (e.g., US through the Affordable Care Act), demand increases. Reimbursement policies will substantially influence sales potential.

Price Analysis and Optimization Strategies

Current Pricing Benchmarks

Existing contraceptive brands typically retail between $20 to $50 per cycle in the US and European markets, with variations depending on formulation, brand positioning, and reimbursement status [2]. Generic versions are often priced lower, around $10 to $15 per cycle.

Pricing Power Factors for TILIA FE

- Product Differentiation: If TILIA FE demonstrates a unique safety profile or reduced side effects, price premiums are justifiable.

- Market Penetration Strategy: Initial launch may favor competitive pricing to capture market share.

- Regulatory Costs and Launch Expenses: Investment in clinical trials and registration influence pricing strategies.

- Reimbursement Landscape: Securing insurance coverage enables premium pricing due to perceived added value.

Price Projection Methodology

Projecting prices involves analyzing competitive pricing trends, market demand elasticity, regulatory environment, and potential payer negotiations. Given market conditions:

- 2023–2024: Entry pricing expected between $25–$35 per cycle, balancing competitiveness and recoupment of R&D investments.

- 2025–2027: As demand stabilizes and brand recognition strengthens, prices could stabilize around $30–$40 per cycle, assuming successful differentiation.

- Post-2027: Generic competition and increased market saturation may drive prices down to $15–$20 per cycle.

Revenue and Market Share Projections

Assuming TILIA FE captures 5–10% of the contraceptive market by 2027, revenues could range from $1.2 billion to $2.4 billion, based on a conservative retail price of $30 per cycle and an estimated 100 million women using oral contraceptives globally.

Market share growth hinges on regulatory approval speeds, physician acceptance, patient adherence, and reimbursement success. Key growth regions include Southeast Asia, Latin America, and Africa, where contraceptive markets are expanding rapidly.

Challenges and Risks

- Regulatory Delays: Lengthy approval processes could postpone market entry.

- Competitive Pricing Pressures: Existing brands' competitive prices may limit TILIA FE’s premium pricing.

- Market Acceptance: Clinician and consumer acceptance depend on clinical data and marketing efficacy.

- Patent Lifecycle and Generic Competition: Patent expirations could lead to price erosion.

Strategic Recommendations

- Leverage Differentiation: Highlight clinical advantages to justify premium pricing.

- Expand in Emerging Markets: Tailor pricing strategies for affordability and reimbursement support.

- Establish Reimbursement Pathways: Engage payers early to facilitate insurance coverage.

- Monitor Competitive Launches: Adjust pricing dynamically based on market reactions and competitor actions.

Key Takeaways

- TILIA FE's success depends on rapid regulatory approval, competitive differentiation, and strategic pricing aligned with market segments.

- Initially, moderate premium pricing positions the product as a value-added contraceptive option, with potential adjustments based on market acceptance.

- Long-term price erosion is likely due to generic competition; hence, early market capture and differentiation are critical.

- Expanding into emerging markets offers significant revenue opportunities but necessitates flexible, localized pricing strategies.

- Stakeholders should monitor epidemiological trends, reimbursement policies, and competitor launches to refine pricing and market strategies continuously.

FAQs

-

When is TILIA FE expected to launch globally?

Launch timelines depend on regulatory approval. Given typical regulatory processes, initial approvals could occur within 12–24 months post-data submission, with subsequent regional rollouts over the following 1–3 years. -

What are the main factors influencing TILIA FE’s pricing strategy?

Differentiation benefits, competitive landscape, reimbursement prospects, manufacturing costs, and regulatory costs primarily influence pricing. -

How will generic competition affect TILIA FE’s market share?

Upon patent expiry, generic versions are likely to enter the market at substantially lower prices, exerting downward pressure on TILIA FE’s market share and pricing. -

Which markets offer the highest growth potential for TILIA FE?

Emerging markets in Southeast Asia, Latin America, and Africa present significant growth opportunities due to expanding contraceptive access and rising healthcare infrastructure. -

What are the risks associated with TILIA FE’s price positioning?

Risks include insufficient clinical differentiation to justify premium pricing, regulatory delays, payer resistance, and aggressive pricing from competitors.

References

[1] MarketsandMarkets. Contraceptive Market by Product, Type, and Region – Global Forecast to 2027.

[2] IQVIA. Pharmaceutical Pricing and Market Trends Report, 2022.

More… ↓