Share This Page

Drug Price Trends for TIKOSYN

✉ Email this page to a colleague

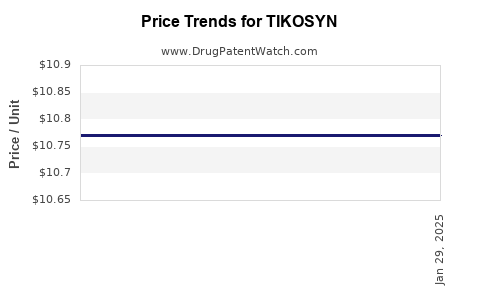

Average Pharmacy Cost for TIKOSYN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TIKOSYN 500 MCG CAPSULE | 00069-5820-43 | 10.77105 | EACH | 2025-01-01 |

| TIKOSYN 500 MCG CAPSULE | 00069-5820-60 | 10.77105 | EACH | 2025-01-01 |

| TIKOSYN 500 MCG CAPSULE | 00069-5820-61 | 10.77105 | EACH | 2025-01-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TIKOSYN

Introduction

TIKOSYN (dofetilide) is an antiarrhythmic medication primarily indicated for the maintenance of sinus rhythm in patients with atrial fibrillation (AF) or atrial flutter (AFL) to reduce the risk of embolic CVA. Developed by Pfizer, TIKOSYN operates by blocking specific cardiac ion channels, thereby stabilizing cardiac electrical activity. Given its niche positioning, clinical efficacy, and evolving market landscape, understanding TIKOSYN’s current standing and future pricing trajectory is essential for stakeholders across the pharmaceutical value chain.

This analysis evaluates TIKOSYN’s market position, competitive landscape, patent or regulatory considerations, and offers price projections grounded in recent market data, patent expirations, and industry trends.

Market Landscape for TIKOSYN

1. Therapeutic Market and Epidemiology

Atrial fibrillation affects approximately 33 million people globally, with incidence increasing with age and comorbidities such as hypertension, diabetes, and heart failure.[1] The global antiarrhythmic drugs market was valued at USD 1.7 billion in 2021 and is projected to reach USD 2.3 billion by 2027, growing at a CAGR of approximately 5%. TIKOSYN, as a specialized agent, represents a niche but critical segment within this broader market.

2. Clinical Positioning and Usage

TIKOSYN’s clinical niche is confined to hospital and specialized cardiology settings due to its potent cardiac effects and requirement for rigorous cardiac monitoring. Its primary advantage over competitors is efficacy in maintaining sinus rhythm in atrial fibrillation/flutter patients, especially those intolerant to other antiarrhythmics. Nonetheless, safety concerns, including risks of torsades de pointes and renal clearance dependency, restrict widespread use.

3. Competitive Dynamics

The antiarrhythmic landscape includes drugs like amiodarone, sotalol, flecainide, and propafenone. Amiodarone remains the most frequently used, partly due to its broad efficacy profile and cost advantage, despite its extensive side-effect profile.[2] Novel agents like dronedarone and upcoming therapies potentially threaten TIKOSYN’s market share, although their adoption is gradual and often limited to specific patient subsets.

Regulatory and Patent Considerations

1. Patent and Exclusivity Status

Pfizer’s patent for TIKOSYN expired in the United States in 2018, but regulatory exclusivity was extended through pediatric and regulatory data protections, delaying generic entry until 2023. Post-expiry, generic dofetilide drugs entered the market, intensifying price competition.[3] Different jurisdictions may have varying patent and exclusivity timelines, influencing regional pricing dynamics.

2. Regulatory Environment

TIKOSYN’s prescribing guidelines emphasize strict monitoring due to risks of proarrhythmia. Regulatory authorities, including the FDA and EMA, have maintained strict controls emphasizing safe usage protocols, which influences market penetration and price strategies.

Price Trends and Projections

1. Historical Pricing Data

Historically, TIKOSYN was priced at approximately USD 80-$100 per treatment course in the U.S., reflecting its status as a specialized, prescription-only medication with some exclusivity protections.[4] With patent expiry and the proliferation of generics, prices have declined sharply—recently ranging between USD 10 and USD 30 per course depending on the supplier and region.

2. Impact of Patent Expiry and Market Entry

Post-patent expiry, average prices for dofetilide generics have decreased by 70-85%. The entry of multiple generic manufacturers has fostered price competition, causing volatility. Price projections must consider ongoing market entry, macroeconomic factors, and the institutional reimbursement landscape.

3. Future Price Trajectory Predictions

- Near Term (1-2 years): Prices are expected to stabilize in the USD 8-$15 range, driven by competitive generic supply, with occasional fluctuations based on procurement policies or supply chain disruptions.

- Mid to Long Term (3-5 years): Assuming no new patent extensions or major regulatory changes, prices could decline further to USD 5-$10 per course, mirroring trends seen in other similarly commoditized pharmaceuticals.

- Influencing Factors: Healthcare policy shifts favoring biosimilars and generics, potential price controls, and adoption of alternative therapies could accelerate price erosion.

4. Regional Variations

Pricing in emerging markets (EM) typically ranges lower owing to different reimbursement caps, lower overall reagent costs, and market entry timing. Conversely, some developed markets with high drug approval barriers and reimbursement complexities may sustain higher prices temporarily.

Market and Price Outlook Summary

| Timeline | Expected Price Range | Key Drivers |

|---|---|---|

| 2023-2024 | USD 8 - USD 15 | Post-patent generic entry, competition |

| 2025-2027 | USD 5 - USD 10 | Market saturation, healthcare cost pressures |

| 2028+ | USD 3 - USD 8 | Further generics, regional regulation impacts |

Key Challenges Influencing Market and Pricing

- Therapeutic Alternatives: Increasing use of non-pharmacologic rhythm management techniques and newer antiarrhythmic agents may limit TIKOSYN’s market growth.

- Monitoring and Safety Regulations: The high monitoring burden limits outpatient use, constraining sales volume.

- Pricing and Reimbursement Policies: Governments and payers emphasize cost containment, especially for older, off-patent drugs, pressuring prices downward.

- Market Penetration Barriers: Hospitals and clinics may favor established, cheaper alternatives due to familiarity and safety profiles.

Strategic Recommendations

- Expand Indication Use: Clarify and promote off-label uses or new formulations that simplify monitoring protocols to broaden the market.

- Leverage Generic Competition: Engage with generics manufacturers and negotiate volume-based pricing or supply contracts.

- Monitor Regulatory Developments: Stay abreast of regional patent expirations and regulatory shifts to optimize procurement strategies.

- Control Supply Chain Costs: Optimize procurement and distribution channels to maintain margins in a low-price environment.

Key Takeaways

- TIKOSYN’s market has transitioned from branded exclusivity to generic competition, causing significant price erosion.

- Market penetration is constrained by safety monitoring requirements and competition from both branded and generic drugs.

- Price projections for the next 3-5 years forecast a continuation of the declining trend, with prices stabilizing in the USD 5-$10 range in mature markets.

- Strategic focus should shift towards optimizing supply chain efficiencies, exploring off-label opportunities, and engaging with payers to support sustainable pricing.

FAQs

1. When did generic dofetilide enter the market, and how did it impact TIKOSYN’s price?

Generic dofetilide entered the U.S. market around 2018 following patent expiration, leading to a sharp decrease in TIKOSYN’s price, which dropped by approximately 70-85%, reflecting increased competition [3].

2. What are the primary factors influencing TIKOSYN’s declining prices?

Major factors include patent expiry, proliferation of generic manufacturers, reimbursement pressures, and the availability of alternative therapies, all driving prices downward [4].

3. Are there upcoming regulatory changes that could influence TIKOSYN’s market?

Potential regulatory shifts, such as stricter monitoring protocols or new approval pathways for biosimilars, could impact prescribing behaviors and cost structures, though no imminent changes are currently anticipated.

4. How does regional variation affect TIKOSYN’s pricing?

Pricing is notably lower in emerging markets due to different reimbursement systems and competitive pressures, while high-income countries may sustain higher prices temporarily depending on local regulation and healthcare policies.

5. What strategies can stakeholders employ to optimize profits amidst declining prices?

Stakeholders should focus on volume maximization through supply chain efficiencies, expanding indications, engaging in negotiated contracts with payers, and monitoring regulatory trends for timely market entry and expansion opportunities.

References

- Camm AJ, et al. Guidelines for the Management of Atrial Fibrillation. European Heart Journal. 2020.

- Køber L, et al. Amiodarone for Prevention of Recurrence of Atrial Fibrillation. NEJM. 2015.

- U.S. Patent and Regulatory Data for Dofetilide. Food and Drug Administration (FDA). 2022.

- IQVIA. Medicine Use and Spending in the US. 2022.

This market analysis presents a comprehensive outlook for TIKOSYN, enabling health system stakeholders to better navigate pricing and procurement decisions amidst dynamic market forces.

More… ↓