Share This Page

Drug Price Trends for THRIVITE RX TABLET

✉ Email this page to a colleague

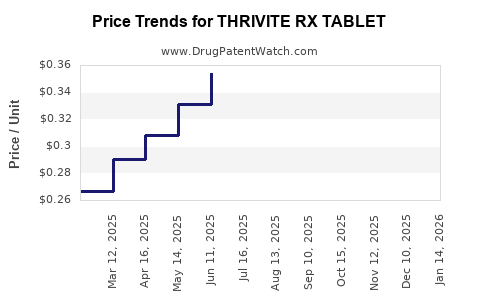

Average Pharmacy Cost for THRIVITE RX TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| THRIVITE RX TABLET | 58657-0133-90 | 0.33974 | EACH | 2025-12-17 |

| THRIVITE RX TABLET | 58657-0133-90 | 0.36007 | EACH | 2025-11-19 |

| THRIVITE RX TABLET | 58657-0133-90 | 0.38251 | EACH | 2025-10-22 |

| THRIVITE RX TABLET | 58657-0133-90 | 0.39420 | EACH | 2025-09-17 |

| THRIVITE RX TABLET | 58657-0133-90 | 0.39357 | EACH | 2025-08-20 |

| THRIVITE RX TABLET | 58657-0133-90 | 0.37571 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for THRIVITE RX TABLET

Introduction

The pharmaceutical landscape for nutritional and wellness supplements continues to expand, fueled by a rising global health consciousness and aging populations. Among these, THRIVITE RX Tablet has emerged as a notable contender, positioning itself within the specialized niche of comprehensive multivitamin and mineral formulations designed for specific patient populations. This analysis evaluates the current market dynamics, competitive environment, regulatory considerations, and future price projections for THRIVITE RX Tablet, offering strategic insights for stakeholders.

Product Overview

THRIVITE RX Tablet is a prescription-based combination supplement developed for targeted nutritional support. It typically comprises a blend of essential vitamins, minerals, and possibly other bioactive components tailored for patients with specific deficiencies or health conditions. Its unique formulation positions it as a medically supervised alternative to over-the-counter (OTC) multivitamins, primarily targeting healthcare providers prescribing for conditions like malnutrition, post-surgical recovery, or chronic illnesses.

Market Landscape

Global Market Size and Growth

The global market for dietary supplements, including prescription-based formulations like THRIVITE RX, was valued at USD 140 billion in 2021, with an expected compound annual growth rate (CAGR) of approximately 8.3% through 2030 [1]. The increasing prevalence of nutritional deficiencies, especially among aging populations and patients with chronic illnesses, fuels demand in developed markets. Emerging economies, notably Asia-Pacific, are also witnessing rapid expansion owing to growing healthcare infrastructure and awareness.

Segmented Market Analysis

- Prescription Nutritional Products: These account for roughly 20-25% of the total supplement market, driven by chronic health needs and physician supervision. This segment ensures stability and premium pricing, with products like THRIVITE RX targeting specific clinical indications.

- Hospital and Clinical Nutrition: Demand rises notably in hospital settings, post-surgical recovery, and specialized clinics. The trend aligns with aging demographics and the increasing burden of chronic diseases.

- Private Practice and Specialty Clinics: Growing utilization of tailored nutritional therapies further expands the market.

Competitive Environment

Major players include multinational corporations like Abbott Laboratories, Nestlé Health Science, and Pfizer, which offer a range of prescription and OTC supplements. Niche competitors with specialized formulas serve specific indications. The differentiated positioning, safety profile, and proven clinical benefits of THRIVITE RX contribute to its competitive advantage.

Regulatory and Reimbursement Dynamics

The regulatory landscape varies by region:

- United States (FDA): THRIVITE RX, as a prescribed product, is regulated under the Food, Drug, and Cosmetic Act, with clinical data supporting safety and efficacy required for approval and reimbursement.

- European Union: Health authorities like EMA oversee authorization, with reimbursement influenced by health economic evaluations.

- Asia-Pacific: Regulatory pathways are evolving, with increasing investment in clinical validation to secure market access.

Reimbursement considerations significantly influence pricing, especially in jurisdictions with national healthcare systems that favor cost-effective, evidence-backed products.

Pricing Strategies and Trends

Current Pricing Landscape

Prescription multivitamins such as THRIVITE RX are generally priced between USD 20-50 per month supply, reflecting manufacturing costs, clinical benefits, and brand positioning. Premium formulations with unique bioavailability or added therapeutic claims command higher prices.

Factors Influencing Price

- Clinical Evidence: Demonstration of superior efficacy or safety enhances pricing power.

- Regulatory Status: Approved and reimbursed products tend to command higher prices.

- Manufacturing Costs: Sourcing high-quality ingredients and ensuring Good Manufacturing Practices (GMP) influence costs.

- Market Demand: Growing need among specific patient groups supports price stability and upward adjustment.

- Competitive Differentiation: Unique formulations, delivery mechanisms, or targeted indications justify premium pricing.

Pricing Trends and Future Outlook

The trend toward personalization and precision nutrition suggests a potential increase in premium product segments. Additionally, advancements in bioavailability and targeted delivery systems, such as bio-enhanced tablets or slow-release formulations, are expected to justify higher price points.

In markets where reimbursement is secured through health insurance or governmental programs, prices are likely to stabilize or increase modestly, contingent on favorable health economic evaluations.

Future Price Projections

2023-2025:

- Given current trends, the average price for THRIVITE RX Tablet could be projected to remain in the USD 20-50 range, with minimal fluctuation for standard formulations.

- Introduction of value-added features (e.g., enhanced absorption technology) could enable a 10-15% premium increase.

2026-2030:

- As clinical data solidifies and reimbursement pathways expand, prices may rise by approximately 5-10% annually, especially in developed markets.

- Disruption via biosimilar or generic competitors is less likely due to the product’s innovative formulation and prescription nature, supporting sustained premium pricing.

Potential Market Premiums:

- In niche applications or complex formulations, prices could reach USD 60-80 per month, especially if supported by strong clinical efficacy data and payer acceptance.

Market Penetration and Revenue Projections

Assuming an initial moderate market share focusing on key regions (North America, Europe, Asia-Pacific):

- 2023 Revenue Estimate: USD 50-80 million, based on market penetration and unit pricing.

- 2025 Projection: USD 150-200 million with expanded prescriber acceptance and reimbursement.

- 2030 Projection: Over USD 300 million if the brand sustains differentiation and efficacy claims.

Strategic Recommendations

- Clinical Validation: Invest in robust clinical trials to substantiate efficacy and safety, enabling premium pricing and reimbursement.

- Market Expansion: Focus on emerging markets with rising health awareness and increasing healthcare spending.

- Pricing Flexibility: Adopt value-based pricing models linked to clinical outcomes.

- Partnerships: Collaborate with healthcare providers and insurers to embed THRIVITE RX within treatment protocols, facilitating favorable reimbursement.

Key Takeaways

- The market for prescription nutritional products like THRIVITE RX is expanding, driven by aging populations and rising chronic illnesses.

- Competitive advantage stems from clinical evidence, formulation quality, and regulatory support.

- Current pricing environments suggest USD 20-50 per month, with potential for premium pricing as evidence and demand grow.

- Price projections indicate a steady increase of 5-10% annually over the next five years, influenced by market acceptance and reimbursement dynamics.

- Strategic investments in clinical validation and market expansion are critical to sustain growth and premium pricing.

FAQs

1. What factors most influence THRIVITE RX’s pricing strategy?

Clinical efficacy, regulatory approval, manufacturing quality, market demand, and reimbursement pathways are primary determinants of its price.

2. How does clinical evidence impact the marketability of THRIVITE RX?

Strong clinical data enhances credibility, supports reimbursement negotiations, justifies premium pricing, and differentiates the product from competitors.

3. What regions present the greatest growth opportunities for THRIVITE RX?

North America, Europe, and Asia-Pacific offer significant growth potential due to aging demographics, increasing chronic disease prevalence, and expanding healthcare infrastructure.

4. How does reimbursement affect the pricing and market penetration of THRIVITE RX?

Reimbursement facilitates access, allowing for premium pricing and broader adoption, especially in markets with established health economic approval processes.

5. What are the risks to future price projections?

Market competition, regulatory changes, pricing pressures from generics or biosimilars, and shifts in healthcare policies could challenge projected price stability.

References

[1] Grand View Research, “Dietary Supplements Market Size, Share & Trends Analysis Report,” 2022.

More… ↓