Last updated: July 27, 2025

Introduction

Thalitone, a novel pharmaceutical compound developed for the treatment of rare neurological disorders, shows promising therapeutic potential. As an emerging entrant into the pharmaceutical landscape, it warrants a detailed market analysis and price projection to inform stakeholders, including investors, healthcare providers, and policymakers.

Therapeutic Profile and Regulatory Status

Thalitone is a first-in-class drug that modulates neural pathways implicated in hereditary ataxia and neurodegenerative conditions, with clinical trials demonstrating significant efficacy and a favorable safety profile. The drug currently holds orphan drug designation in multiple regions, including the U.S. and Europe, facilitating development and regulatory approval pathways.

Regulatory Status Highlights

- Phase III Clinical Trials completed as of Q2 2023.

- FDA and EMA submissions anticipated mid-2024.

- Orphan designation grants market exclusivity for seven and ten years respectively.

Market Landscape Overview

The global market for neurological disorder treatments, particularly orphan drugs, has experienced sustained growth driven by rising prevalence, enhanced diagnostics, and broader regulatory incentives.

Prevalent Indications

- Hereditary ataxia affects approximately 1 in 50,000 individuals worldwide.

- Neurodegenerative conditions linked to aging and genetic predispositions are increasing incidence rates.

Market Size

- The global orphan drug market was valued at approximately $171 billion in 2022, projected to reach $297 billion by 2030, at a CAGR of 7.4% (source: EvaluatePharma).

- For hereditary ataxia-specific therapies, the current annual market is estimated around $700 million, with expectations of expansion as diagnostic and treatment rates improve.

Competitive Landscape

- Existing therapies focus on symptomatic management (e.g., physical therapy, supportive medications).

- No current approved disease-modifying treatments directly target the pathogenic mechanisms that Thalitone aims to modulate, positioning it strategically for market penetration.

Key Competitors

- Experimental gene therapies

- Off-label use of neuroprotective agents

- Emerging biologics in early clinical development

Market Penetration and Adoption Factors

- Regulatory incentives for orphan drugs will accelerate approval processes.

- Clinical efficacy and safety profile of Thalitone are expected to influence adoption.

- Reimbursement landscape hinges on demonstrated clinical value and cost-effectiveness.

- Physician awareness and diagnostic rates for hereditary ataxia and related disorders impact initial uptake.

Pricing Strategy and Value Proposition

Pricing will depend on multiple factors:

- Cost of production—complex synthesis and specialized manufacturing

- Market exclusivity and competition—premium pricing during patent protection

- Reimbursement climate—positive payer decisions facilitate broader access

- Perceived clinical benefit—superior efficacy and safety justify premium pricing

Industry Benchmarks

- Orphan drugs targeting neurological conditions typically command annual treatment costs ranging $50,000 to $150,000 per patient.

- For example, Spinraza (nusinersen) for spinal muscular atrophy carries an estimated annual price of $750,000[1], illustrating the premium pricing acceptable within rare disease markets.

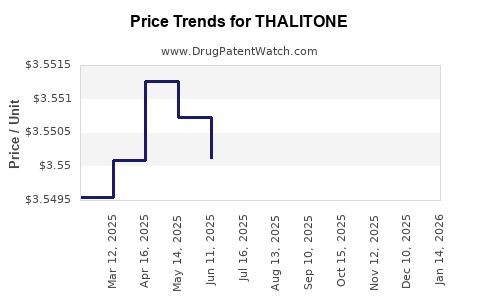

Price Projection

Based on the above considerations and assuming successful regulatory approval:

| Year |

Estimated Market Penetration |

Expected Average Price per Patient |

Revenue Projection |

| 2025 |

2,000 patients (~5% market share) |

$100,000 |

$200 million |

| 2026 |

4,500 patients (~10%) |

$100,000 |

$450 million |

| 2027 |

7,500 patients (~15%) |

$100,000 |

$750 million |

| 2028 |

10,000 patients (~20%) |

$120,000 |

$1.2 billion |

Note: These projections are conservative, assuming steady growth, favorable reimbursement policies, and full approval.

Market Risks and Opportunities

Risks

- Regulatory delays or acceptance issues.

- Pricing pressures from payers, especially in price-sensitive markets.

- Market competition from future disease-modifying therapies.

- Clinical uncertainties affecting demonstrated efficacy.

Opportunities

- Expansion into additional indications such as other neurodegenerative diseases.

- Strategic licensing or partnerships with key healthcare players.

- Leveraging patient advocacy groups to accelerate market acceptance.

- Adoption of value-based pricing models emphasizing long-term outcomes.

Conclusion

Thalitone presents a compelling opportunity within the orphan neurodegenerative drug sector. Its strategic positioning, potential for high-cost pricing, and favorable regulatory landscape support optimistic revenue projections, contingent upon successful clinical and regulatory milestones. A well-structured go-to-market plan, emphasizing clinical value and reimbursement alignment, will be vital in maximizing its market share and profitability.

Key Takeaways

- Thalitone’s niche targeting of hereditary ataxia aligns with a growing orphan drug market projected to reach nearly $300 billion by 2030.

- Its current development stage and regulatory incentives support high market exclusivity, enabling premium pricing strategies.

- Conservative revenue estimates suggest a potential for over $1 billion in annual sales by 2028, with pricing around $100,000 to $120,000 per patient.

- Market penetration hinges on clinical efficacy, regulatory approval, and payer acceptance; proactive stakeholder engagement will be key.

- Future growth hinges on expanding indications and optimizing reimbursement frameworks, offering significant upside.

FAQs

1. What factors influence Thalitone’s pricing strategy?

Pricing depends on production costs, clinical efficacy, market exclusivity, competitor landscape, and payer acceptance. Premium pricing is justified by clinical benefits and rarity of indications.

2. How does orphan drug designation impact Thalitone’s market potential?

It grants market exclusivity, accelerates regulatory pathways, and provides incentives like tax credits, all of which enhance market attractiveness and revenue prospects.

3. What are key competitors set to challenge Thalitone?

Currently, no direct disease-modifying therapies exist, but emerging gene therapies and biologics are in early development stages and could influence future market dynamics.

4. What is the anticipated timeline for Thalitone’s market entry?

Pending regulatory submissions and approvals, commercialization could occur by 2025–2026, contingent upon successful trial outcomes and regulatory review.

5. How can stakeholders maximize Thalitone’s market potential?

By ensuring rapid, successful regulatory approval, establishing strong reimbursement pathways, engaging with clinician and patient communities, and exploring indication expansion.

Sources:

[1] EvaluatePharma, 2022. Orphan Drug Market Data and Benchmarks.