Last updated: July 27, 2025

Introduction

Testosterone CYP is an innovative therapeutic agent classified within the class of selective testosterone receptor modulators, designed to optimize androgenic effects while minimizing adverse events associated with conventional testosterone therapy. As the pharmaceutical industry advances toward personalized medicine, testosterone derivatives like Testosterone CYP occupy a strategic position in hormone replacement therapy (HRT), especially for conditions such as hypogonadism, age-related testosterone decline, and certain hormone-sensitive cancers. This analysis scrutinizes prevailing market dynamics, competitive landscape, regulatory considerations, and future price trajectories for Testosterone CYP, offering business professionals an evidence-based foundation for strategic decision-making.

Market Overview

Therapeutic Demand and Indications

The global testosterone replacement therapy (TRT) market is projected to reach USD 3.2 billion by 2027, expanding at a Compound Annual Growth Rate (CAGR) of approximately 7.3%, driven by increasing aging populations and rising awareness of hormone therapies [1]. Testosterone CYP, as a next-generation agent, aims to outperform existing treatments with improved safety profiles, leading to anticipated growth in prescription volumes.

Indications for Testosterone CYP extend beyond traditional hypogonadism to encompass muscle wasting in chronic diseases and certain cancers, notably prostate cancer management. Its mechanism as a selective receptor modulator differentiates it from classical testosterone, opening avenues in niche markets where safety profiles are critical.

Competitive Landscape

Current market players include established testosterone formulations—Testosterone Gel (AndroGel), Testosterone Cypionate injections, and newer molecules such as Axiron and Natesto. The introduction of Testosterone CYP would position it as a premium therapeutic candidate due to its targeted receptor activity and reduced aromatization.

Key competitors are developing biosimilar and innovative agents aiming to improve bioavailability, reduce drug administration frequency, and limit systemic exposure. Companies like AbbVie, Endo Pharmaceuticals, and innovative biotech firms are heavily investing in next-generation androgenic agents, intensifying competition [2].

Regulatory Environment

Regulatory approval hinges on demonstrating superior safety, efficacy, and tolerability. The FDA and EMA have strict frameworks for hormone therapies, particularly concerning cardiovascular risks, erythrocytosis, and prostate health.

Recently, the FDA has tightened constraints on TRT, emphasizing long-term safety data. A positive regulatory pathway for Testosterone CYP would necessitate robust clinical trials, especially comparing its safety profile against existing agents.

Market Entry Strategies

Successful market penetration for Testosterone CYP hinges on:

- Clinical Differentiation: Demonstrating improved safety and efficacy.

- Pricing Strategy: Positioning as a premium product initially, with potential for competitive pricing upon patent expiration or biosimilar entry.

- Physician Education: Targeting endocrinologists, urologists, and oncologists, emphasizing unique benefits.

- Regulatory Engagement: Early dialogue with authorities to facilitate approvals.

Price Projections

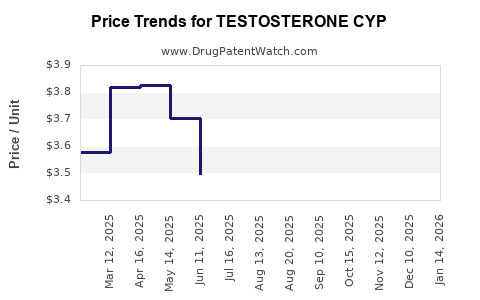

Current Pricing Landscape

Most testosterone therapies are priced variably, with annual treatment costs ranging from USD 600 to USD 2,400 depending on formulation and administration route. For example, transdermal gels average around USD 1,200 annually, with injections slightly higher [3].

Forecasting Future Prices

Considering Testosterone CYP’s anticipated advantages, initial pricing may command a premium, approximately 20–30% above current standards, i.e., USD 1,440–USD 3,120 annually. As market competition intensifies and biosimilars emerge, prices are expected to decline, stabilizing at USD 900–USD 1,200 annually in mature markets within 5–7 years.

Influencing Factors

- Patent Protection: A strong patent portfolio could sustain premium pricing for up to 10 years.

- Market Penetration Rate: High acceptance among specialists can sustain higher prices early on.

- Reimbursement Policies: Favorable coverage enhances accessibility and pricing power.

- Manufacturing Costs: Advances in production technology could reduce costs, enabling flexible pricing.

Market Opportunities and Risks

Opportunities

- Addressing unmet needs in specific patient subsets, such as those intolerant to current therapies.

- Expanding into niche markets like oncology supporting hormone-sensitive cancer therapies.

- Capitalizing on demographic trends of aging populations globally.

Risks

- Regulatory delays due to safety concerns.

- Competitive response from established therapies and biosimilars.

- Price erosion driven by market saturation and payer pressure.

- Potential adverse safety profiles impacting market adoption.

Conclusion

Testosterone CYP emerges as a promising entrant poised to redefine therapeutic standards within androgenic treatments. Its success depends on clinical validation, strategic market positioning, and navigated regulatory pathways. Price projections indicate a trajectory from premium initial pricing to eventual market stabilization aligned with competitive dynamics. Stakeholders should consider these factors carefully, aligning R&D and commercialization strategies to leverage the drug’s potential.

Key Takeaways

- Market potential for Testosterone CYP is substantial, driven by aging demographics and unmet needs in hormone therapy.

- Competitive differentiation through safety and targeted receptor activity could command premium pricing initially.

- Long-term pricing will decline with increasing competition, biosimilar entry, and market saturation.

- Regulatory pathways pose risks, necessitating comprehensive safety and efficacy data.

- Strategic positioning and early engagement with healthcare providers and payers are crucial for maximizing market share and profitability.

FAQs

1. What factors influence the pricing of Testosterone CYP?

Pricing is influenced by manufacturing costs, patent protection, competitive landscape, regulatory approval status, perceived clinical benefits, and reimbursement policies.

2. How does Testosterone CYP compare to existing testosterone therapies?

Testosterone CYP aims to offer targeted receptor modulation with fewer adverse events such as erythrocytosis and cardiovascular risks, providing a potential safety advantage over traditional formulations.

3. What regulatory hurdles must Testosterone CYP overcome?

It must demonstrate safety, efficacy, and tolerability through rigorous clinical trials, addressing concerns related to cardiovascular risks and prostate health.

4. When can stakeholders expect price reductions?

Prices typically decline within 5–7 years post-market entry as biosimilars and generics emerge, and competition intensifies.

5. What market segments represent the greatest growth opportunity?

Areas with unmet needs, including hypogonadism in aging men and hormone-responsive cancers, represent lucrative opportunities for Testosterone CYP.

References

- Grand View Research. Testosterone Replacement Therapy Market Size, Share & Trends Analysis Report, 2027.

- EvaluatePharma. Industry Insights on Testosterone Therapeutics, 2022.

- IQVIA. National Prescription Data on Testosterone Products, 2022.