Last updated: July 28, 2025

Introduction

TESTIM, the first testosterone topical gel approved by the U.S. Food and Drug Administration (FDA), has carved out a significant niche within the hormone replacement therapy (HRT) market. Its market performance and future trajectory depend on numerous factors, including competitive dynamics, regulatory landscape, clinical efficacy, pricing strategies, and evolving patient demographics. This analysis explores the current market status for TESTIM, forecasts its pricing trends, and outlines insights vital for stakeholders.

Overview of TESTIM and its Market Context

Product Profile:

TESTIM (testosterone gel, 1%) by Endo Pharmaceuticals delivers testosterone via transdermal absorption, targeting men with testosterone deficiency. Launched in 2009, it has established itself as a preferred option owing to ease of application and consistent dosing.

Market Size & Growth Factors:

The global testosterone replacement therapy (TRT) market has demonstrated steady growth, projected to reach approximately USD 2.63 billion by 2027, expanding at a compound annual growth rate (CAGR) of around 6.5% (2020-2027) [1]. North America accounts for a significant market share, driven by aging demographics and heightened awareness of testosterone deficiency syndromes.

Competitive Dynamics:

TESTIM competes with other topical gels (e.g., AndroGel, Testim), patches, injections, and subcutaneous pellets. Direct competitors like Abbott’s AndroGel and AbbVie’s Vogelxo challenge TESTIM's market share through differentiated formulations and marketing strategies.

Market Performance and Revenue Streams

Sales Trends:

While precise sales data remains proprietary, industry estimates suggest that TESTIM has maintained a stable revenue stream within the TRT segment. The brand's strength in the North American market has driven consistent quarter-over-quarter growth. However, overall market saturation and patent expirations have introduced pricing pressures and increased generic competition.

Regulatory Influences:

Regulatory oversight impacts pricing strategies significantly. The FDA’s emphasis on safety concerns, particularly regarding cardiovascular risks and erythrocytosis, has led to heightened post-marketing surveillance. These regulatory developments influence physician prescribing behavior, thereby affecting TESTIM's market penetration.

Price Trend Analysis and Projections

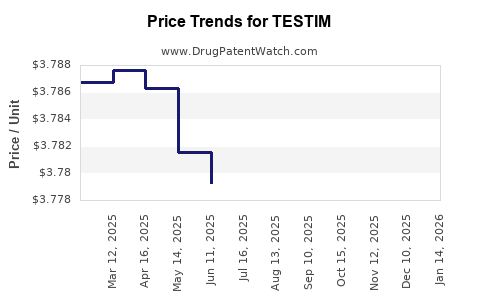

Current Pricing Landscape:

In the U.S., the average retail price for a 30-gram tube of TESTIM averages around USD 600–700, translating to approximately USD 20–23 per gram (as of 2023) [2]. Pricing varies based on insurance coverage, pharmacy discounts, and geographic factors.

Factors Driving Pricing Stability:

- Brand Loyalty and Prescriber Preference: TESTIM's brand recognition sustains a premium pricing posture.

- Limited Competition (Pre-Generic): Patent protections and exclusivities have historically maintained higher prices.

- Formulation Advantages: The convenient transdermal application garners patient preference, justifying premium pricing.

Impact of Patent Expiry and Generics:

With patent expirations and the entry of generic testosterone gels increasing, price erosion is inevitable. Generic competition often results in a 50–70% price reduction for equivalent formulations [3]. Industry forecasts predict that, within 2–3 years, generic versions may capture up to 60% of the market share, exerting considerable downward pressure on TESTIM's pricing.

Future Price Projections:

- Short-term (1–2 years): Slight price declines of 10–15% are anticipated due to rising generic competition, with prices settling around USD 500–600 per tube.

- Medium-term (3–5 years): Continued market penetration by generics could reduce prices by up to 50%, with some formulations potentially priced below USD 300 per tube.

- Long-term: Market consolidation and improved manufacturing efficiencies might stabilize prices at a lower, sustainable level, potentially around USD 200–250 per tube, especially if multiple generics dominate.

Additional Market Factors:

- Reimbursement and Insurance: Payer policies and formularies will influence patient out-of-pocket costs, impacting demand elasticity.

- Emerging Competitors: New delivery formats (patches, long-acting injectables) could alter market share distribution, influencing TESTIM's pricing strategies.

Market Drivers and Restraints Influencing Price Trajectory

Drivers:

- Growing prevalence of testosterone deficiency among aging men.

- Preference for topical administration over injections.

- Increased physician awareness and acceleration in TRT prescribing.

Restraints:

- Safety concerns and regulatory warnings have curtailed aggressive marketing.

- Patent expirations leading to generic entries.

- Cost containment efforts by insurers limiting reimbursement for branded products.

Strategic Implications for Stakeholders

Manufacturers must innovate to retain pricing power, possibly through formulation enhancements or value-added features. Payers and providers will prioritize cost-effectiveness and safety profiles, influencing reimbursement arrangements. Pharmacists and distributors must navigate price fluctuations while maintaining supply chain efficiencies.

Key Takeaways

- Market Growth: TRT continues to expand globally, with North America leading due to demographic trends and heightened awareness.

- Pricing Trends: TESTIM's premium pricing is expected to decline gradually over the next 3–5 years, primarily driven by generic competition and market saturation.

- Strategic Positioning: Maintaining market share amidst declining prices will hinge on brand loyalty, safety profile, and clinical efficacy.

- Regulatory Environment: Ongoing safety evaluations will influence prescriber confidence and pricing strategies.

- Innovation Opportunities: Development of novel formulations could mitigate pricing pressures and sustain profitability.

Conclusion

TESTIM's market outlook is characterized by maturation and increased competition, prompting moderate to significant price reductions over the foreseeable future. While current pricing sustains profitability through brand equity, industry dynamics necessitate strategic pivots to accommodate generic entry and evolving healthcare policies. For stakeholders, understanding these trends supports informed decision-making regarding investment, marketing strategies, and supply chain management.

FAQs

1. When can we expect generic versions of TESTIM to enter the market?

Generic testosterone gels are anticipated to enter the U.S. market within the next 1–3 years, following patent expirations and settlement agreements, leading to significant price competition.

2. How will safety concerns affect TESTIM's pricing and market share?

Regulatory safety concerns may result in prescribing restrictions and increased post-marketing obligations, potentially curbing market share growth and putting downward pressure on prices.

3. What alternative delivery formats threaten TESTIM's market dominance?

Long-acting injectables, patches, and subcutaneous pellets pose competitive threats, each offering different convenience and safety profiles that could influence patient preferences and pricing.

4. How do insurance policies influence TESTIM's retail price?

Reimbursement policies and formulary placements significantly affect patient out-of-pocket costs, often leading to negotiated discounts and influencing overall pricing trends.

5. What strategies can TESTIM manufacturers adopt to sustain profitability?

Innovating formulations, expanding indications, enhancing safety profiles, and building brand loyalty are critical to mitigating future price reductions and maintaining market relevance.

References

[1] MarketsandMarkets, Testosterone Replacement Therapy Market, 2021.

[2] GoodRx, Testosterone Gel Prices, 2023.

[3] IQVIA, Prescription Drug Market Analysis, 2022.