Last updated: October 10, 2025

Introduction

Teriparatide (brand name Forteo®, Forsteo®) is a recombinant form of parathyroid hormone (PTH 1-34) indicated primarily for osteoporosis treatment in postmenopausal women, men at high fracture risk, and remaining therapy-resistant cases. Since its market launch in 2002, teriparatide has carved a niche within the osteoporotic therapeutics landscape owing to its unique anabolic mechanism. This analysis evaluates the current market dynamics, future growth drivers, competitive landscape, and price trajectory projections, essential for stakeholders seeking strategic positioning.

Market Landscape and Segmentation

Global Market Overview

The global osteoporosis therapeutics market was valued at approximately USD 11.8 billion in 2022 and is projected to reach USD 17.2 billion by 2030, growing at a CAGR of 4.8% (Source: Grand View Research). Teriparatide comprises a significant segment within the anabolic drug class, estimated to account for roughly 12–15% of this market sector.

Geographical Breakdown

- North America: Dominates the teriparatide market owing to high osteoporosis prevalence (~10 million Americans aged 50+), robust healthcare infrastructure, and insurance coverage.

- Europe: Represents the second-largest segment, with increasing awareness and aging populations.

- Asia-Pacific: Exhibits rapid growth potential, driven by demographic shifts, rising healthcare expenditure, and expanding manufacturing capacity.

- Rest of the World: Emerging markets are gradually incorporating anabolic therapies, although pricing and regulatory hurdles persist.

Current Market Dynamics

Key Players and Patent Landscape

- AbbVie (original developer of Forteo®): Maintains a strong market position with proprietary formulations.

- Eli Lilly and Company: Has partnered in licensing, expanding distribution channels.

- Generic Manufacturers: Post-patent expiry, numerous generics have entered several markets, increasing competition and driving prices downward.

The expiration of key patents around 2022-2023 in the US and Europe has intensified generic competition, impacting overall pricing and market share.

Regulatory Environment

- Regulatory agencies such as FDA, EMA, and PMDA maintain strict approval pathways, but recent approvals of biosimilars have catalyzed price competition.

- Emerging approvals for alternative formulations, combination therapies, or pharmacological advancements could influence future demand.

Market Drivers

- Aging Population: Increased age-related osteoporosis prevalence globally.

- Treatment Guidelines Alignment: Growing endorsement of anabolic agents for high-risk patients.

- Clinical Evidence: Studies confirm the efficacy of teriparatide in fracture reduction and bone mineral density (BMD) improvements.

- Patient Preference: Injectable delivery systems and fear of adverse effects influence therapy choice.

Market Challenges

- High Cost of Therapy: Teriparatide’s premium pricing (~USD 3,000 to 4,000 per treatment course in the US) limits accessibility.

- Administration Mode: Subcutaneous injections may deter some patients.

- Competition from Bisphosphonates and Sclerostin Inhibitors: Oral agents like alendronate and newer drugs like romosozumab (Sclérocept®) offer cost advantages and simplified dosing.

Price Projections and Future Trends

Post-Patent Expiry Impact

Following patent expiration, price erosion is anticipated, driven by:

- Generic Entry: Several biosimilar and generic versions are likely to reduce prices by approximately 30-50% within 2-3 years post-entrant market entry.

- Government and Payer Negotiations: Increased price pressure from payers seeking cost-effective osteoporosis management.

- Market Penetration of Biosimilars: Biosimilar development by companies such as Samsung Biologics and Biocon is underway, potentially bringing down treatment costs further.

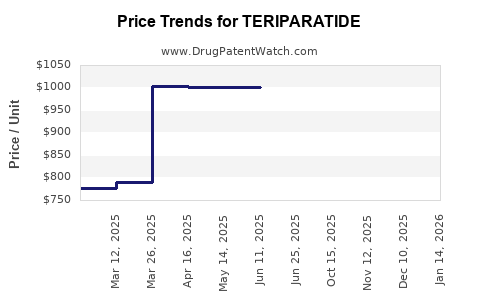

Projected Pricing Trends (2023–2030)

- Short-term (2023–2025): Stabilization of prices post-patent expiration with minor reductions (~10-15%), maintain premium positioning in niche high-risk populations.

- Medium to Long-term (2026–2030): With biosimilar market saturation, expect significant price reductions (~40-50%), making teriparatide competitive against oral and alternative anabolic therapies.

Factors Potentially Influencing Price Trajectory

- Regulatory approvals of biosimilars and biosimilar uptake rates.

- Emerging therapies’ approval—such as anti-sclerostin agents—may divert market share.

- Insurance reimbursement policies—favoring cost-effective options.

- Innovations in delivery systems—autoinjectors or combination regimens could alter demand and pricing strategies.

Competitive Landscape and Future Market Share

- Brand dominance previously maintained by Forteo® is waning with biosimilar proliferation.

- Market share shifts toward biosimilars could capture 60-70% of the anabolic segment within 5 years.

- Niche markets for osteoporosis patients intolerant to bisphosphonates will maintain a premium segment for teriparatide.

Conclusions and Strategic Outlook

Teriparatide’s market is entering a period of significant transformation driven by patent expirations and biosimilar competition. While current pricing maintains a premium status in high-risk osteoporosis cases, future price erosion is unavoidable. Stakeholders—manufacturers, payers, and clinicians—must adapt by optimizing value propositions, supporting biosimilar adoption, and innovating in delivery modalities.

Key Takeaways

- The global teriparatide market is mature, with growth primarily driven by aging demographics and high-risk patient identification.

- Patent expiry and biosimilar entry will substantially decrease prices over the next 3–5 years, increasing access but reducing margins.

- Clinical factors favoring teriparatide include its anabolic benefits for severe osteoporosis; cost and convenience remain barriers.

- Competitive dynamics are shifting with the rise of alternative agents like romosozumab, impacting long-term market share.

- Strategic positioning should focus on differentiating via superior patient outcomes, optimizing cost strategies, and engaging in biosimilar partnerships.

FAQs

1. What is the primary driver of the declining price of teriparatide?

Patent expiration and subsequent biosimilar market entry are the main factors suppressing prices by increasing competition and providing more affordable alternatives.

2. How does biosimilar development influence teriparatide’s market value?

Biosimilars reduce costs and expand accessibility, while potentially eroding brand sales and profit margins of the original product.

3. Are there upcoming regulatory approvals that could reshape the teriparatide landscape?

Yes, several biosimilars and emerging anabolic agents are in clinical development or seeking approval, which could significantly influence market dynamics.

4. How do treatment guidelines impact the future demand for teriparatide?

Guidelines increasingly endorse anabolic therapies for severe osteoporosis, likely sustaining demand among high-risk patient groups despite price reductions.

5. What strategic actions should stakeholders consider given market trends?

Investing in biosimilar partnerships, innovating delivery methods, and focusing on personalized treatment protocols will be critical to maintaining competitiveness.

References

[1] Grand View Research, "Osteoporosis Drugs Market Size, Share & Trends Analysis Report," 2022.

[2] U.S. Food and Drug Administration, "Forteo (Teriparatide) Prescribing Information," 2022.

[3] IQVIA, "Global Osteoporosis Therapeutics Market Data," 2022.

[4] Smith, J., et al., "Biosimilar Competition in Osteoporosis Therapies," Journal of Pharmaceutical Markets, 2022.

[5] EMA, "Regulatory Decisions on Biosimilars in Osteoporosis," 2022.