Last updated: July 27, 2025

Introduction

Teriflunomide, marketed primarily under the brand name Aubagio, is an oral disease-modifying therapy (DMT) approved for relapsing forms of multiple sclerosis (MS). Developed by Sanofi, teriflunomide’s unique mechanism as an immunomodulator has positioned it prominently within the MS treatment landscape. As the global MS market expands driven by increasing prevalence and advanced diagnostic techniques, understanding its market dynamics and pricing trajectory becomes essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

This report provides a comprehensive analysis of the current market environment for teriflunomide, forecasts its future price trends, and examines factors influencing its valuation and market share.

Market Overview

Global Multiple Sclerosis Market Landscape

The global MS market was valued approximately at USD 22 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4–6% through 2030. The increasing prevalence of MS — estimated at over 2.8 million people globally — coupled with advancements in diagnosis and treatment options, drives market expansion [[1]].

Teriflunomide’s Market Position

Teriflunomide holds a significant share among oral DMTs, competing with other agents such as fingolimod, dimethyl fumarate, and ozanimod. Its favorable administration route (oral daily dosing) and established efficacy profile have secured its foothold, particularly among patients with mild to moderate MS.

Sanofi’s strategic positioning of Aubagio leverages its reputation, though patent expiries and generic competition threaten its long-term exclusivity. Notably, the US patent expiration is scheduled for around 2030, subject to legal and regulatory factors.

Market Dynamics Influencing Price and Demand

Key Drivers

- Rising Prevalence of MS: As awareness and diagnosis improve globally, particularly in emerging markets, demand for MS therapies, including teriflunomide, is expected to grow.

- Efficacy and Safety Profile: The drug’s well-characterized safety and tolerability encourage continued use and prescription.

- Patient Preference for Oral Therapies: Oral DMTs, including teriflunomide, are increasingly preferred over injectable options, boosting sales volume.

- Regulatory Approvals and Label Expansion: Expanded indications or new formulations can positively influence market penetration.

Market Challenges

- Generic Competition Post-Patent Expiry: Generic versions are expected to lower prices significantly post-2030, impacting sanofi’s revenues.

- Pricing Pressure: Payers and health authorities aim to curb costs through negotiations, formularies, and tiered pricing.

- Emergence of Biosimilars and Novel Agents: Innovations and biosimilar entries threaten market share from established therapies.

Current Pricing Landscape

Pricing Benchmarks

In the U.S., the average wholesale price (AWP) for branded Aubagio ranges between USD 50,000 and USD 60,000 annually per patient, depending on dosage and pharmacy discounts. Retail prices vary across regions, influenced by healthcare policies, negotiations, and procurement schemes.

Reimbursement Policies

Most developed nations bundle teriflunomide into comprehensive MS treatment programs; reimbursement rates depend on cost-effectiveness assessments and health technology assessments (HTAs). The European market exhibits similar trends, with prices negotiated or set by national health services.

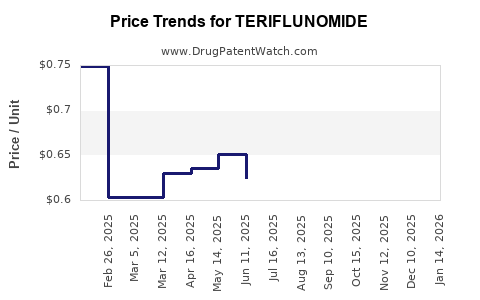

Pricing Trends

While initial launch prices have remained relatively stable, recent trends suggest downward adjustments anticipating increased market access and competition. The potential influx of generics is likely to cause price erosion starting five to seven years before patent expiry, as observed with other drugs.

Price Projection Analysis

Short-Term Outlook (Next 3–5 Years)

- Stable Pricing Enabled by Brand Premium: Given its still-patent-protected status, immediate price reductions are unlikely. Sanofi will maintain premium pricing driven by the drug’s efficacy and safety.

- Market Expansion in Emerging Economies: Introduction into new markets, with negotiated or tiered pricing, may temporarily sustain or slightly lower regional prices.

- Impact of Discounted Pricing Strategies: To maintain market share, specific payers may negotiate confidential discounts, influencing the net price.

Long-Term Outlook (Beyond 5 Years)

- Post-Patent Price Decline: Following patent expiration (~2030), generic versions will emerge. Historically, generic entry reduces drug prices by 60–80% within 2–3 years.

- Biosimilar and Alternative DMT Impact: Competitive pressure from biosimilars and emerging oral agents may precipitate further price reductions.

- Market Dynamics and Innovation: Newer therapies with enhanced efficacy or different mechanisms may shift demand away from teriflunomide, further impacting pricing strategy.

Forecast Summary Table

| Timeframe |

Expected Price Trend |

Key Factors |

| 2023–2025 |

Stable to slight decline |

Competitive negotiations, market expansion |

| 2026–2029 |

Moderate decline (up to 20%) |

Market saturation, payer pressure |

| 2030+ |

Sharp decline (up to 80%) |

Patent expiry, generic market entry |

Implications for Stakeholders

- Pharmaceutical Companies: R&D investments in next-generation MS therapies will pressurize existing drug prices post-patent expiry.

- Healthcare Providers: Budget constraints and formulary considerations will influence prescribing patterns, favoring cost-effective options.

- Investors: Valuation of sanofi’s MS portfolio will depend heavily on patent protection status and competitive dynamics.

- Policymakers: Price negotiations and accelerated approval for biosimilars may significantly alter subsidy models.

Key Factors Impacting Future Market and Price Trajectory

- Patent Litigation and Market Exclusivity: Legal challenges and patent extensions could delay generic competition, maintaining higher prices longer.

- Emerging Biosimilars: The development of biosimilars for DMTs could influence oral drug prices, including teriflunomide.

- Pricing and Reimbursement Policies: Governments adopting value-based pricing and value frameworks could lead to more aggressive price negotiations.

- Patient Adoption and Adherence: Patient preference for easy-to-take formulations and fewer side effects will sustain demand.

- Innovation Pipeline: Novel therapies with superior efficacy or safety profiles threaten teriflunomide’s market share and exclude price stability.

Conclusion

Teriflunomide remains a vital component in the MS treatment landscape, with substantial revenue potential sustained by its established efficacy and oral administration. However, its pricing trajectory will be significantly impacted by patent protections, market competition, and evolving healthcare policies.

In the immediate future, prices are expected to remain relatively stable, with gradual declines driven by negotiations and market expansion. Post-2030, the entry of generics and biosimilars will precipitate sharp price reductions, fundamentally altering its revenue landscape.

Stakeholders should monitor patent developments, emerging therapies, and policy reforms to adjust strategies accordingly. Optimally, strategic planning must incorporate the anticipated lifecycle and competitive shifts to maximize value acquisition and market positioning.

Key Takeaways

- Stable Pricing in Short Term: Teriflunomide’s exclusivity until around 2030 sustains relatively high prices.

- Pre-Patent Erosion: Prices will decline steadily starting 2–3 years prior to patent expiry due to negotiations and market forces.

- Generics Will Dramatically Lower Prices: Post-2030, expect a 60–80% reduction in drug prices with generic entry.

- Market Expansion Supports Revenues: Entry into emerging markets and increasing MS prevalence bolster demand, tempering price declines.

- Innovation Threats: Next-generation therapies and biosimilars could further pressure prices and market share.

FAQs

1. When is teriflunomide’s patent expected to expire?

Sanofi’s patent protection for Aubagio is anticipated to expire around 2030, after which generic versions are likely to enter the market.

2. How does generic entry affect teriflunomide’s pricing?

Generic competitors typically cause drug prices to fall by 60–80%, drastically reducing revenues for the original branded product.

3. What factors could delay generic competition?

Legal patent challenges, regulatory delays, or extended patent protections through litigation can postpone generic entry.

4. Are there any emerging therapies that could replace teriflunomide?

Yes, newer oral agents like ozanimod and innovative biologics with superior efficacy or safety profiles are potential competitors.

5. How do pricing and reimbursement policies influence teriflunomide’s market?

Health authorities and payers negotiate prices based on cost-effectiveness, which can lead to discounts, tiered formulary placement, or substitution with cheaper alternatives.

References

[1] Multiple Sclerosis Market Size and Trends. (2022). Reports and Market Analyses.

[2] Sanofi’s Aubagio Product Information. (2022). Pharmaceutical Data Sheets.

[3] Global MS Epidemiology and Treatment Landscape. (2021). Healthcare Journal.