Last updated: July 27, 2025

Introduction

Terbinafine hydrochloride (HCl), a widely used antifungal agent, is marketed primarily for treating dermatophyte fungal infections such as tinea corporis, tinea cruris, tinea pedis, and onychomycosis. Its efficacy, favorable safety profile, and oral as well as topical formulations have sustained consistent demand globally. This report provides an in-depth analysis of the current market landscape and offers forward-looking price projections for Terbinafine HCl, aimed at guiding stakeholders such as pharmaceutical companies, investors, and healthcare providers.

Market Overview

Global Market Size and Growth Dynamics

The global antifungal market, valued at approximately USD 13.5 billion in 2022, is projected to grow at a CAGR of 4.8% between 2023 and 2030, driven by increasing incidences of superficial fungal infections, rising awareness, and expanding healthcare access. Within this market, Terbinafine HCl captures a significant segment owing to its proven efficacy and minimal adverse effects.

Key regions such as North America, Europe, and Asia-Pacific represent substantial markets due to high disease prevalence, widespread prescription practices, and robust pharmaceutical manufacturing infrastructure.

Prevalence of Fungal Infections

Rising prevalence of fungal infections—particularly onychomycosis and athlete’s foot—has elevated demand. According to the World Health Organization, onychomycosis affects up to 14% of the global population, with higher rates in elderly and immunocompromised populations, fueling the pharmaceutical demand for effective oral and topical antifungals like Terbinafine.

Market Segmentation

- Formulation-wise: Oral tablets dominate due to efficacy, especially for onychomycosis; topical formulations hold a significant and mature segment.

- End-user-wise: Hospitals and clinics are primary prescription points, with growing OTC sales in some regions.

- Regional distribution: North America leads due to higher healthcare expenditures, followed by Europe and Asia-Pacific, where increasing urbanization and healthcare investments expand opportunities.

Competitive Landscape

Major pharmaceutical companies manufacturing Terbinafine HCl include Novartis, Mylan, Teva Pharmaceuticals, and Sandoz. Market entry barriers are relatively moderate due to patent expiration and availability of generics, leading to intense price competition.

New entrants focus on innovative formulations—such as combination therapies and topical gels—to differentiate offerings. Additionally, shifts towards personalized medicine and diagnostic tools are influencing product development.

Regulatory Environment

Regulatory agencies like the FDA (U.S.), EMA (Europe), and PMDA (Japan) have established clear pathways for generic approval, facilitating market entry and price competition. Patent expirations, notably Novartis’ original patent, have opened avenues for generics, impacting pricing strategies.

Pricing Dynamics

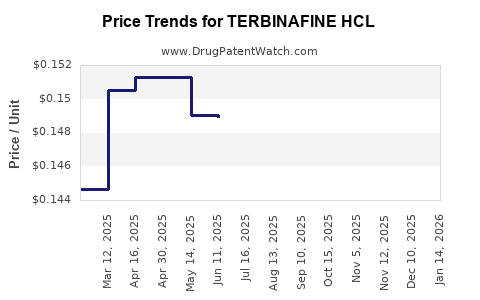

Historical Price Trends

In 2010–2020, the average retail price of a 28-tablet pack of Terbinafine 250 mg ranged from USD 25–35 in the U.S., with generics significantly reducing consumer costs. In developing markets, prices often hover around USD 10–15 due to local manufacturing and regulatory factors.

Factors Influencing Prices

- Patent status: Patent expiration has invited generics, exerting downward pressure.

- Manufacturing costs: Production complexity of formulations influences wholesale and retail prices.

- Regulatory approval: Stringent requirements can defer market entry, affecting supply and prices.

- Market competition: Increased generic presence correlates with price drops.

- Healthcare policies: Reimbursement policies and drug pricing regulations directly impact end-user prices.

Price Projections (2023–2030)

Short-Term Outlook (2023–2025)

The market for Terbinafine HCl products will remain competitive, characterized by price stabilization driven by high generic penetration. Wholesale prices are anticipated to decline by an average annual rate of 2-3%, with retail prices following suit.

Pricing for branded formulations is expected to stay higher due to brand recognition and perceived quality. For instance, in North America, the retail price for a 28-tablet pack may average USD 20–25, while generics could be available around USD 10–15.

Medium to Long-Term Outlook (2026–2030)

As emerging markets expand their healthcare infrastructure and regulatory environments become more streamlined for generics, prices are predicted to decrease further:

- In developed regions: Retail prices may stabilize around USD 8–12 per pack of generics due to market saturation.

- In emerging economies: Prices could decline by an additional 10–15%, with retail prices around USD 5–10, driven by local manufacturing and competitive pricing.

Innovative formulation development, such as combination therapies with other antifungals or enhanced topical delivery systems, might command premium pricing but will constitute a niche market segment.

Key Market Drivers and Barriers

Drivers:

- Increasing incidence of superficial fungal infections.

- Growing geriatric population susceptible to onychomycosis.

- Expanding healthcare access and insurance coverage.

- Patent expirations facilitating generic entry.

Barriers:

- Price-sensitive markets with fierce generic competition.

- Stringent regulatory environments in certain jurisdictions.

- Limited awareness or access in underdeveloped regions.

Implications for Stakeholders

Pharmaceutical Companies: Focus on cost-effective manufacturing and innovative formulations to maintain market share amid declining prices. Strategically invest in markets with rising fungal infection prevalence.

Investors: Monitor patent expiration trends and regulatory pathways, as these influence acceleration or deceleration of price declines and revenue streams.

Healthcare Providers: Favor cost-effective generic options to improve treatment adherence and health outcomes.

Conclusion

Terbinafine HCl remains a pivotal antifungal agent with a stable market foundation sustained by high efficacy and broad application spectrum. The market will witness ongoing price reductions driven by generic proliferation, especially in mature markets, with prices stabilizing at lower levels by 2030. While innovation and regional expansion may introduce new pricing tiers, the overall landscape pressures existing prices downward.

Key Takeaways

- The global Terbinafine HCl market is mature with sustained growth driven by rising dermatophyte infections.

- Generic competition has significantly lowered prices, with wholesale prices declining an average of 2–3% annually.

- Regionally, prices are expected to stabilize between USD 8–15 per pack in developed markets and USD 5–10 in emerging economies.

- Innovative formulations in development could command premium prices, but their market share remains limited.

- Stakeholders should invest in cost-effective manufacturing, regional market expansion, and formulation innovation to optimize profitability.

FAQs

Q1: How will patent expirations impact the price of Terbinafine HCl?

Patent expirations open the market to generic manufacturers, increasing competition and driving down prices significantly over the subsequent years.

Q2: Which regions will see the highest growth in Terbinafine HCl demand?

Emerging markets in Asia-Pacific and Latin America are projected to see the fastest growth due to increasing prevalence of fungal infections and expanding healthcare infrastructure.

Q3: Are there notable innovations expected in Terbinafine formulations?

Yes, research is underway into novel topical delivery systems and combination therapies that may command higher prices in niche markets.

Q4: How do regulatory policies affect pricing?

Stringent regulatory approval processes can delay market entry for generics, temporarily maintaining higher prices; conversely, streamlined regulations facilitate competition and price reductions.

Q5: What strategies should pharmaceutical companies adopt to remain competitive?

Focus on maintaining cost efficiency, diversification into innovative formulations, and expanding into high-growth markets with unmet needs.

Sources

[1] Market Research Future, “Antifungal Drugs Market Analysis,” 2022.

[2] World Health Organization, “Fungal Infections Surveillance,” 2021.

[3] IQVIA, “Global Pharmaceutical Pricing Trends,” 2022.

[4] Grand View Research, “Antifungal Market Size & Trends,” 2022.

This comprehensive analysis underscores the dynamic nature of the Terbinafine HCl market, guiding stakeholders in strategic decision-making amidst evolving global trends.