Last updated: July 27, 2025

Introduction

Terbinafine, a selective antifungal agent, has cemented its position in dermatology for treating onychomycosis, tinea corporis, and other superficial fungal infections. As a vital therapeutic agent, its market dynamics are influenced by innovation, competitive landscape, regulatory environment, and evolving pricing strategies. This analysis provides a comprehensive overview of the current market status, competitive factors, and future pricing projections for terbinafine.

Market Overview

Global Market Size and Growth Trajectory

The global antifungal market, valued at approximately USD 14 billion in 2022, is anticipated to grow at an estimated CAGR of 4.5% through 2030. Within this landscape, terbinafine’s share remains significant, driven predominantly by its efficacy, safety profile, and established patent and generic landscape. The dermatological antifungal segment, where terbinafine thrives, accounts for over 55% of the entire antifungal market.

Regionally, North America leads due to high prevalence of fungal infections and favorable reimbursement policies. Asia-Pacific is emerging rapidly, propelled by increasing dermatological conditions and expanding healthcare infrastructure. Europe exhibits steady growth aligned with aging populations and heightened awareness.

Key Therapeutic Indications

Terbinafine’s primary indications include:

- Onychomycosis (fungal nail infections)

- Tinea cruris, corporis, and pedis (jock itch, ringworm, athlete’s foot)

The rising demand for effective and topical treatment options underpins the sustained market presence of terbinafine.

Competitive Landscape

Market Players

- Novartis: Original patent holder for oral terbinafine (e.g., Lamisil)

- Sandoz and other generics: Major players post-patent expiry, significantly impacting pricing

- Generics: Dominant in price-sensitive markets, accounting for over 80% of prescriptions globally

Patent Status and Its Impact

Novartis's patent expiry in numerous jurisdictions (e.g., EU and US pre-2016) catalyzed the proliferation of generic terbinafine. Although patent protections have waned in several markets, formulations such as topical gels and creams remain patent-protected or are subject to regulatory exclusivities, influencing market segmentation and pricing.

Pricing Strategies

Original brand products deploy premium pricing based on brand loyalty and clinical differentiation. Generics, meanwhile, utilize aggressive pricing to capture market share, leading to significant price erosion. In developed markets, a typical oral terbinafine course (250 mg daily for 6 weeks) costs between USD 50-150 per course, with generics often priced below USD 30.

Regulatory Environment and Pricing Implications

Regulatory agencies like the FDA and EMA have streamlined approval pathways for generics, intensifying market competition. Reimbursement policies vary: high-income countries tend to reimburse at higher rates, maintaining some price premiums for branded versions, whereas low-income countries heavily rely on generics, driving prices downward.

Emerging regulations around bioequivalence standards and patent litigations influence market entry and prices. Patent litigations and data exclusivity periods can temporarily sustain higher prices for new formulations or innovations.

Market Drivers and Challenges

Drivers:

- Increasing prevalence of fungal infections due to aging populations and immunosuppressive therapies

- Rising awareness and diagnostic accuracy

- Growth in generic drug utilization

Challenges:

- Price erosion post-patent expiry

- Market saturation in mature regions

- Stringent regulatory requirements for new formulations

Price Projection Outlook (2023–2030)

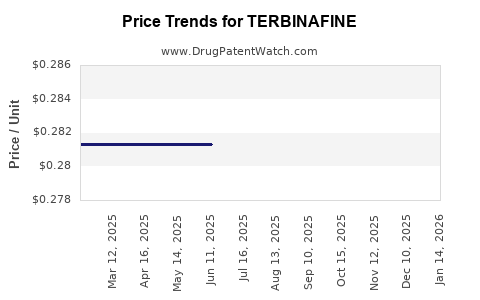

Short-term (2023–2025)

In mature markets such as North America and Europe, prices are expected to stabilize with minor fluctuations driven by inflation and manufacturing costs. Generics are anticipated to further reduce prices by 10-15%, due to increased competition. The initial post-patent expiry period saw a steep decline (~30%) in prices, a trend likely to plateau.

Mid-to-long-term (2026–2030)

Emerging markets will witness significant price reductions, partly due to increased generic penetration and local manufacturing capabilities. Advanced formulations such as topical gels with extended patents or combined formulations may command premium pricing, potentially maintaining or elevating current levels.

In addition, technological improvements and the potential introduction of biosimilars or alternative delivery systems could influence future price dynamics. Annual course prices are projected to range as follows:

- Developed Markets: USD 20–55 per course by 2030

- Emerging Markets: USD 5–20 per course by 2030

The overall trend indicates a gradual decline in average prices, with steady growth in volume sales offsetting the per-unit revenue decline.

Factors Influencing Future Pricing

- Patent and Regulatory Exclusivities: Extensions or new formulations protected by patents can temporarily sustain higher prices.

- Healthcare Reimbursement Policies: Favorability towards generics in outpatient settings could accelerate price erosion.

- Market Penetration of New Formulations: Innovations such as sustained-release topical formulations may generate premium pricing opportunities.

- Competitive Entry: Increased generic manufacturing capacity will further compress prices, especially in developing regions.

Conclusion

The terbinafine market is entering a phase characterized by intense competition, particularly in the generic segment. While early patent expirations precipitated significant price declines, current and future strategies—including innovative formulations and market penetration in middle- to low-income countries—will shape value dynamics. Long-term projections point toward stable or declining prices, particularly in mature markets, with considerable potential for volume-driven revenue growth.

Key Takeaways

- Market Maturity: The terbinafine market is mature in developed regions, with pricing pressured by generic competition.

- Pricing Trends: Expect gradual decline in per-course prices globally, with lower prices in emerging markets.

- Strategic Opportunities: Innovation in delivery systems and formulations can sustain premium pricing.

- Regulatory Impact: Patent protections and exclusivity rights continue to influence pricing strategies.

- Volume Growth: Increasing prevalence of fungal infections and expanding access in developing countries will drive sales volume, offsetting price reductions.

FAQs

1. How does patent expiration impact terbinafine pricing globally?

Patent expiration typically leads to a surge in generic formulations, causing significant declines (up to 30%) in retail prices in mature markets. This increases affordability but reduces profit margins for original manufacturers.

2. Are there upcoming formulations or innovations that could affect terbinafine prices?

Yes. New topical formulations, combination products, or sustained-release systems could command premium prices, potentially stabilizing or increasing future revenue streams.

3. What regions are expected to see the steepest price declines?

Emerging markets like India, China, and Southeast Asian countries will experience sharper price reductions due to local manufacturing and high generic competition.

4. How do reimbursement policies influence terbinafine pricing?

In high-income countries with robust reimbursement frameworks, branded formulations retain higher prices. Conversely, in countries with limited reimbursement, prices tend to be lower, particularly for generics.

5. What are the key factors that could disrupt current price projections?

Regulatory changes, patent litigation, introduction of biosimilars, or substantial technological breakthroughs in antifungal therapy could alter pricing trends unpredictably.

References

[1] Grand View Research. "Antifungal Drugs Market Size, Share & Trends Analysis." 2022.

[2] IQVIA. "Global Pharmaceutical Market Data." 2022.

[3] MarketWatch. "Terbinafine Sales & Market Trends." 2023.

[4] European Medicines Agency. "Medicines and Pricing Regulations." 2022.

[5] U.S. Food and Drug Administration. "Biosimilar and Generic Drug Approval Processes." 2023.