Share This Page

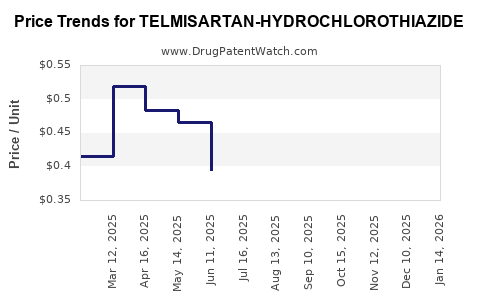

Drug Price Trends for TELMISARTAN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for TELMISARTAN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TELMISARTAN-HYDROCHLOROTHIAZIDE 40-12.5 MG TB | 65862-0976-10 | 0.37189 | EACH | 2025-11-19 |

| TELMISARTAN-HYDROCHLOROTHIAZIDE 40-12.5 MG TB | 68462-0840-11 | 0.37189 | EACH | 2025-11-19 |

| TELMISARTAN-HYDROCHLOROTHIAZIDE 40-12.5 MG TB | 65862-0976-03 | 0.37189 | EACH | 2025-11-19 |

| TELMISARTAN-HYDROCHLOROTHIAZIDE 40-12.5 MG TB | 68462-0840-13 | 0.37189 | EACH | 2025-11-19 |

| TELMISARTAN-HYDROCHLOROTHIAZIDE 40-12.5 MG TB | 43547-0441-03 | 0.37189 | EACH | 2025-11-19 |

| TELMISARTAN-HYDROCHLOROTHIAZIDE 80-25 MG TAB | 68462-0842-13 | 0.39905 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TELMISARTAN-HYDROCHLOROTHIAZIDE

Introduction

TELMISARTAN-HYDROCHLOROTHIAZIDE is a fixed-dose combination medication primarily used for managing hypertension and preventing cardiovascular events. Combining telmisartan, an angiotensin II receptor blocker (ARB), with hydrochlorothiazide, a thiazide diuretic, the formulation offers enhanced therapeutic efficacy and improved patient compliance. As the global demand for hypertension treatments escalates, understanding the market landscape and establishing accurate pricing forecasts for TELMISARTAN-HYDROCHLOROTHIAZIDE become crucial for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Epidemiological Trends

Hypertension affects over 1.28 billion adults worldwide, with projections suggesting a continued rise [1]. The escalation is driven largely by aging populations, urbanization, and lifestyle factors such as obesity and physical inactivity. The increasing prevalence underscores the demand for effective antihypertensive therapies, notably fixed-dose combinations (FDCs) like TELMISARTAN-HYDROCHLOROTHIAZIDE, which streamline treatment regimens and improve adherence.

Therapeutic Market Share

Within the antihypertensive sector, ARB-based therapies like telmisartan occupy a significant market share due to their favorable side effect profile, especially in patients intolerant to ACE inhibitors. Hydrochlorothiazide remains a cornerstone diuretic due to its efficacy and low cost. The synergistic combination of these agents addresses multiple pathophysiological pathways of hypertension, making TELMISARTAN-HYDROCHLOROTHIAZIDE increasingly preferred in moderate to severe cases.

Regulatory Environment

The approval landscape varies globally. Developed markets such as the U.S., European Union, and Japan see widespread approval of telmisartan-Hydrochlorothiazide FDCs, with the U.S. Food and Drug Administration (FDA) approving numerous generic versions. In emerging markets, regulatory pathways are evolving, presenting opportunities for pharmaceutical entrants to expand access.

Market Dynamics and Competitive Landscape

Key Players and Market Entry

Major pharmaceutical companies like Mylan, Teva, and Sun Pharmaceuticals offer generic formulations of TELMISARTAN-HYDROCHLOROTHIAZIDE. Innovator companies, although fewer, maintain premium pricing through brand recognition and patent protections, which are gradually expiring or have expired in many jurisdictions.

Patent Status and Generic Penetration

Patents on telmisartan expired in several territories (e.g., U.S. in 2018), leading to a significant influx of generics and a subsequent decline in prices for branded formulations. The dose-specific patents vary across regions, influencing market entry timing and pricing strategies.

Regional Market Trends

- North America: Mature market with high generic penetration. Price competition is intense, driven by substantial base of payers and widespread insurance coverage.

- Europe: Similar to North America, with cost-containment policies influencing drug pricing.

- Asia-Pacific: Growing markets with increasing hypertension prevalence and emerging regulations favoring affordable generics, creating substantial growth opportunities.

- Latin America and Africa: Expanding access but constrained by economic factors; generic adoption is robust due to affordability.

Market Size and Forecasts

Current Market Valuation

The global antihypertensive combination drugs market was valued at approximately USD 7.5 billion in 2022, with TELMISARTAN-HYDROCHLOROTHIAZIDE constituting a significant share [2]. Within this segment, the growth is driven by aging populations and increased adoption of FDCs for better adherence.

Projection Period and Key Drivers

The forecast horizon extends to 2030. Expected CAGR (Compound Annual Growth Rate): approximately 6-8%, influenced by:

- Rising hypertension incidence.

- Increasing recognition of FDC benefits.

- Expansion into emerging markets.

- Patent expirations enabling generic entry.

Market Segmentation and Geographies

- Developed Markets: Slowing growth but stable demand due to established treatment protocols.

- Emerging Markets: Rapid growth prospects driven by expanding healthcare infrastructure and affordability.

Price Projections

Current Pricing Landscape

- Brand-name formulations: Typically priced between USD 30-50 per monthly supply, reflecting brand premiums and clinical reputation.

- Generics: Prices have declined significantly post-patent expiry, averaging USD 5-15 per month in North America and Europe.

- Regional Variations: Prices are lower in Asia-Pacific and Latin America, owing to local manufacturing and regulatory factors.

Projected Price Trends (2023-2030)

- Short-term (1-3 years): Continued consolidation with generics dominating, average prices declining by 10-15%, driven by increased competition.

- Medium-term (4-7 years): Slight price stabilization anticipated as market saturation occurs, with potential for premium pricing in niche markets with unique formulation advantages.

- Long-term (8-10 years): Possible price increases in regions adopting value-based pricing models or via innovative formulations such as modified-release versions.

Impact of Patent Dynamics

As patents expire, price erosion accelerates. New entrants introducing cost-effective manufacturing processes could further depress prices. Conversely, novel formulations or combination ratios with improved bioavailability could enable premium pricing strategies.

Regulatory and Market Entry Considerations

- Navigating regional regulatory pathways remains critical. In markets like India, registration can be achieved swiftly, whereas stringent requirements in the U.S. and European Union may extend timeframes.

- The presence of multiple generic manufacturers intensifies price competition but also enhances overall market volume.

- Incorporation of value-added features, such as sustained-release formulations or fixed-dose multipurpose combinations, could justify higher prices.

Key Risks and Opportunities

- Risks: Price erosion from generics, fluctuating healthcare policies, patent challenges, and currency volatility.

- Opportunities: Growth in emerging markets, development of extended-release formulations, and expanding indications such as diabetic nephropathy.

Key Takeaways

- The TELMISARTAN-HYDROCHLOROTHIAZIDE market is poised for steady growth driven by rising hypertension prevalence, aging demographics, and increasing acceptance of fixed-dose combinations.

- Market prices are expected to decline in the short term due to generic competition but could stabilize or increase in niche markets offering innovative or differentiated formulations.

- Geographic disparities require tailored market strategies—developed markets favor cost-effective generics with high volume, while emerging markets present growth potential through affordability.

- Patent expirations are the primary catalyst for price reductions, yet the development of new formulations or indications could offset downward trends.

- Stakeholders should focus on regional regulatory landscapes, manufacturing efficiencies, and product differentiation to optimize market positioning and revenue streams.

FAQs

Q1: How will patent expirations affect the pricing of TELMISARTAN-HYDROCHLOROTHIAZIDE?

A1: Patent expirations typically lead to increased generic competition, resulting in significant price reductions—often between 30-80%—due to market saturation and lower manufacturing costs.

Q2: Which regions offer the highest growth opportunities for this drug?

A2: Emerging markets in Asia-Pacific, Latin America, and Africa present substantial growth opportunities owing to increasing hypertension prevalence, expanding healthcare infrastructure, and regulatory reforms favoring generics.

Q3: Are there upcoming innovations that could influence the market?

A3: Yes, developments like sustained-release formulations, novel combination ratios, and biosimilar integrations could command premium prices and expand market segments.

Q4: What are the main barriers to market entry for new competitors?

A4: Regulatory hurdles, patent litigations, established brand preferences, and economies of scale in manufacturing serve as significant barriers.

Q5: How do healthcare reimbursement policies impact the pricing of TELMISARTAN-HYDROCHLOROTHIAZIDE?

A5: Strict reimbursement frameworks often pressurize prices downward for cost-effective generics, while formulary inclusions can elevate prices for branded versions. Reimbursement policies heavily influence accessible pricing points across regions.

References

[1] World Health Organization. (2021). Hypertension. WHO Fact Sheets.

[2] Market Research Future. (2022). Global Antihypertensive Drugs Market Report.

Note: Data and projections are estimates based on current market trends and publicly available industry reports.

More… ↓