Share This Page

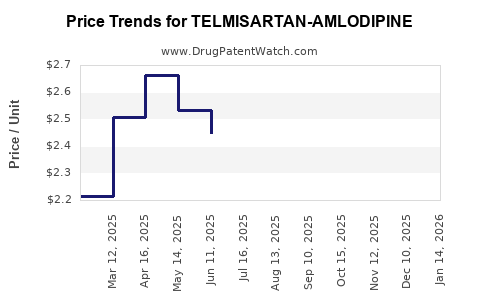

Drug Price Trends for TELMISARTAN-AMLODIPINE

✉ Email this page to a colleague

Average Pharmacy Cost for TELMISARTAN-AMLODIPINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TELMISARTAN-AMLODIPINE 40-10 | 00378-1076-93 | 2.86858 | EACH | 2025-12-17 |

| TELMISARTAN-AMLODIPINE 40-5 MG | 00378-1075-93 | 2.76577 | EACH | 2025-12-17 |

| TELMISARTAN-AMLODIPINE 80-5 MG | 00378-1077-93 | 2.89539 | EACH | 2025-12-17 |

| TELMISARTAN-AMLODIPINE 80-10 | 00378-1078-93 | 3.38169 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TELMISARTAN-AMLODIPINE

Introduction

Telmisartan-Amlodipine combination therapy occupies a significant niche within the antihypertensive pharmaceutical market. With hypertension affecting approximately 1.2 billion people worldwide—projected to rise further—innovations in combination drug therapies address unmet clinical needs by improving compliance and treatment efficacy. This analysis deconstructs the current market landscape and offers price projections, illuminating growth trajectories and strategic opportunities.

Market Overview

Global Hypertension Treatment Landscape

Hypertension remains a leading risk factor for cardiovascular diseases globally, with an estimated economic burden exceeding $370 billion annually, according to the World Health Organization (WHO). The treatment paradigm has evolved toward fixed-dose combinations (FDCs), such as Telmisartan-Amlodipine, due to their capacity to enhance patient adherence, reduce pill burden, and improve blood pressure control.

Pharmacological Profile

- Telmisartan: An angiotensin receptor blocker (ARB), praised for its once-daily dosing and renal protective effects.

- Amlodipine: A calcium channel blocker (CCB), with proven efficacy in decreasing peripheral vascular resistance.

Combined, these agents synergistically manage hypertensive patients resistant to monotherapy, solidifying their role within combination regimens.

Market Dynamics

The increasing prevalence of resistant hypertension, aging populations, and the rising awareness of cardiovascular risk factors fuel demand. Additionally, the shift toward generic formulations amplifies accessibility, influencing market volume and pricing strategies.

Current Market Players

Major pharmaceutical companies that market Telmisartan-Amlodipine formulations include:

- Pfizer (Norvasc & Telmisartan-based products)

- Novartis (Amlodipine-based therapies)

- Sun Pharmaceutical

- Aurobindo Pharma

- Mylan (now part of Viatris)

Generic manufacturers increasingly capture market share, exerting downward pressure on prices, especially as patent expirations approach.

Market Size and Forecast (2023-2028)

Current Market Valuation

The global antihypertensive combination drugs market was valued at approximately $20 billion in 2022[1]. Telmisartan-Amlodipine combinations comprise an estimated 15-20% of this market, suggesting a valuation near $3-4 billion.

Growth Drivers

- Prevalence of Resistant Hypertension: Resistance to monotherapy now accounts for nearly 10-15% of hypertensive cases, increasing demand for combination treatments.

- Regulatory Approvals: Regulatory bodies favor fixed-dose combinations for their improved efficacy profiles.

- Patient Compliance Focus: Driven by healthcare policies and clinical guidelines that emphasize adherence.

Projected CAGR (2023-2028)

Analysts forecast a compound annual growth rate of approximately 6-8% for the Telmisartan-Amlodipine segment, reaching a market valuation of $5-6 billion by 2028[2].

Price Projections

Current Pricing Landscape

- Brand-name Formulations: Annual treatment costs range between $300-$600 for branded Telmisartan-Amlodipine products, varying by region.

- Generics: Prices drop substantially, with annual costs falling to $50-$150 in key markets like India, China, and emerging economies.

Factors Influencing Future Pricing

- Patent Expirations: The primary patent for innovator drugs generally expires within 5-7 years, facilitating generic entries.

- Regulatory Landscape: Stringent regulations may impact pricing flexibility.

- Market Competition: Increased generic availability typically leads to significant price erosion.

- Healthcare Reimbursement Policies: Shift toward value-based care pressures prices downward in some markets.

Price Trajectory (2023-2028)

- Branded Drugs: Expected to decline by 10-15% annually due to generic competition, with prices stabilizing around $150-$200 annually in mature markets by 2028.

- Generics: Could see a gradual price plateau, maintaining low-cost accessibility, with minimal fluctuations around $30-$70 annually.

Impact of Biosimilars and Combination Variants

The emergence of biosimilar competitors and alternative combination formulations could further compress pricing margins, particularly in developed markets.

Regional Market Insights

United States

The U.S. dominates demand, driven by high hypertension prevalence and healthcare expenditure. Regulatory approval and uptake depend heavily on clinical guidelines alignment and insurance reimbursement policies.

Europe

European markets follow similar trends but with regional pricing controls, resulting in generally lower prices compared to the U.S. market.

Asia-Pacific

The fastest-growing segment propelled by large patient populations, expanding healthcare infrastructure, and increasing adoption of generics.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Must balance innovation-driven differentiation with cost-effective generics to sustain margins.

- Healthcare Payers: Need to negotiate drug prices while ensuring access to effective therapies.

- Investors: Should monitor patent lifecycles, regulatory changes, and market penetration rates to inform valuation models.

Key Challenges and Opportunities

- Challenges: Patent cliffs, aggressive generic competition, regulatory hurdles, and price control policies.

- Opportunities: Expansion into emerging markets, development of improved formulations, and combination with novel pharmacologics.

Conclusion

The Telmisartan-Amlodipine market is poised for moderate growth, dominated by generic erosion of prices along with increasing adoption driven by clinical need. While branded formulations maintain premium pricing in the short term, the long-term outlook indicates significant price reductions, particularly in competitive markets. Strategic stakeholders should leverage regional insights, patent situations, and evolving regulatory landscapes to optimize market positioning and investment decisions.

Key Takeaways

- The global Telmisartan-Amlodipine market is projected to reach $5-6 billion by 2028 with a CAGR of approximately 6-8%.

- Pricing is expected to decline significantly, especially for generic formulations, stabilizing in the $30-$70 annual treatment cost range.

- Patent expirations in the next 5-7 years will catalyze generic competition, pressure pricing, and expand access regions.

- Market growth is driven by rising hypertension prevalence, increased awareness, and regulatory favorability for fixed-dose combinations.

- Stakeholders should focus on regional market dynamics, patent strategy, and evolving healthcare policies to capitalize on opportunities.

References

[1] MarketResearch.com. "Global Antihypertensive Drugs Market Analysis," 2022.

[2] Fortune Business Insights. "Hypertensive_fixed Dose Combinations Market Size, Share & Industry Analysis," 2023.

FAQs

-

What is the primary driver for growth in the Telmisartan-Amlodipine market?

The rising prevalence of resistant hypertension and the clinical preference for fixed-dose combinations to improve adherence are key growth drivers. -

How are patent expirations affecting the market?

Patent expirations facilitate generic entry, leading to substantial price reductions and increased market accessibility. -

What regions are expected to dominate future markets?

North America and Europe currently lead, but Asia-Pacific is rapidly expanding due to demographic shifts and healthcare infrastructure development. -

Will branded Telmisartan-Amlodipine formulations remain profitable?

Likely in the short to medium term, but long-term profitability will decline as generics dominate and prices converge. -

How do regulatory policies impact drug prices?

Price controls and reimbursement policies in certain regions can suppress drug prices, accelerating generic adoption and price erosion.

More… ↓