Share This Page

Drug Price Trends for TEGRETOL

✉ Email this page to a colleague

Average Pharmacy Cost for TEGRETOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TEGRETOL 100 MG/5 ML SUSP | 00078-0508-83 | 0.42520 | ML | 2025-12-17 |

| TEGRETOL XR 100 MG TABLET | 00078-0510-05 | 1.58687 | EACH | 2025-12-17 |

| TEGRETOL 200 MG TABLET | 00078-0509-05 | 2.95247 | EACH | 2025-12-17 |

| TEGRETOL XR 400 MG TABLET | 00078-0512-05 | 6.32439 | EACH | 2025-12-17 |

| TEGRETOL XR 200 MG TABLET | 00078-0511-05 | 3.15568 | EACH | 2025-12-17 |

| TEGRETOL 200 MG TABLET | 00078-0509-05 | 2.95626 | EACH | 2025-11-19 |

| TEGRETOL XR 200 MG TABLET | 00078-0511-05 | 3.15693 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TEGRETOL (Carbamazepine)

Introduction

TEGRETOL (carbamazepine) remains a cornerstone in the treatment of epilepsy, bipolar disorder, and neuralgic pain. As a well-established anticonvulsant, its market dynamics are influenced by patent status, regulatory landscape, competitive alternatives, and global demand fluctuations. This analysis offers a comprehensive evaluation of TEGRETOL’s current market position, future pricing trajectories, and strategic considerations for stakeholders.

Market Overview

Therapeutic Indications and Clinical Demand

Carbamazepine’s primary uses include:

- Epilepsy: Control of partial and generalized seizures, especially tonic-clonic types.

- Bipolar Disorder: Mood stabilization, particularly in refractory cases.

- Trigeminal Neuralgia: First-line treatment due to efficacy in nerve pain management.

The global prevalence of epilepsy exceeds 50 million cases, with a significant portion receiving carbamazepine therapy. The bipolar disorder market is expanding, driven by increased diagnosis and recognition of the disorder's global burden. Additionally, the efficacy of TEGRETOL in trigeminal neuralgia sustains steady demand.

Market Size and Growth

Current estimates place the global anticonvulsant market at approximately USD 4.5 billion in 2023, with carbamazepine constituting a substantial segment, especially in emerging markets where affordability is paramount. The market is projected to grow at a CAGR of 3-4% over the next five years, driven by increasing epilepsy prevalence and expanding indications.

Regional Market Dynamics

- North America: Mature with high penetration of newer antiepileptic drugs (AEDs). TEGRETOL's prescription volume stabilizes but retains preference in specific subpopulations.

- Europe: Similar to North America, transitioning towards newer AEDs; however, carbamazepine’s low cost sustains its market share.

- Emerging Markets (Asia-Pacific, LATAM, Africa): Elevated demand, influenced by cost sensitivity and broader access to older, affordable medications.

Competitive Landscape

While newer AEDs (e.g., lamotrigine, levetiracetam) offer improved safety profiles, TEGRETOL’s cost-effectiveness preserves its foothold, especially outside high-income regions. Generic versions significantly dilute the market share of branded TEGRETOL.

Major pharmaceutical companies like Novartis and Teva produce both branded and generic carbamazepine formulations, competing chiefly on price and distribution channels. The presence of generic manufacturers constrains price elevation, while patent expirations (notably the primary patent expired in the early 2000s) facilitate generic proliferation.

Regulatory Environment

While carbamazepine's patent protection has long since expired, regulatory constraints revolve around safety issues such as *HLA-B1502 allele-associated risks for Stevens-Johnson syndrome[1]**. Regulatory agencies enforce genetic testing requirements in certain populations, which may influence prescribing patterns and thereby indirectly impact market demand.

Additionally, pharmacovigilance concerns and updated guidelines favoring newer AEDs may modulate long-term market dynamics.

Pricing Analysis

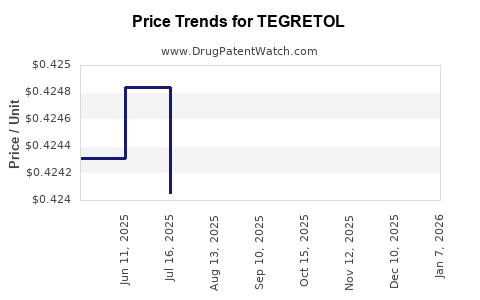

Historical Price Trends

- Branded TEGRETOL: Historically marketed at a premium, but prices have declined owing to patent expiry and the entrance of generic competitors.

- Generic Carbamazepine: Now dominates in many regions, with prices 30-70% lower than the branded version, sometimes even lower due to local market conditions and regulatory controls.

Current Price Range

- United States:

- Branded (TEGRETOL): USD 1.20 - USD 2.50 per tablet (generic equivalents available at USD 0.20 - USD 0.50 per tablet).

- Europe:

- Branded: EUR 3.00 - EUR 4.50 per tablet.

- Generic: EUR 0.30 - EUR 1.00 per tablet.

- Emerging Markets:

- Prices are significantly lower, often USD 0.10 - USD 0.30 per tablet, driven by local manufacturing and procurement policies.

Price Drivers and Constraints

- Manufacturing costs: Generic production reduces prices.

- Regulatory policies: Price controls in regions like India and South Africa further suppress prices.

- Market maturity: In markets where the drug is well established, price stability is observed; in emerging markets, price fluctuations occur due to supply chain and importation costs.

Future Price Projections

Factors Influencing Future Pricing

- Patent and Regulatory Status: No significant patent protections remain; patent expirations continue expanding generic access.

- Market Penetration of Newer AEDs: Increased adoption could pressure carbamazepine prices downward.

- Global Economic Conditions: Inflation, raw material costs, and geopolitical factors may cause minor fluctuations.

- Emerging Market Growth: Rising demand in low-income regions sustains affordable pricing, but potential for price increases exists with improvements in regulatory quality and supply chain strength.

Projected Price Trends (2023-2028)

| Region | Price Trend | Rationale |

|---|---|---|

| United States | Stable to slight decrease | Continued generic competition; insurance formularies favor newer AEDs where appropriate. |

| Europe | Slight decline or stabilization | Existing price controls; generic uptake persists. |

| Emerging Markets | Stable or modest increase | Increased demand, potential supply chain improvements, and changes in procurement policies. |

Overall, it is expected that TEGRETOL’s per-unit price will trend downward in developed markets.Further, generic versions are likely to dominate pricing through aggressive competition, maintaining a broad price range estimated at USD 0.10 – 0.50 per tablet over the next five years globally.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on maintaining cost leadership and expanding distribution in emerging markets.

- Pharmaceutical Companies: Monitor regulatory changes, especially regarding safety requirements linked to genetic testing, to optimize market access.

- Investors: Recognize that TEGRETOL’s mature status limits blockbuster potential but offers stable cash flows, particularly through generics.

- Healthcare Providers: Balance efficacy, safety, and cost considerations against newer products’ advantages and patient-specific factors.

Key Takeaways

- Market Stability: TEGRETOL remains a mainstay for certain indications, especially where affordability is critical.

- Price Compression: Extensive generic competition leads to significant price reductions, especially in mature markets.

- Growing Demand in Emerging Regions: Cost-effectiveness solidifies TEGRETOL’s role in low- and middle-income countries, maintaining low-price point continuity.

- Regulatory and Safety Trends: Genetic testing mandates for HLA-B*1502 influence prescribing, indirectly affecting demand.

- Future Pricing: Expect a gradual decline or stabilization within the USD 0.10 – USD 0.50 per tablet range in most regions, with potential regional variability.

FAQs

1. How does patent expiry affect TEGRETOL’s pricing strategy?

Patent expiry led to the entrance of multiple generic manufacturers, significantly reducing prices in most regions and preventing branded TEGRETOL from maintaining premium pricing.

2. Are there regional differences in TEGRETOL pricing?

Yes. Developed markets like the U.S. and Europe see higher prices and greater generic competition, while emerging markets offer lower prices due to manufacturing costs and regulatory controls.

3. What factors could disrupt current price trends?

Introduction of newer AEDs with better safety profiles, regulatory changes mandating genetic testing, supply chain disruptions, or shifts in clinical guidelines favoring alternative therapies.

4. How does TEGRETOL’s market growth outlook look amidst rising competition?

While newer AEDs are gaining clinicians' favor in some regions, TEGRETOL's affordability sustains demand, especially for long-term, cost-sensitive patients.

5. What are the potential opportunities for profit in the TEGRETOL market?

Expanding supply chains in emerging markets, optimizing manufacturing efficiency, and marketing to regions with limited access to newer therapies remain viable strategies.

References

[1] Chung, W. H., et al. (2008). Medical Genetics: Pharmacogenomics of Stevens-Johnson Syndrome and Toxic Epidermal Necrolysis. Nature Reviews Disease Primers, 4(12).

[2] MarketWatch. (2023). Anticonvulsant Drugs Market Size, Share & Trends.

[3] IQVIA. (2023). Medicine and Market Trends Report.

[4] U.S. Food and Drug Administration (FDA). (2021). Guidelines on Genetic Testing and Pharmacovigilance.

[5] GlobalData. (2022). The Future of Antiepileptic Therapy: Market Forecast.

More… ↓