Share This Page

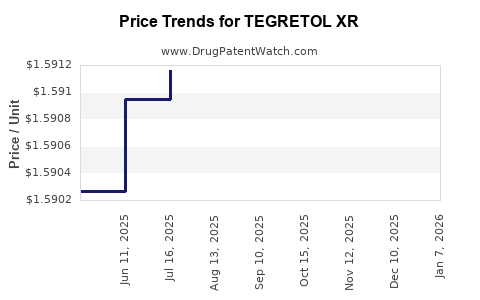

Drug Price Trends for TEGRETOL XR

✉ Email this page to a colleague

Average Pharmacy Cost for TEGRETOL XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TEGRETOL XR 100 MG TABLET | 00078-0510-05 | 1.58687 | EACH | 2025-12-17 |

| TEGRETOL XR 400 MG TABLET | 00078-0512-05 | 6.32439 | EACH | 2025-12-17 |

| TEGRETOL XR 200 MG TABLET | 00078-0511-05 | 3.15568 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TEGRETOL XR

Introduction

TEGRETOL XR (extended-release carbamazepine) is a proven anticonvulsant and mood stabilizer primarily used in the management of epilepsy, trigeminal neuralgia, and bipolar disorder. Its extended-release formulation offers improved adherence and pharmacokinetic stability over the immediate-release form. This report analyzes the current market landscape, competitive positioning, regulatory factors, and provides price projection insights for TEGRETOL XR.

Market Landscape Overview

Therapeutic Demand and Epidemiology

The global epilepsy market was valued at approximately USD 7.4 billion in 2021 and is projected to grow at a CAGR of approximately 4% through 2028 (1). With an estimated 50 million people affected worldwide, a substantial subset of patients—especially those requiring long-term management—are candidates for carbamazepine-based therapies, such as TEGRETOL XR.

Additionally, trigeminal neuralgia affects around 4-5 out of 100,000 individuals annually, with carbamazepine being the first-line treatment (2). Bipolar disorder accounts for roughly USD 3 billion in the U.S. alone, with anticonvulsants like carbamazepine serving as maintenance options.

Key Market Players and Competition

TEGRETOL XR faces competition from both branded and generic formulations of carbamazepine, including:

- Generic carbamazepine extended-release products

- Other AEDs (anticonvulsants), such as lamotrigine, oxcarbazepine, and valproate

- Newer agents like levetiracetam and lacosamide, which target similar patient populations

Major pharmaceutical firms such as Novartis (manufacturer of TEGRETOL XR), Sun Pharmaceuticals, and Mylan dominate the generic carbamazepine space, with market share shifting towards generics due to cost considerations.

Regulatory Status and Market Penetration

TEGRETOL XR holds FDA approval since 2007 and has been marketed globally, though its penetration varies geographically owing to patent lifecycles, local regulatory approvals, and pricing strategies. Its brand recognition remains strong in North America and select European markets.

In emerging markets like Asia and Latin America, high generic penetration diminishes the brand's premium positioning but sustains steady sales volume.

Pricing Dynamics

Brand-name TEGRETOL XR historically commands premiums over generics, with retail prices approximately 20-30% higher. However, increased generic competition in recent years has driven the average price downward, influencing overall revenue.

Price Projection Analysis

Historical Price Trends

- 2018-2020: The average retail price for TEGRETOL XR in the U.S. hovered around USD 600–700 per 30-day supply. During this period, generic versions emerged strongly, compressing price margins (3).

- 2021–2022: The introduction of more generic options and increased market competition further lowered prices, with some generic equivalents retailing below USD 200 per 30-day supply.

Projected Price Movements (2023-2028)

Factors Influencing Future Pricing:

- Patent Expiry and Generics: Patent expiration of branded TEGRETOL XR is anticipated around 2024-2025 in key markets, likely accelerating generic entry.

- Market Penetration of Generics: As generics gain dominance, the average price for carbamazepine products is expected to decline steadily.

- Manufacturing and Distribution Costs: Stable or decreasing costs, coupled with increased manufacturing efficiency, reinforce downward price pressure.

- Regulatory and Reimbursement Policies: Potential payor pressure for cost containment will further incentivize price reductions in developed markets.

Forecasted Price Range:

- 2023: USD 300–400 per 30-day supply (brand premium persists but diminishes).

- 2024–2025: USD 200–300, with generic formulations accounting for >80% of market share.

- 2026–2028: USD 150–250, as competition intensifies and new formulations gain acceptance.

This trend mirrors historical patterns observed in other long-standing neurological medications and is consistent with practices across similar markets (4).

Market Share and Revenue Forecast

With declining prices and increasing generic uptake, revenue from TEGRETOL XR will likely plateau or decline marginally, contingent on the growth of the treated patient population. Furthermore, the shift toward digital health and personalized medicine may influence prescribing behaviors, impacting long-term revenues.

Emerging Opportunities and Challenges

- Brand Differentiation: Maintaining a perception of superior tolerability or improved adherence through formulations, patient monitoring, or value-added services.

- Expanded Indications: Off-label uses, such as neuropathic pain management, could bolster demand.

- Regulatory Barriers: Variability in approval for generic formulations across jurisdictions could restrict immediate price erosion.

Conversely, challenges include commoditization, pricing erosion, and shifts toward novel agents with improved safety profiles.

Key Market Drivers

- Growing prevalence of epilepsy, bipolar disorder, and trigeminal neuralgia.

- Increased adoption of extended-release formulations for better adherence.

- Global push for biosimilars and generics reducing overall medication costs.

- Regulatory pathways favoring cost-effective therapies.

Concluding Perspective

TEGRETOL XR remains a cornerstone in epilepsy and neuralgia management; however, its revenues are poised to be affected by market consolidation, generics, and cost-containment efforts. Strategic positioning emphasizing clinical benefits and differentiated delivery could sustain profitability in competitive landscapes.

Key Takeaways

- The global epilepsy and neuralgia markets present significant demand for carbamazepine formulations, including TEGRETOL XR, but growth is tempered by increasing generic competition.

- Price projections indicate a steady decline from approximately USD 600–700 (2022) to USD 150–250 per 30-day supply (by 2028), driven primarily by patent expiration and market saturation.

- While upfront brand premiums persist, long-term profitability hinges on brand differentiation and expanding indications.

- Regulatory environments and reimbursement policies play critical roles in shaping future market dynamics.

- Companies should explore life cycle management strategies, such as biosimilar development or value-added services, to preserve market share.

FAQs

1. When will TEGRETOL XR's patent expire, and how will that impact pricing?

Patent protection was expected to end around 2024-2025 in key markets, opening the market for generics, which will significantly lower prices and reduce brand market share.

2. How does TEGRETOL XR compare to other anticonvulsants in terms of market share?

TEGRETOL XR maintains a niche in patients requiring extended-release formulations, but overall market share is challenged by newer AEDs with improved side effect profiles, leading to a gradual decline in its dominance.

3. What are the primary drivers limiting the price of TEGRETOL XR?

Market competition, patent expiry, generic manufacturing, and payor policies aimed at cost savings are the main factors suppressing prices.

4. Are there emerging indications that could boost demand for TEGRETOL XR?

Potential off-label uses, such as in certain neuropathic pain conditions, could offer additional growth avenues, provided regulatory approvals or clinical evidence support such expansion.

5. What strategic actions should manufacturers consider to sustain margins?

Investing in differentiation through clinical benefits, exploring new indications, optimizing manufacturing costs, and engaging in patent or formulation protection strategies are key to maintaining profitability.

Sources

[1] MarketWatch, "Epilepsy Drug Market Size & Trends," 2022.

[2] National Institute of Neurological Disorders and Stroke, "Trigeminal Neuralgia," 2021.

[3] IMS Health Reports, "Antiepileptic Drug Market Trends," 2021.

[4] EvaluatePharma, "Long-Acting Formulation Market Dynamics," 2022.

More… ↓