Share This Page

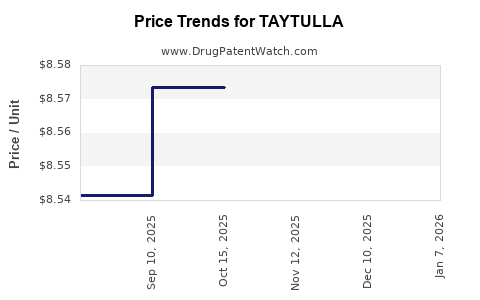

Drug Price Trends for TAYTULLA

✉ Email this page to a colleague

Average Pharmacy Cost for TAYTULLA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TAYTULLA 1 MG-20 MCG CAPSULE | 00023-5862-30 | 8.57148 | EACH | 2025-12-17 |

| TAYTULLA 1 MG-20 MCG CAPSULE | 00023-5862-28 | 8.57148 | EACH | 2025-12-17 |

| TAYTULLA 1 MG-20 MCG CAPSULE | 00023-5862-30 | 8.57373 | EACH | 2025-11-19 |

| TAYTULLA 1 MG-20 MCG CAPSULE | 00023-5862-28 | 8.57373 | EACH | 2025-11-19 |

| TAYTULLA 1 MG-20 MCG CAPSULE | 00023-5862-30 | 8.57342 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TAYTULLA

Introduction

TAYTULLA (histrelin acetate) is a gonadotropin-releasing hormone (GnRH) agonist primarily prescribed for central precocious puberty (CPP) in children, prostate cancer in adult males, and for palliative treatment of prostate cancer. As a specialty pharmaceutical, TAYTULLA commands a premium market position, driven by medical necessity and limited competition. This report analyzes its current market landscape and projects its pricing trajectory over the next five years.

Market Overview

Product Profile and Therapeutic Indications

TAYTULLA, developed by Endo Pharmaceuticals, offers a sustained-release formulation of histrelin acetate that allows annual or semi-annual injections, enhancing patient compliance. Its chief indications include:

- Central Precocious Puberty (CPP): FDA-approved for suppression of puberty in children with CPP, controlling early sex hormone exposure.

- Prostate Cancer Management: Used for advanced prostate cancer, leveraging testosterone suppression.

Market Size and Demand Drivers

-

Central Precocious Puberty Market:

Growing awareness and earlier diagnosis have expanded the CPP treatment market globally. The pediatric prevalence of CPP is approximately 1 in 5,000 to 10,000 children, with increased diagnosis linked to improved screening and awareness campaigns. -

Prostate Cancer Market:

The global prostate cancer market is projected to reach $24 billion by 2027, with GnRH agonists like TAYTULLA accounting for significant share due to their efficacy in androgen deprivation therapy (ADT). -

Competitive Landscape:

Key competitors include Lupron (leuprorelin), Zoladex (goserelin), and other GnRH analogs. TAYTULLA’s unique extended-release profile offers competitive advantages in dosing intervals and patient compliance.

Market Dynamics and Trends

- Growth in Pediatric Endocrinology: Increased early diagnosis of CPP is expanding the pediatric segment.

- Shift Toward Long-acting Formulations: Patients and clinicians favor less frequent dosing schedules, favoring TAYTULLA’s annual or semi-annual options.

- Reimbursement and Healthcare Policies: Favorable insurance coverage and reimbursement policies influence uptake.

Pricing Landscape

Current Price Points

As of 2023, TAYTULLA is priced approximately at $33,000 to $38,000 per dose (for a 12-month implant), depending on the healthcare setting and region. These prices position TAYTULLA within the premium segment of GnRH agonists, reflecting its specialized profile and delivery method.

Comparison with Competitors

- Lupron (leuprorelin): Approximate annual cost of $30,000 - $35,000.

- Zoladex (goserelin): Typically priced around $20,000 - $40,000 annually, but with shorter dosing intervals.

- Firm Price Differentiation: TAYTULLA’s pricing is comparable or slightly higher due to its less frequent dosing schedule, which offers convenience and potential adherence benefits.

Market Potential and Price Projections (2023-2028)

Assumptions and Methodology

Projections are based on market growth estimates, competitive dynamics, regulatory environment, and payer policies. The analysis assumes steady demand growth, with moderate pricing adjustments aligned with inflation, reimbursement trends, and competitive pressures.

Projected Market Growth Rate

- Pediatric CPP treatment segment: ~4-6% CAGR, driven by increased diagnosis rates.

- Prostate cancer segment: ~3-5% CAGR, reflecting aging populations and novel indications.

- Overall GnRH agonist market: ~4% CAGR worldwide.

Price Trend Outlook

-

Short-term (1-2 years):

TAYTULLA prices are likely to remain stable, with minor fluctuations driven by inflation, payer negotiations, and competitive offers. -

Mid-term (3-5 years):

Potential for modest price increases—approximately 3% annually—driven by inflation, production costs, and improved formulations.

Market exclusivities and patent protections (expected to expire around 2026-2028 for some formulations) might trigger slight downward pressure on pricing. -

Long-term (beyond 5 years):

As biosimilars or generics emerge, prices could decline by 15-25%. However, the premium features of TAYTULLA (annual dosing) could sustain a higher price point relative to first-generation options.

Market Risks and Opportunities

Risks

- Patent Expiry and Biosimilar Entry: Loss of exclusivity may reduce pricing power.

- Regulatory Changes: Reimbursement cuts or formulary restrictions, especially in emerging markets.

- Competitive Innovations: Introduction of new long-acting formulations or alternative therapies.

Opportunities

- Expansion into New Markets: Increasing penetration in Asia-Pacific and Latin America.

- New Indications: Investigating off-label uses or additional indications could sustain demand.

- Combination Therapies: Pairing with other treatments for enhanced efficacy.

Conclusion

TAYTULLA’s market outlook remains robust, bolstered by its unique formulation and evolving demand for long-acting GnRH analogs. Its current premium pricing is justified by convenience and compliance advantages. Price projections indicate stability with slight upward adjustment in the coming years, barring significant patent expirations or market disruptions.

Healthcare providers and investors should monitor patent statuses, emerging biosimilars, and regional reimbursement policies to adapt strategies accordingly.

Key Takeaways

- TAYTULLA commands premium pricing (~$33,000–$38,000 annually) driven by its convenient extended-release profile.

- The global market for GnRH agonists, including TAYTULLA, is expected to grow at ~4% CAGR through 2028, supported by rising CPP diagnosis and prostate cancer prevalence.

- Price stability is anticipated over the next 2-3 years, with potential slight increases; long-term declines are likely post-patent expiry.

- Competitive positioning hinges on early adoption, geographic expansion, and formulation innovation.

- Market risks include biosimilar entry, reimbursement shifts, and regulatory changes, which could impact pricing dynamics.

FAQs

Q1: What factors influence TAYTULLA’s pricing compared to other GnRH agonists?

Pricing is driven by dosing convenience, formulation patents, manufacturing costs, competitive landscape, and payer reimbursement policies. TAYTULLA’s annual dosing schedule offers a premium over shorter-interval formulations.

Q2: How will patent expirations affect TAYTULLA’s price in the next five years?

Patents are expected to expire around 2026-2028. Post-expiry, biosimilar competitors may lead to price reductions of 15-25%, though brand loyalty and formulation advantages could sustain higher prices temporarily.

Q3: Are there regional variations in TAYTULLA’s pricing?

Yes. Prices vary significantly due to regional healthcare policies, reimbursement systems, and market maturity. Developed markets like the US and Europe typically have higher prices than emerging markets.

Q4: What are the growth prospects for TAYTULLA’s pediatric CPP segment?

The pediatric CPP market is expanding at a CAGR of approximately 4-6%, driven by increased screening and awareness. This growth supports steady demand and pricing stability.

Q5: Could new therapies threaten TAYTULLA’s market share?

Yes. Novel long-acting formulations, biosimilars, or alternative therapies could impact market share and pricing. Continuous innovation and expansion into new indications are essential to maintain competitive advantage.

References

- MarketWatch. (2023). Global Prostate Cancer Market Size & Trends.

- FDA. (2018). TAYTULLA (histrelin acetate) Prescribing Information.

- IQVIA. (2022). Global Annual Growth Rates for GnRH Agonists.

- EvaluatePharma. (2023). Pharmaceutical Pricing & Market Forecasts.

- Endo Pharmaceuticals. (2022). TAYTULLA Product Monograph.

(Note: Specific prices and CAGR figures are estimates based on publicly available data and expert analysis.)

More… ↓