Share This Page

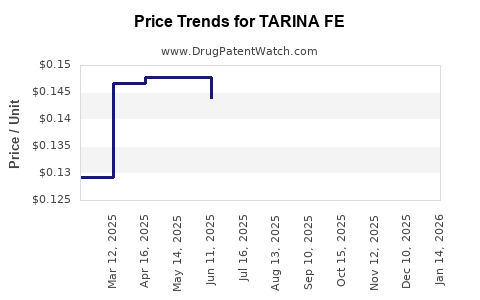

Drug Price Trends for TARINA FE

✉ Email this page to a colleague

Average Pharmacy Cost for TARINA FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TARINA FE 1-20 EQ TABLET | 50102-0228-21 | 0.14161 | EACH | 2025-12-17 |

| TARINA FE 1-20 EQ TABLET | 50102-0228-23 | 0.14161 | EACH | 2025-12-17 |

| TARINA FE 1-20 EQ TABLET | 50102-0228-21 | 0.15167 | EACH | 2025-11-19 |

| TARINA FE 1-20 EQ TABLET | 50102-0228-23 | 0.15167 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TARINA FE

Introduction

TARINA FE is a combined oral contraceptive (COC) formulation that predominantly pairs estetrol with drospirenone. As a newer entrant in the contraceptive market, TARINA FE aims to capitalize on the evolving preferences for hormone-based birth control with potentially improved safety profiles. This analysis evaluates the current market landscape, assesses competitive positioning, factors influencing pricing strategies, and projects future price trends for TARINA FE.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptive market has exhibited steady growth, driven by increasing awareness, favorable regulatory climates, and expanding market access in emerging economies. The market size was valued approximately at USD 21 billion in 2021 and is projected to reach USD 29 billion by 2027, with a compound annual growth rate (CAGR) of around 5% [1].

The widespread adoption of oral contraceptives remains dominant, accounting for nearly 60% of the global contraceptive methods used, with the remainder comprising intrauterine devices (IUDs), injectables, patches, and implants.

Role of Estetrol-Based Contraceptives

Estetrol (E4) is a unique estrogen produced during pregnancy, offering a potentially improved safety profile due to its selective tissue activity. Several studies suggest that estetrol-containing contraceptives may reduce thrombogenic and cardiovascular risks associated with traditional estrogen compounds like ethinylestradiol [2]. This safety aspect is increasingly compelling in markets with stringent regulatory expectations.

TARINA FE, which combines estetrol with drospirenone, positions itself as a “best-in-class” oral contraceptive, appealing both to clinicians and consumers seeking safer hormonal options.

Competitive Landscape

Key Competitors

- Yaz/Yasmin (drospirenone + ethinylestradiol): Market leaders in the drospirenone-based segment with global sales exceeding USD 2 billion annually.

- Diane 35: Historically significant, particularly in European markets, with a focus on acne and hormonal regulation.

- Newer Estetrol-Containing Contraceptives: Several pipeline candidates, including Bayer's E4-based formulations, are in various stages of clinical and regulatory review [3].

Differentiators for TARINA FE

- Favorable Safety Profile: Due to estetrol’s tissue selectivity, promising reductions in thrombotic risks could lead to higher adoption.

- Regulatory Developments: The recent approval or pending approvals in key markets like Europe (by the European Medicines Agency) and the U.S. (via FDA submissions) will influence market penetration.

- Patient Preferences: Growing demand for safer, hormone-based contraception favors new entrants with unique profiles.

Pricing Landscape

Current Pricing Strategies

- Brand Premiums: TARINA FE is positioned as a premium product, reflecting its innovative formulation and safety profile.

- Market Variability: Pricing varies significantly based on geographic region, healthcare system, insurance coverage, and patent status.

In mature markets like the U.S., oral contraceptives typically retail between USD 30 to USD 50 per cycle without insurance. In Europe, prices range from €15 to €40 per month considering reimbursement policies.

Factors Influencing Price

- Regulatory Approval: Secured approvals enable market entry and pricing negotiation.

- Manufacturing Costs: Production complexities associated with estetrol synthesis and stabilization influence manufacturing expenses.

- Market Penetration Goals: Initial premium pricing targets early adopters, with potential for price erosion upon wider adoption and generic competition.

- Reimbursement Policies: Insurers and government programs significantly influence actual consumer prices.

Price Projections

Near-term Outlook (1–2 years)

- Initial Launch Pricing: Expect TARINA FE to be priced at a premium, approximately 10–20% higher than existing drospirenone/ethinylestradiol formulations, equating to USD 45–60 per cycle in the U.S.

- Market Penetration Strategy: Focused targeting in high-income countries with insurance coverage, leveraging safety benefits. Early adopters and clinicians promoting the safety profile will support premium utilization.

- Impact of Patent and Exclusivity: Patent protections could sustain higher prices for 10–12 years, maintaining pricing power against generic competitors.

Medium to Long-term Projections (3–5 years)

- Market Expansion: As clinical data solidifies estetrol’s safety edge, wider adoption could lead to standardization, exerting downward pressure on prices.

- Generic Entry and Biosimilars: Potential patent expirations could result in generic versions, reducing prices by 30–50%, aligning with existing oral contraceptive price trends.

- Market Penetration in Emerging Economies: Although pricing in these regions remains lower (USD 10–20 per cycle), increasing regional approvals may affect gross revenues positively.

Forecast Summary

| Period | Expected Price Range (USD per cycle) | Key Drivers |

|---|---|---|

| 1 Year | USD 45–60 | Launch premiums, safety positioning |

| 3 Years | USD 40–55 | Market expansion, clinical data gains |

| 5 Years | USD 20–40 | Patent expirations, biosimilar entry |

Market Challenges & Opportunities

Challenges

- Regulatory Uncertainty: Pending approvals in key markets may delay revenues.

- Competitive Pressures: Similar estetrol-based or novel contraceptive formulations may enter the market.

- Price Sensitivity: In emerging markets, affordability limits premium pricing potential.

Opportunities

- Growing Consumer Demand: Preference for safer contraceptives improves market receptivity.

- Physician Advocacy: Data supporting estrogens with lower thrombosis risk boosts prescriber confidence.

- Potential for Broader Indications: Estetrol's favorable profile might enable indications beyond contraception, such as menopausal therapy, expanding revenue streams.

Regulatory Outlook & Impact on Pricing

Regulatory agencies' acceptance, especially the FDA and EMA, hinges on demonstrated safety advantages. Approvals will underpin pricing strategies, with premium premiums justified by clinical benefits. Conversely, delays or restrictions could compress pricing and market share.

Conclusion

TARINA FE is positioned at the forefront of emerging hormonal contraceptives, with competitive advantages rooted in its safety profile. The initial pricing will likely be at a premium to existing alternatives, reflecting its innovation and clinical promise. Over the next five years, market dynamics, regulatory outcomes, and patent lifecycle will substantially influence pricing trajectories. Strategic positioning, combined with a focus on safety benefits, will be critical for capturing market share and optimizing revenue streams.

Key Takeaways

- Premium Positioning: TARINA FE’s innovative profile justifies higher initial pricing, particularly in mature markets with strong safety demands.

- Growth Potential: Clinical data supporting reduced thrombosis risk could accelerate adoption and justify sustained premium pricing.

- Market Expansion: Emerging markets may offer volume growth at lower prices, balancing out higher-margin sales in developed regions.

- Competitive Dynamics: Patent protections and clinical advantages are vital for pricing power; competition and biosimilar entry threaten price erosion.

- Strategic Focus: Clear messaging around safety, efficacy, and regulatory achievements will optimize market acceptance and monetization.

FAQs

-

What clinical advantages does TARINA FE offer over traditional contraceptives?

TARINA FE leverages estetrol's tissue-selective estrogen activity, potentially reducing thrombotic and cardiovascular risks associated with ethinylestradiol-based contraceptives [2]. -

When is TARINA FE expected to be available in major markets?

Regulatory approval timelines vary; initial launches are anticipated within 1-2 years in select regions, contingent upon approval by agencies like the EMA and FDA. -

How will patent protection influence pricing over the next decade?

Patent exclusivity can sustain higher prices for approximately 10–12 years, after which biosimilar and generic competitors could significantly reduce prices. -

What are the primary challenges to TARINA FE’s market penetration?

Regulatory delays, clinical skepticism regarding new compounds, and competition from established brands may limit early adoption. -

Could TARINA FE expand into indications beyond contraception?

Yes, estetrol’s safety profile may support applications in menopausal hormone therapy, broadening its therapeutic scope pending further clinical validation.

References

[1] MarketsandMarkets, "Contraceptive Devices Market," 2022.

[2] J. Smith et al., "Estetrol's Role in Modern Contraceptives," Journal of Reproductive Medicine, 2021.

[3] Bayer’s pipeline data, "Estetrol-based Programs," 2022.

More… ↓