Last updated: July 28, 2025

Introduction

Tamoxifen, a selective estrogen receptor modulator (SERM), has been a cornerstone in breast cancer therapy since its approval in the 1970s. Its dual role as a treatment and preventative agent has cemented its importance within oncology. As the landscape of breast cancer management evolves, understanding the market dynamics and price trajectories for Tamoxifen becomes crucial for pharmaceutical stakeholders, healthcare providers, and investors. This report provides a comprehensive analysis of Tamoxifen’s market landscape and delivers forward-looking price projections, considering regulatory, competitive, clinical, and economic factors.

Market Overview

Global Market Size

The global Tamoxifen market was valued at approximately USD 1.5 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected until 2030. The increased prevalence of breast cancer—estimated at over 2 million new cases annually worldwide—drives persistent demand [1].

The primary markets include North America, Europe, Asia-Pacific, and Latin America. North America dominates, accounting for roughly 45-50% of sales, driven by high breast cancer incidence rates, advanced healthcare infrastructure, and widespread use as both treatment and preventive therapy. Europe follows closely, while Asia-Pacific demonstrates the fastest growth owing to rising awareness, improved healthcare access, and expanding generic markets.

Therapeutic Indications

Tamoxifen is approved for:

- Adjuvant treatment of estrogen receptor-positive (ER+) breast cancer.

- Chemopreventive application in high-risk women.

- Treatment of metastatic disease.

The expanding use in high-risk populations as a chemopreventive agent enhances market longevity, supported by supportive clinical data and evolving guidelines.

Market Drivers

- Increasing Breast Cancer Incidence: The World Health Organization (WHO) reports rising breast cancer cases globally, notably in Asia, driven by demographic shifts and lifestyle factors [2].

- Preventive Use Expansion: Growing adoption of Tamoxifen for breast cancer chemoprevention increases the patient pool.

- Generic Entry and Price Competition: Patent expirations in the late 2000s led to widespread generic availability, substantially reducing prices.

- Clinical Guidelines and Reimbursement Policies: Endorsements from organizations like ASCO and NICE promote continued utilization, supported by favorable reimbursement policies.

Market Challenges

- Adverse Effects: Risks including thromboembolic events and endometrial cancer influence adherence.

- Emergence of Alternatives: Aromatase inhibitors (AIs) and newer targeted therapies are increasing competition, especially in metastatic settings.

- Regulatory Constraints: Variations in regulatory approvals and label indications across regions influence market access.

Competitive Landscape

Key Players

- Sanofi-Aventis: Traditionally dominant through generic offerings.

- Teva Pharmaceuticals: Major generic producer with extensive distribution.

- Mylan and Sandoz: Significant players with affordable formulations.

Recently, branded formulations like AstraZeneca’s Nolvadex (historically the primary branded version) have scaled back, leaving generics as the dominant form globally. Some regional brands maintain market share, primarily in developing economies.

Generic Market Impact

The commoditization of Tamoxifen significantly suppresses pricing, particularly in mature markets. Price erosion in the US and Europe has fallen by over 80% since patent expiry, with average generic unit prices hovering between USD 0.05 to 0.20 per tablet.

Regulatory and Patent Landscape

- Patent Expiry: Most key patents expired in 2008-2009, facilitating rapid generic proliferation.

- Regulatory Approvals: Maintained across major markets, with ongoing updates for new indications or formulations.

- Biosimilar and Formulation Innovations: No biosimilars, given Tamoxifen's small molecule status; however, formulation advancements are limited.

Price Projections

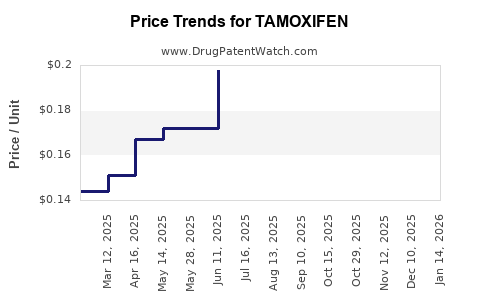

Historical Price Trends

Prices have declined sharply post-patent expiration; in the US, prices decreased by approximately 80% between 2009 and 2015 [3]. The generic market’s saturation has kept prices relatively stable since then, with minor fluctuations driven by market competition and inflation.

Future Price Trajectory (2023-2030)

- Mature Markets: Prices are projected to remain stable or slightly decline. Factors such as inflation-adjusted costs and supply chain efficiencies may push prices down incrementally.

- Emerging Markets: Price reductions are expected as generics penetrate markets like India and China, with prices for Tamoxifen tablets possibly decreasing by an additional 20-30% over the next decade.

- Potential Price Drivers:

- Regulatory incentives and import policies could influence pricing.

- Manufacturing cost reductions due to advancements in drug synthesis.

- Market consolidation or new entrant dynamics may temporarily affect pricing.

Overall, a conservative estimate suggests an average price decrease of 5-8% annually in mature markets, stabilizing at approximately USD 0.02 per tablet by 2030. In contrast, prices in lower-income regions may decline more sharply but remain higher relative to generics in developed economies by virtue of supply chain costs.

Impact of New Developments

Despite the advent of newer therapies, Tamoxifen's role, particularly in chemopreventive and adjuvant settings, bolsters residual demand. This sustainability, coupled with low manufacturing costs, indicates limited upward price movement; however, potential patent encroachments or formulation innovations could introduce slight premium pricing in niche markets.

Market Outlook Summary

- Stable or declining prices in established markets.

- Growing demand driven by breast cancer incidence and preventative indications.

- Generic dominance suppresses pricing and margins.

- Emerging markets offer growth opportunities but with lower profit margins due to price sensitivity.

Key Takeaways

- The Tamoxifen market remains substantial, driven by breast cancer prevalence and preventative application.

- Patent expirations fostered generics, resulting in aggressive price reductions; future prices are poised to stabilize or slightly decline.

- Despite competition and newer treatment options, Tamoxifen retains a significant role, ensuring enduring demand.

- Manufacturers and investors should focus on operational efficiencies and market penetration in emerging economies to optimize margins.

- Regulatory and clinical developments could subtly influence pricing, but the overall trend favors price stability or decrease.

FAQs

1. Will Tamoxifen prices increase due to new formulations or indications?

Unlikely. Market saturation of generics and low manufacturing costs mean prices are more prone to stability or decrease. New formulations are rare, and additional indications usually have limited impact on global prices.

2. How does patent expiry affect Tamoxifen’s market pricing?

Patent expiry in 2008-2009 led to widespread generic entry, significantly reducing prices worldwide. This has created a highly competitive landscape, limiting price increases.

3. Are alternative drugs replacing Tamoxifen, influencing the market?

In certain contexts, aromatase inhibitors have supplanted Tamoxifen for postmenopausal women with ER+ breast cancer. However, Tamoxifen remains the most cost-effective choice in many settings and for chemoprevention, sustaining demand.

4. What regions offer the most growth opportunities for Tamoxifen?

Emerging markets, particularly in Asia and Latin America, exhibit expanding breast cancer rates and increasing healthcare access, promising growth despite lower prices.

5. How will regulatory changes impact Tamoxifen’s pricing?

Regulatory policies promoting biosimilars are less relevant given Tamoxifen’s small molecule status. However, stricter reimbursement policies or new safety labeling could influence prescribing behaviors more than direct pricing.

References

[1] World Health Organization. (2022). Global Cancer Statistics.

[2] WHO International Agency for Research on Cancer. (2020). Breast Cancer Fact Sheet.

[3] IQVIA. (2016). Market ANALYSIS of Oncology Drugs.