Share This Page

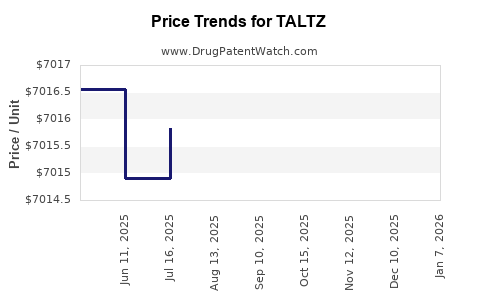

Drug Price Trends for TALTZ

✉ Email this page to a colleague

Average Pharmacy Cost for TALTZ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TALTZ 80 MG/ML AUTOINJECTOR | 00002-1445-01 | 6997.66167 | ML | 2025-12-17 |

| TALTZ 80 MG/ML AUTOINJECTOR (2-PACK) | 00002-1445-27 | 7081.78167 | ML | 2025-12-17 |

| TALTZ 80 MG/ML AUTOINJECTOR | 00002-1445-11 | 6997.66167 | ML | 2025-12-17 |

| TALTZ 80 MG/ML AUTOINJECTOR | 00002-1445-11 | 6999.05195 | ML | 2025-11-19 |

| TALTZ 80 MG/ML AUTOINJECTOR (2-PACK) | 00002-1445-27 | 7082.14400 | ML | 2025-11-19 |

| TALTZ 80 MG/ML AUTOINJECTOR | 00002-1445-01 | 6999.05195 | ML | 2025-11-19 |

| TALTZ 80 MG/ML AUTOINJECTOR | 00002-1445-01 | 6995.79737 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TALTZ (ixekizumab)

Introduction

TALTZ (ixekizumab) stands as a pivotal biologic therapy developed by Eli Lilly and Company, primarily designated for the treatment of moderate to severe plaque psoriasis, psoriatic arthritis, and more recently, conditions like Crohn's disease. Since its market entry, TALTZ has distinguished itself through its targeted mechanism of action as an interleukin-17A (IL-17A) inhibitor. This analysis offers an in-depth review of current market dynamics, competitive positioning, pricing strategies, and future price trajectory forecasts for TALTZ.

Market Overview

Therapeutic Landscape & Market Size

The dermatology and immunology markets have experienced sustained growth over the past decade, driven by the increasing prevalence of psoriasis and psoriatic arthritis globally. According to IQVIA data [1], the global psoriasis treatment market was valued at approximately USD 7.4 billion in 2022, with biologics accounting for over 60% of sales due to their superior efficacy and safety profile compared to traditional systemic therapies.

TALTZ, as an IL-17A inhibitor, competes primarily with established biologics such as Johnson & Johnson’s REMICADE (infliximab), Novartis’ Cosentyx (secukinumab), and pharmaceutical counterparts like Johnson & Johnson’s Stelara (ustekinumab). Its market penetration benefits from a rapid onset of action and favorable patient tolerability, positioning it competitively within the biologic segment.

Regulatory Approvals and Market Penetration

TALTZ received FDA approval for plaque psoriasis in 2016, with subsequent approvals covering psoriatic arthritis and other indications. Eli Lilly's strategic launches across multiple markets, including the United States, European Union, and Japan, have expanded TALTZ’s footprint. As of 2022, TALTZ held an estimated 8-12% market share in the biologic psoriasis segment [2], attributed to aggressive marketing, reimbursement negotiations, and clinical advantages.

Market Drivers and Challenges

Growth Drivers

- Increasing Prevalence: Rising global incidences of psoriasis—estimated at 2-3% in many countries—favors market growth [3].

- Expanded Indications: Ongoing clinical trials aim to broaden TALTZ’s approved uses, including Crohn’s disease and hidradenitis suppurativa, which could boost revenue.

- Patient Preference for Biologics: Biologics’ efficacy and dosing convenience favor sustained demand.

- Reimbursement Policies: Favorable insurance coverage and inclusion in formularies bolster accessibility.

Market Challenges

- Generic Biosimilars: The entrance of biosimilars for IL-17 inhibitors could pressure pricing.

- Pricing Pressure: Payer negotiations and cost-containment measures constrain pricing flexibility.

- Competition: Continuous innovation by rivals, including new IL-17 and IL-23 inhibitors, threaten market share.

Pricing Analysis

Current Pricing Landscape

In the United States, the list price for TALTZ is approximately USD 4,600 to USD 5,300 per dose, depending on dosing frequency and formulary negotiations [4]. Each patient typically receives an initial dose followed by maintenance doses every 4 weeks, with the annual treatment cost estimated around USD 50,000 to USD 70,000.

In Europe, retail prices reflect regional healthcare policies, often resulting in lower net prices following negotiations. Average annual treatment costs are estimated at EUR 35,000 to EUR 50,000 [5].

Reimbursement and Access

Reimbursement status varies widely, with private insurance covering a significant proportion of TALTZ prescriptions in the U.S., while public health systems in Europe negotiate prices directly with manufacturers. The push for value-based agreements, including pay-for-performance models, influences net prices and ongoing access.

Price Projections for the Next 3-5 Years

Factors Influencing Future Pricing

- Biosimilar Competition: The imminent approval of biosimilars for IL-17 inhibitors could lead to incremental price reductions, potentially by 10-20% over five years.

- Market Saturation: As TALTZ approaches peak market share, price stabilization or slight reductions are anticipated to maintain competitiveness.

- Regulatory and Policy Changes: Governments' emphasis on drug affordability could inspire further price negotiations.

- Expansion of Indications: Broader therapeutic applications might justify maintaining premium pricing, especially if clinical benefits are substantiated.

Forecasted Price Trends

Based on current market trends and competitive dynamics, the following projections are posited:

- Short-term (1-2 years): Marginal price stability or slight decreases (~3-5%) driven by payer negotiations.

- Medium-term (3-5 years): Potential pricing reduction of up to 15% due to biosimilar entry and increased market competition.

- Long-term (beyond 5 years): Price adjustments aligning with generic biologic entry and evolving reimbursement frameworks, with net prices potentially decreasing by 20-30%.

Strategic Implications for Stakeholders

Manufacturers like Eli Lilly should consider dynamic pricing strategies, incorporating value-based agreements to sustain profitability amid biosimilar competition. Payers and providers should leverage formulary management and negotiated discounts to optimize treatment access. Investors should monitor biosimilar pathways and regulatory developments, which could impact TALTZ’s market and pricing landscape significantly.

Key Takeaways

- TALTZ currently commands premium pricing aligned with biologic standards, but faces imminent pressure from biosimilars and market saturation.

- Market growth is driven by increasing psoriasis prevalence, expanded indications, and patient preferences.

- Price declines are predicted over the next five years, primarily due to biosimilar competition and policy measures aimed at reducing healthcare costs.

- Strategic negotiations, value-based pricing, and indication expansion remain essential levers to maintain TALTZ’s market positioning.

- Continuous monitoring of regulatory changes and competitive advances is critical for stakeholders to optimize investment and market strategies.

FAQs

-

What is the current market price of TALTZ in the U.S.?

The list price per dose ranges from approximately USD 4,600 to USD 5,300, with annual treatment costs estimated around USD 50,000 to USD 70,000 after insurance adjustments. -

How does biosimilar competition affect TALTZ pricing?

Biosimilar entrants could reduce TALTZ prices by 10-20% due to increased competition, especially as biosimilars typically enter the market at lower prices. -

Are there ongoing clinical trials that could expand TALTZ’s indications?

Yes, several clinical trials are assessing TALTZ for conditions such as Crohn’s disease and hidradenitis suppurativa, which could expand its market and justify pricing strategies. -

What are the primary challenges facing TALTZ in maintaining its market share?

Intensifying competition from biosimilars and new biologics, reimbursement pressures, and policy-driven cost containment measures. -

What strategic steps should Eli Lilly consider for TALTZ’s future pricing?

Implementing value-based pricing models, expanding indications through clinical trials, and engaging in negotiations to offset biosimilar price reductions will be crucial.

References

[1] IQVIA, “Global Psoriasis Market Report,” 2022.

[2] MarketWatch, “Biologic Psoriasis Market Share,” 2022.

[3] World Health Organization, “Global Psoriasis Prevalence Data,” 2021.

[4] GoodRx, “TALTZ Cost & Pricing,” 2023.

[5] European Medicines Agency, “Pricing and Reimbursement in Europe,” 2022.

More… ↓