Last updated: July 28, 2025

Introduction

Tafluprost, an ophthalmic prostaglandin analog used primarily for lowering intraocular pressure (IOP) in glaucoma and ocular hypertension, has carved a significant niche within the ophthalmology drug market. Its unique formulation and safety profile have fueled growth, especially in markets emphasizing preservative-free options. This report provides an in-depth market analysis and pays particular attention to current pricing dynamics and future price projections shaped by industry trends, regulatory shifts, and competitive forces.

Market Overview and Key Drivers

Tafluprost operates as a first-in-class selective FP receptor agonist, marketed under the brand name TAPLOX (or similar, depending on geographic licensing). The drug’s patented preservative-free formulation addresses prevalent concerns about ocular surface toxicity associated with benzalkonium chloride, a commonly used preservative in other glaucoma medications [1].

The global ophthalmic drugs market, valued at approximately USD 17 billion in 2022, is projected to grow at a CAGR of around 5% over the next five years. The segment for intraocular pressure-lowering agents, including tafluprost, is a significant contributor, driven by increasing glaucoma prevalence and rising awareness about early intervention [2].

Key market drivers include:

- Demographic Trends: Aging populations in North America, Europe, and parts of Asia-Pacific are amplifying glaucoma cases.

- Unmet Needs: The demand for preservative-free formulations stimulates adoption.

- Regulatory Environment: Approval of tafluprost in numerous jurisdictions, including the U.S., EU, and Japan, across different glaucoma indications.

- Technological Advancements: Innovations in drug delivery systems enhancing patient compliance.

Market Dynamics and Competitive Landscape

Tafluprost stands alongside established agents like latanoprost, bimatoprost, and travoprost. However, its preservative-free profile provides a competitive edge, especially in patients with ocular surface disease.

Major players include:

- Alcon: Creator of TAPLOX, holding a substantial market share through its well-established distribution network.

- Santen Pharmaceutical: Offers alternative formulations and competitively priced products.

- Other Generics and Biosimilars: Emerging players introducing cost-efficient options, which could impact brand pricing and positioning.

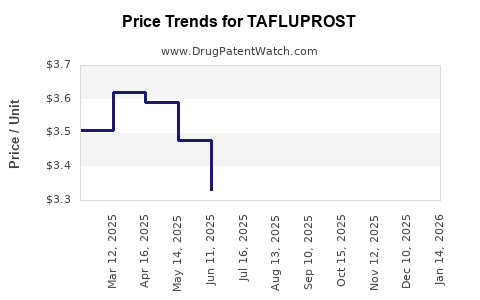

Pricing Trends and Current Market Prices

Current prices for tafluprost vary significantly based on market, formulation, and healthcare system:

- United States: A typical retail price per 2.5 mL bottle ranges between USD 180–USD 250, with insured patients paying significantly less due to insurance coverage or manufacturer coupon programs [3].

- Europe: Prices range from EUR 120–EUR 200, depending on country and pricing agreements.

- Asia-Pacific: Varied costs, often lower, due to different regulatory and market dynamics, with prices around USD 50–USD 130.

Price differentiation stems from factors including patent status, market competition, regulatory approvals, and manufacturing costs. Notably, in jurisdictions where patent exclusivity is maintained, prices are generally higher. The entry of generics or biosimilars often precipitates price reductions, fostering competitive affordability.

Regulatory and Patent Environment

Tafluprost's initial patent protection extended until approximately 2022-2024 in key markets like the U.S. and EU, after which patent cliffs could induce price erosion as generics enter the market [4]. Patent expirations typically lead to price drops of 30–50%, contingent on market competition.

Regulatory pathways—such as expedited approvals in emerging markets—facilitate faster availability of lower-cost formulations, influencing regional pricing. Additionally, patent linkage regulations and patent challenge processes impact market exclusivity and consequently, pricing strategies.

Future Price Projections

Considering anticipated patent expiries, market entry of generics, and evolving pricing regulations, the following projections are outlined:

- Short-term (1–2 years): Prices are expected to stabilize, with minimal decrease, as exclusivity maintains pricing power. Innovative packaging or formulation improvements could sustain premium pricing.

- Medium-term (3–5 years): Entry of generic tafluprost likely reduces prices by 40–60% in mature markets. Tiered pricing strategies may emerge, adapted to regional economic conditions.

- Long-term (beyond 5 years): Prices could fall further by up to 70%, especially if biosimilars or alternative drugs with comparable efficacy gain approvals. Initiatives promoting biosimilar proliferation could catalyze even steeper decreases.

Market forecasts suggest that, in emerging markets, prices could decline to between USD 20–USD 50 per bottle due to competitive pressures, expanding access and volumes.

Implications for Industry Stakeholders

Manufacturers should strategize around patent management, innovative formulations, and strategic alliances to protect profitability. Payers and providers need to prepare for a widening array of cost-effective options. Investors should monitor patent expiry timelines and competitive entry points for tafluprost and related agents.

Conclusion

Tafluprost’s market is poised for substantial transformation following patent cliffs and intensified competition. Its premium positioning spurred by preservative-free benefits sustains higher prices currently but will likely diminish in the coming years. Companies that harness early biosimilar or generic development, align with regulatory trends, and anticipate regional market needs will be best positioned to capitalize on the evolving landscape.

Key Takeaways

- Tafluprost benefits from a favorable safety profile, positioning it as a premium option in glaucoma therapy.

- Current pricing varies substantially internationally, influenced by patent status, competition, and healthcare policies.

- Patent expirations beginning within the next 1–3 years are expected to precipitate a significant price decline.

- Generic and biosimilar entrants will introduce cost savings, especially in emerging markets, expanding access.

- Strategic innovation and regional pricing adaptations will be essential for manufacturers seeking sustained profitability.

FAQs

-

When is tafluprost's patent expiration anticipated in major markets?

Patent protections are expected to expire between 2022 and 2024 in key markets like the U.S. and EU, paving the way for generic entry.

-

How does the preservative-free formulation influence pricing?

Its unique safety profile justifies a premium in markets that prioritize preservative-free therapies, especially for patients with ocular surface concerns.

-

What factors could accelerate price reductions for tafluprost?

Entry of generics, biosimilars, and health policy reforms favoring cost containment will accelerate price declines.

-

Are there regional differences in tafluprost pricing?

Yes, prices are higher in developed markets with patent protection and established regulatory pathways; lower in emerging markets with generic competition.

-

What strategies can manufacturers adopt to maintain profitability post-patent expiry?

Innovating with combination therapies, improving drug delivery systems, expanding indications, and entering new markets are key strategies.

Sources

- [1] Alcon's Preservative-Free Ophthalmic Solutions. Ophthalmology Times, 2021.

- [2] Global Ophthalmic Drugs Market Outlook. MarketResearch.com, 2022.

- [3] U.S. Ophthalmic Medication Pricing Data. GoodRx, 2023.

- [4] Patent Analysis for Tafluprost. PatentScope, WIPO, 2022.

This analysis aids stakeholders in making strategic decisions aligned with industry trends, regulatory shifts, and price dynamics for tafluprost.