Last updated: September 24, 2025

Overview of SYNJARDY

SYNJARDY, a combination medication containing empagliflozin and metformin, is prescribed for managing type 2 diabetes mellitus. It offers a dual-action approach—empagliflozin, a sodium-glucose co-transporter 2 (SGLT2) inhibitor, facilitates glycosuria, while metformin improves insulin sensitivity and reduces hepatic glucose production. Approved by the FDA in 2016, SYNJARDY has rapidly gained market share due to its convenience and enhanced glycemic control profile.[^1]

Market Landscape for Type 2 Diabetes Medications

The global type 2 diabetes market commanded an estimated USD 74 billion in 2022, with projections reaching USD 113 billion by 2030, registering a Compound Annual Growth Rate (CAGR) of approximately 6.0%. This growth is driven by rising prevalence, aging populations, and increasing adoption of innovative therapeutics like SGLT2 inhibitors and GLP-1 receptor agonists.[^2]

Key players include Novo Nordisk, Eli Lilly, AstraZeneca, and Johnson & Johnson, competing primarily through innovative drug pipelines and expanding indications. The shift towards combination therapies—particularly those with cardiovascular and renal benefits—favor drugs like SYNJARDY.

Market Positioning of SYNJARDY

SYNJARDY’s unique combination profile positions it favorably among oral antidiabetes agents, especially for patients inadequately controlled on monotherapy. Its benefits include simplified dosing, reduced pill burden, and demonstrated cardiovascular benefits, as evidenced by the EMPA-REG OUTCOME trial showing reduced cardiovascular mortality with empagliflozin (a component of SYNJARDY).[3]

Currently, synthesized as part of the collaboration between Boehringer Ingelheim and Eli Lilly, SYNJARDY's market share primarily targets North America and Europe, where reimbursement frameworks and clinical guidelines favor SGLT2 inhibitors. Its positioning as a second-line therapy aligns with ADA guidelines emphasizing cardiovascular and renal risk reduction.[^4]

Market Challenges and Opportunities

Despite its advantages, SYNJARDY faces challenges such as high drug pricing, competition from other SGLT2 inhibitors like Jardiance (empagliflozin monotherapy) and Farxiga, and evolving treatment paradigms favoring combination pills with GLP-1 receptor agonists. Moreover, concerns over side effects like genital infections, ketoacidosis, and urinary tract infections influence clinician prescribing behaviors.[^5]

However, opportunities lie in expanding indications—for example, heart failure management and chronic kidney disease—where SGLT2 inhibitors have shown significant benefits. Increasing adoption in developing markets, driven by the rising prevalence of diabetes and improving healthcare infrastructure, also presents growth avenues.

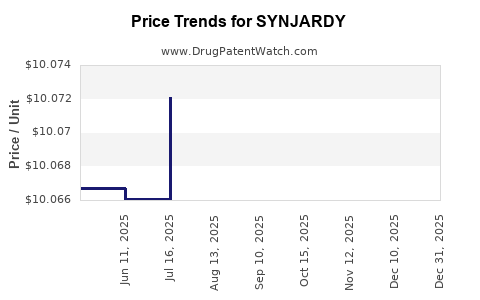

Price Trends and Projections

Current Pricing Landscape

In the U.S., the list price of SYNJARDY averages around USD 550–600 per month (approximately USD 18–20 per day), although actual out-of-pocket costs vary based on insurance coverage and discounts. With biosimilar and generic competition, some generic formulations are emerging, likely exerting downward pressure on prices.

Price Trajectory Outlook

Based on market dynamics, the following projections are anticipated:

-

Short-term (1–3 years): Slight decline in average retail pricing due to increased competition from generic formulations and the entry of biosimilars, with an estimated decrease of 5–10% annually.

-

Medium-term (3–5 years): Stabilization of prices, with potential marginal increases driven by inflation, enhanced formulation features, or expanded indications. Price may hover around USD 400–500 per month for premium branded versions.

-

Long-term (5+ years): Prices are likely to decline further, possibly below USD 300 per month, as biosimilars and generics gain market share and reimbursement policies evolve to favor cost-sensitive healthcare systems.

It is important to note that targeted pricing strategies, especially in emerging markets and Medicaid or Medicare programs, may differ significantly from retail estimates.

Regulatory and Market Dynamics Impacting Pricing

Pricing strategies are influenced by regulatory policies, patent expirations, and competitive landscape shifts. Although SYNJARDY’s patents, held jointly by Boehringer Ingelheim and Eli Lilly, are set to expire around 2027–2028, exclusivity periods extend through secondary patents and formulations, potentially delaying generic entry.[^6]

Pricing negotiations with payers and formulary inclusions significantly influence net prices. Favorable demonstration of clinical benefits and cost-effectiveness models support higher reimbursement rates, maintaining profitability despite downward price pressures.

Regional Variances in Pricing and Market Penetration

-

United States: Higher per-unit costs with significant payer negotiations, but also intense competition from monoclonal therapies and other combination pills.

-

Europe: Moderate pricing influenced by national health policies and price regulation frameworks.

-

Emerging Markets: Lower absolute costs but rapid growth potential driven by increasing diabetes prevalence, with price points potentially below USD 100–200 per month.

Competitive Landscape and Future Prospects

In addition to direct competitors like Jardiance and Farxiga, emerging therapies combining SGLT2 inhibitors with novel modalities (e.g., dual GIP/GLP-1 receptor agonists) threaten SYNJARDY’s market position.[^7] Price competition combined with clinical differentiation will shape the competitive environment.

The push for combination formulations with additional benefits (e.g., weight loss, renal protection) is likely to elevate the value proposition, enabling premium pricing. Moreover, biosimilar development for empagliflozin and other components could substantially alter the pricing landscape by 2028.

Key Takeaways

- Market Growth: The global market for type 2 diabetes medications is expanding at a CAGR of approximately 6%, driven by rising prevalence and drug innovation.

- SYNJARDY’s Position: Its combination therapy offers flexibility and cardiovascular benefits, reinforcing its role in second-line treatment.

- Pricing Trends: Short-term prices are expected to decline marginally due to generics and biosimilars, with long-term prices likely falling below USD 300/month.

- Competitive Dynamics: Patent expirations, biosimilars, and emerging therapies will reshape pricing and market share within the next 5–7 years.

- Market Opportunities: Expansion into additional indications and emerging markets will sustain growth, while reimbursement strategies remain critical.

FAQs

1. What factors influence SYNJARDY's pricing strategy?

Pricing depends on patent statuses, competition from generics and biosimilars, clinical benefits demonstrated in trials, negotiating power with payers, regional healthcare policies, and market demand dynamics.

2. How do patent expirations affect SYNJARDY’s future price?

Patent expirations around 2027–2028 are anticipated to introduce biosimilar and generic competition, exerting downward pressure on prices and potentially reducing margins for the original manufacturers.

3. What are the main competitors to SYNJARDY in the market?

Key competitors include Jardiance (empagliflozin monotherapy), Farxiga (dapagliflozin), and emerging combination therapies integrating GLP-1 receptor agonists, which may offer superior efficacy or additional benefits.

4. How does regulatory approval influence potential pricing?

Regulatory approvals expand indications and justify premium pricing if the therapy offers clear clinical advantages. Conversely, delayed approval or restrictions can limit market penetration and profitability.

5. Will biosimilars significantly impact SYNJARDY's market share?

Yes. Biosimilars for empagliflozin and other components, once approved and widely adopted, will likely lead to substantial price reductions and increased market accessibility.

References

- FDA Drug Approval Package. (2016). SYNJARDY (empagliflozin/metformin).

- Grand View Research. (2022). Diabetes Drugs Market Size & Trends.

- Zinman B, et al. (2015). Empagliflozin, cardiovascular outcomes, and mortality in type 2 diabetes. New England Journal of Medicine.

- American Diabetes Association. (2022). Standards of Medical Care in Diabetes.

- Bailey CJ. (2019). SGLT2 inhibitors: benefits and risks. The Lancet Diabetes & Endocrinology.

- Boehringer Ingelheim and Eli Lilly. Patent filings and expiry timelines.

- Nussinovitch M, et al. (2022). Emerging dual GIP/GLP-1 receptor agonists. Frontiers in Endocrinology.

Note: Market dynamics and price projections are subject to change based on regulatory developments, clinical research outcomes, and shifts in healthcare policy.