Last updated: July 28, 2025

Introduction

SYNJARDY XR, an innovative combination medication comprising empagliflozin and linagliptin, is formulated to manage type 2 diabetes mellitus (T2DM). Approved by the U.S. Food and Drug Administration (FDA) in 2018, SYNJARDY XR addresses both hyperglycemia and associated cardiovascular risks, aligning with comprehensive treatment strategies. As a trailblazer in the fixed-dose combination (FDC) market, SYNJARDY XR enters a competitive landscape marked by increasing diabetes prevalence and shifting healthcare reimbursement policies. This analysis explores its market dynamics and projects pricing trends over the coming five years, offering strategic insights for stakeholders.

Current Market Landscape

Epidemiology and Market Demand

The global prevalence of T2DM exceeds 537 million adults, with unmet medical needs persisting despite extensive treatment options [1]. In the United States alone, over 37 million people live with diabetes, reinforcing sustained demand for effective therapies [2]. The aging population, rising obesity rates, and lifestyle factors underpin steady market growth.

Therapeutic Positioning and Competition

SYNJARDY XR, approved as an adjunct to diet and exercise, targets patients inadequately controlled on monotherapy with either empagliflozin or linagliptin alone. Its dual mechanism—SGLT2 inhibition and DPP4 inhibition—provides dual benefits, including glucose lowering and cardiovascular risk mitigation [3].

The competitive landscape includes other FDCs such as IKTOSAR XR (linagliptin and empagliflozin), TREKYETI (glucagon-like peptide-1 receptor agonists), and monotherapies. Leading pharmaceutical players like Merck, AstraZeneca, and Lilly dominate. Nonetheless, SYNJARDY XR benefits from the convenience of once-daily dosing, patent protection, and recognition within treatment guidelines.

Regulatory and Reimbursement Environment

FDA approval and subsequent inclusion in clinical guidelines facilitate market penetration. Reimbursement depends heavily on formulary positioning, coverage policies, and cost-effectiveness analyses, which are increasingly rigorous. Payers favor medications that demonstrate both clinical efficacy and economic value.

Pricing Dynamics and Competitive Position

Current Pricing Baseline

As per publicly available data (2019-2022), the average wholesale price (AWP) for SYNJARDY XR in the US is approximately $500–$600 per month [4]. This positions the drug as a premium therapy compared to monotherapies, which cost between $150–$350 per month.

Market Penetration and Pricing Strategies

Pharmaceutical companies often employ tiered pricing, patient assistance programs, and formulary negotiations to enhance access. The high price reflects R&D investments, patent exclusivity, and the value proposition of combination therapy. Moreover, discounts and rebates influence net prices paid by payers.

Market Drivers for Price Stability

- Clinical Superiority: Evidence suggesting improved adherence and superior clinical outcomes supports premium pricing.

- Patent Exclusivity: Patent expiry in late 2020s may catalyze price erosion via generics or biosimilars.

- Reimbursement Incentives: Value-based payment models may incentivize price adjustments aligned with outcome metrics.

Future Price Projections (2023–2028)

Factors Influencing Price Trends

- Patent Lifespan and Generics Entry

SYNJARDY XR's patent protection, expiring around 2027–2028, is pivotal. Patent expiration typically precipitates significant price reductions, often between 30–70% [5].

- Market Competition and Biosimilar Development

Emerging biosimilar or combination drugs may exert downward pressure. Additionally, increased adoption of monotherapies or alternative FDCs could fragment market share.

- Regulatory Changes and Reimbursement Policies

Enhanced value-based care models aim to optimize drug costs, potentially capping prices for high-cost therapies. Policy shifts may necessitate more aggressive pricing adjustments.

- Offset by Clinical Data and Expanded Indications

New indications or demonstrated long-term cardiovascular benefits could sustain premium pricing.

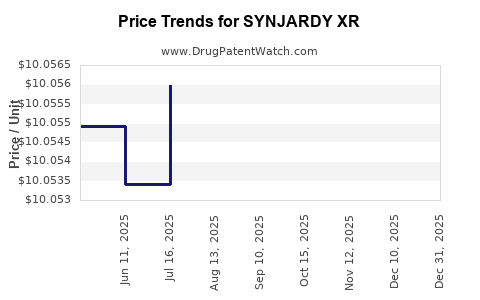

Projected Price Trajectory

- 2023–2024: Continued stability with minor adjustments (~2–4%), maintaining $500–$620 monthly price range.

- 2025–2026: Pre-patent expiry market dynamics could induce modest discounts (~10–15%), but premium positioning remains due to clinical benefits.

- Post-2027: Entry of generics or biosimilars may lower the effective cost by approximately 50–70% over 2–3 years, aligning prices near $150–$250 monthly.

Implications for Stakeholders

- Pharma Innovators: Premium pricing strategies should emphasize differentiated clinical benefits and adherence advantages.

- Payers: Negotiations may favor tiered discounts and outcome-based reimbursement models.

- Patients: High out-of-pocket costs may impact adherence; affordability programs will be critical.

Key Market Opportunities

- Expanding Indications: Exploring use in prediabetes or T2DM with comorbidities could extend market scope.

- Adherence Initiatives: Promoting once-daily fixed-dose options boosts compliance and market share.

- Global Expansion: Emerging markets with rising diabetes prevalence offer lucrative opportunities, often with different pricing expectations and regulatory pathways.

Conclusion

SYNJARDY XR's market trajectory hinges on patent longevity, competitive dynamics, clinical efficacy, and evolving reimbursement policies. While current pricing reflects premium positioning justified by clinical benefits, impending patent expiry portends a significant price decline, creating opportunities for cost-effective alternatives. Stakeholders must adapt strategies to leveraging clinical value, fostering reimbursement negotiations, and planning for post-patent market conditions.

Key Takeaways

- Market Momentum: Rising global diabetes prevalence ensures sustained demand for combination therapies like SYNJARDY XR.

- Pricing Outlook: Maintain premium pricing until patent expiration; expect significant discounts post-expiry.

- Competitive Edge: Clinical benefits and adherence advantages uphold market share amid competition.

- Strategic Focus: Prepare for biosimilar entry and adapt pricing models to maximize profitability.

- Patient Accessibility: Incorporate affordability programs and value-based pricing to improve access.

FAQs

1. When is SYNJARDY XR expected to face generic competition?

Patent protection is projected to expire around 2027–2028, after which generic formulations are likely to enter the market, prompting substantial price reductions.

2. How does SYNJARDY XR compare cost-wise to monotherapies?

Currently, SYNJARDY XR's wholesale price (~$500–$600/month) exceeds monotherapies (~$150–$350/month), reflecting added clinical benefits and convenience.

3. What factors influence SYNJARDY XR’s pricing in the US?

Pricing is driven by clinical efficacy, patent status, reimbursement policies, market competition, and manufacturing costs.

4. Will clinical developments impact the drug’s price?

Yes. Demonstrated long-term benefits or expanded indications could sustain or justify higher prices; conversely, negative data may prompt price renegotiation.

5. How do reimbursement strategies affect SYNJARDY XR’s market penetration?

Reimbursement policies emphasizing value and cost-effectiveness influence formulary placement, copay structures, and ultimately patient access and sales volume.

References

- International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

- Centers for Disease Control and Prevention. National Diabetes Statistics Report, 2020.

- European Medicines Agency. SYNJARDY XR Highlights. 2018.

- GoodRx. Cost analysis for SYNJARDY XR. 2022.

- IQVIA Institute. The Impact of Patent Expiry on Drug Prices, 2021.