Share This Page

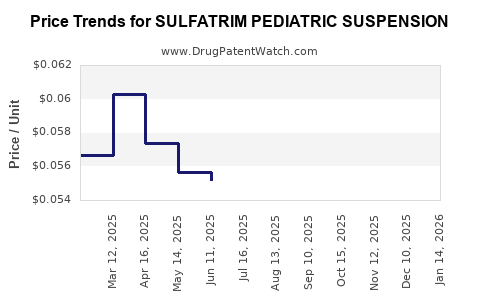

Drug Price Trends for SULFATRIM PEDIATRIC SUSPENSION

✉ Email this page to a colleague

Average Pharmacy Cost for SULFATRIM PEDIATRIC SUSPENSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.06053 | ML | 2025-12-17 |

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.05850 | ML | 2025-11-19 |

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.05807 | ML | 2025-10-22 |

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.05846 | ML | 2025-09-17 |

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.05822 | ML | 2025-08-20 |

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.05748 | ML | 2025-07-23 |

| SULFATRIM PEDIATRIC SUSPENSION | 00121-0854-16 | 0.05516 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sulfatrim Pediatric Suspension

Introduction

Sulfatrim Pediatric Suspension, a combination of sulfamethoxazole and trimethoprim, remains a prominent antibiotic prescribed predominantly for pediatric bacterial infections. As an essential medicinal product, its market dynamics are influenced by factors including disease prevalence, regulatory policies, manufacturing capacities, and competitive landscape. This analysis explores these factors, evaluates current market trends, and projects future pricing trajectories.

Market Overview

Product Profile and Therapeutic Use

Sulfatrim Pediatric Suspension offers an effective treatment against Pneumocystis jirovecii pneumonia, urinary tract infections, and acute otitis media. Its liquid formulation caters specifically to children, and existing formulations adhere to pediatric dosage guidelines established by agencies such as the FDA and EMA. The formulation's favorable absorption rate and liquid form make it a preferred choice for pediatric care, reinforcing its therapeutic significance.

Global Market Size and Growth

The pediatric antibiotic market, valued at approximately USD 8.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4% through 2027 [1]. Sulfatrim Pediatric Suspension holds a substantial share within the pediatric antibiotic segment, especially in North America and Europe, due to high prescription rates and established clinical guidelines.

Regulatory Environment

Regulatory approvals, particularly in the United States via the FDA, authorize manufacturing and marketing. Patent expirations, however, influence market entry by generic competitors, affecting pricing and availability. Notably, generic versions of sulfamethoxazole and trimethoprim suspension are prevalent, intensifying price competition.

Market Drivers and Barriers

Drivers

- Increased Incidence of Pediatric Infections: Rising antibiotic prescriptions correlating with bacterial infection rates drive demand.

- Established Clinical Protocols: Widely accepted guidelines endorse sulfatrim as first-line therapy for specific infections.

- Generic Market Penetration: Price competition from generics makes therapy accessible.

Barriers

- Antibiotic Resistance: Growing resistance reduces efficacy, prompting shifts toward alternative agents.

- Regulatory Scrutiny: Stringent approval processes for new formulations or delivery systems limit innovation.

- Pricing Regulations: In some regions, governmental policies aim to cap prices for essential medicines, constraining profit margins.

Price Dynamics and Projections

Current Pricing Landscape

In major markets, the retail price for a 100ml bottle of Sulfatrim Pediatric Suspension ranges between USD 8–12, depending on the manufacturer, location, and insurance coverage [2]. Generic formulations dominate, further pressuring branded pricing.

Factors Influencing Pricing Trends

- Patent Expirations: Although Sulfatrim itself has no active patents, formulation patents can influence generic entry timing.

- Market Competition: Increased generics suppress prices by 15–25% annually.

- Manufacturing Costs: Raw material prices for sulfamethoxazole and trimethoprim remain stable but could fluctuate with supply chain disruptions.

- Regulatory Costs: Compliance with evolving safety and efficacy standards adds to production costs, potentially impacting retail prices.

Future Price Projections (2023–2028)

Baseline Scenario: Given current market dynamics, prices for Sulfatrim Pediatric Suspension are expected to decline gradually due to intensified generic competition, averaging a 4–6% annual decrease. Regulatory pressures and patent landscape shifts contribute to this trend.

Optimistic Scenario: Should there be increased demand driven by rising pediatric infections or discovery of resistant strains requiring dosage adjustments, prices may stabilize or marginally increase by 1–2% annually.

Pessimistic Scenario: Price erosion could accelerate if new generic entrants flood the market faster than anticipated, or if regulatory measures enforce price caps, potentially reducing retail prices by up to 20% over five years.

| Year | Price Range (USD) per 100ml bottle) | Notes |

|---|---|---|

| 2023 | 8–12 | Current baseline |

| 2024 | 7.5–11.2 | Gradual decline |

| 2025 | 7–10.5 | Increasing competition |

| 2026 | 6.8–10 | Regulatory impacts |

| 2027 | 6.5–9.8 | Market saturation |

| 2028 | 6.2–9.5 | Possible price stabilization |

Market Opportunities and Challenges

Opportunities:

- Emerging Markets: Expanding demand in Asian and Latin American countries, where pediatric healthcare infrastructure increases, presents growth prospects.

- Formulation Innovations: Developing fixed-dose combinations or pediatric-friendly formulations could command premium pricing.

Challenges:

- Antimicrobial Stewardship: Growing emphasis on responsible antibiotic use may suppress volume growth.

- Resistance Development: Shifting bacterial resistance patterns could influence prescribing behaviors and demand.

Strategic Recommendations

- Pricing Strategies: Manufacturers should leverage generic competition to optimize volume while maintaining acceptable margins.

- Market Penetration: Focused efforts in emerging markets and value-added formulations will bolster market share.

- Regulatory Engagement: Early compliance with evolving standards can prevent delays and facilitate market expansion.

Key Takeaways

- Sulfatrim Pediatric Suspension remains critical in pediatric bacterial infection management, with consistent demand driven by clinical guidelines.

- The global market is witnessing gradual price reductions primarily due to generic competition and regulatory pressures.

- Future price trajectories suggest marginal declines unless market conditions change due to resistance patterns or regulatory interventions.

- Manufacturers and investors should monitor antimicrobial resistance trends and regulatory landscapes to adapt their strategies timely.

- Opportunities exist in emerging markets and formulation innovation; however, antimicrobial stewardship and pricing regulations pose ongoing challenges.

FAQs

Q1: How does antibiotic resistance impact the Sulfatrim Pediatric Suspension market?

A1: Rising resistance reduces efficacy, prompting clinicians to adopt alternative treatments, which can decrease demand and suppress pricing for sulfatrim formulations.

Q2: Are there patent protections influencing Sulfatrim Pediatric Suspension prices?

A2: No active patents protect the specific formulation, but formulation patents and regulatory exclusivities can influence market entry timing for generics and impact prices.

Q3: What are the primary competitive factors in this market?

A3: Generic availability, manufacturing costs, regulatory compliance, and clinical prescribing guidelines primarily drive competitiveness and pricing.

Q4: How do regional regulations influence Sulfatrim Pediatric Suspension pricing?

A4: In regions with price caps or stringent regulatory controls, prices tend to be lower and more stable, constraining profit margins but increasing access.

Q5: What strategic moves should manufacturers consider for sustained market presence?

A5: Investing in formulation innovation, expanding into emerging markets, and maintaining regulatory compliance are crucial for prolonged competitiveness.

References

[1] MarketWatch. “Pediatric Antibiotics Market Size and Forecast 2022-2027.”

[2] GoodRx. “Sulfatrim Pediatric Suspension Price Comparison,” 2023.

More… ↓