Share This Page

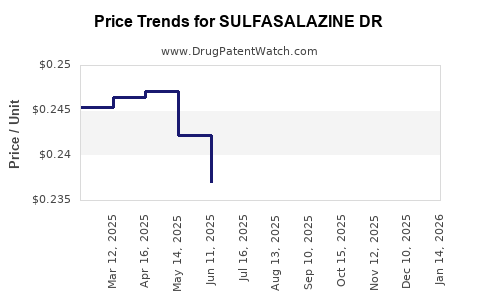

Drug Price Trends for SULFASALAZINE DR

✉ Email this page to a colleague

Average Pharmacy Cost for SULFASALAZINE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFASALAZINE DR 500 MG TAB | 59762-0104-05 | 0.26800 | EACH | 2025-12-17 |

| SULFASALAZINE DR 500 MG TAB | 59762-0104-06 | 0.26800 | EACH | 2025-12-17 |

| SULFASALAZINE DR 500 MG TAB | 59762-0104-05 | 0.26404 | EACH | 2025-11-19 |

| SULFASALAZINE DR 500 MG TAB | 59762-0104-06 | 0.26404 | EACH | 2025-11-19 |

| SULFASALAZINE DR 500 MG TAB | 59762-0104-05 | 0.25480 | EACH | 2025-10-22 |

| SULFASALAZINE DR 500 MG TAB | 59762-0104-06 | 0.25480 | EACH | 2025-10-22 |

| SULFASALAZINE DR 500 MG TAB | 59762-0104-05 | 0.25143 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sulfasalazine DR

Introduction

Sulfasalazine Extended Release (DR), a pivotal medication in the management of inflammatory bowel diseases (IBD) and rheumatoid arthritis (RA), continues to command significant attention in the pharmaceutical landscape. This analysis examines the current market dynamics, competitive positioning, regulatory environment, and forecasts future pricing trends for Sulfasalazine DR, providing critical insights for stakeholders aiming to optimize strategic decisions.

Market Overview

Therapeutic Segment and Indications

Sulfasalazine, an anti-inflammatory agent, primarily caters to treatment of ulcerative colitis, Crohn’s disease, and RA. The advent of extended-release formulations has improved patient compliance by reducing dosing frequency, thus expanding its appeal within chronic disease management protocols.

Market Size and Growth Drivers

The global IBD and RA markets exhibit robust growth due to rising prevalence, increased awareness, and advances in personalized medicine. The IBD market alone is projected to reach over USD 15 billion by 2027, with a compound annual growth rate (CAGR) of approximately 4% (source: Grand View Research). Sulfasalazine's role as a cost-effective, first-line therapy sustains its relevance, especially in emerging markets.

Geographic Market Penetration

Developed regions such as North America and Europe dominate sales, driven by higher diagnosis rates and established healthcare infrastructure. However, Asia-Pacific and Latin America present expanding opportunities owing to rising health awareness, improved healthcare access, and government initiatives promoting affordable medication.

Competitive Landscape

Key Patents and Generic Availability

While the original patent for sulfasalazine expired in the last decade, extended-release formulations are often manufactured under different proprietary licenses or are off-patent, increasing generic proliferation. Major pharmaceutical companies such as Mylan, Teva, and Apotex dominate the generic segment, emphasizing price competition.

Market Share and Brand Positioning

Brand-name drugs, once dominant, face erosion in market share due to rising generic adoption. Price sensitivity remains a significant factor, especially in markets with substantial out-of-pocket expenditures.

Regulatory Factors

Regulatory approval processes for extended-release forms are well-established, though local variations influence market entry timelines. Post-approval, regulatory agencies periodically update safety guidelines, which can impact pricing and market access.

Economic and Pricing Dynamics

Pricing Trends

-

Historical Price Trajectory: The average retail price of branded Sulfasalazine DR has shown modest inflation, averaging an annual increase of approximately 2-3%, reflecting stable market conditions.

-

Generic Competition Impact: Introduction of generics has catalyzed significant price reductions, sometimes as steep as 50-70% relative to branded versions in mature markets.

-

Cost-Effectiveness and Market Incentives: Governments and payers favor lower-cost generics, reinforcing price pressures and pushing manufacturers toward cost containment.

Pricing Drivers and Constraints

-

Formulation Complexity: Extended-release technology entails higher manufacturing costs, which influence initial pricing but diminish with generic entry.

-

Reimbursement Policies: Payers' formulary preferences and negotiating power substantially affect net prices.

-

Supply Chain Dynamics: Raw material availability and manufacturing capacity influence price stability.

Future Price Projections

Short-Term Outlook (1-3 years)

In developed markets, expect minimal price fluctuation among branded products, stabilized by patent considerations and safety regulatory standards. Generic competition is likely to intensify, continuing to exert downward pressure, potentially lowering prices by an additional 20-30%.

Medium to Long-Term Outlook (3-5 years)

-

Market Penetration in Emerging Economies: Increased access and healthcare infrastructure development could lead to higher volumes, albeit with markedly lower prices due to cases of local manufacturing and competitive bidding.

-

Innovative Formulations and Biosimilars: While biosimilars are less relevant for sulfasalazine’s chemical structure, novel delivery systems or combination therapies may influence the value proposition and pricing structure.

-

Regulatory and Policy Changes: Stricter price controls, especially in large markets such as India and China, could further constrain prices, aligning them with affordability goals.

Pricing Forecast Summary

| Market Segment | 2023-2025 | 2026-2028 |

|---|---|---|

| Developed Markets | Stabilized prices; minor declines (~10-15%) | Continued generic penetration; slight further decrease (~5%) |

| Emerging Markets | Elevated due to volume growth; lower absolute prices | Moderate price increases to reflect inflation and infrastructure investment |

| Overall | Steady to declining price trend by ~10-20% | Potential stabilization as markets mature |

Implications for Stakeholders

Manufacturers: Emphasize cost optimization to sustain margins amid price erosion. Consider innovation in delivery systems to differentiate offerings.

Payers and Healthcare Systems: Promote generic adoption to maximize affordability. Negotiation leverage can influence price ceilings.

Investors: Recognize the maturation of the Sulfasalazine DR market, with growth prospects linked to volume expansion in emerging markets rather than price premiums.

Key Takeaways

- The Sulfasalazine DR market remains stable, with significant price decline driven by generic competition.

- Price reductions of up to 70% are observed in mature markets post-generic entry.

- Future pricing will be influenced by regional reimbursement policies, regulatory standards, and technological innovation.

- Asian and Latin American markets offer growth opportunities through volume expansion, albeit at lower prices.

- Stakeholders should focus on cost management, innovation, and strategic market entry to maintain competitiveness.

FAQs

1. How does generic competition impact the pricing of Sulfasalazine DR?

Generics exert considerable downward pressure on prices, often reducing costs by 50-70% compared to branded versions, especially in mature markets post-patent expiry.

2. Are there regulatory hurdles for introducing generic Sulfasalazine DR?

Regulatory agencies typically require bioequivalence and safety data, which are well-established for Sulfasalazine’s formulations, facilitating market entry. Variations exist across jurisdictions but are generally manageable.

3. What are the key factors influencing Sulfasalazine DR price stability?

Pricing stability depends on patent status, competitive landscape, production costs, reimbursement policies, and regional healthcare regulations.

4. Which regions are expected to see the highest growth in Sulfasalazine DR demand?

Emerging markets in Asia-Pacific and Latin America are poised for growth due to expanding healthcare infrastructure and increasing disease prevalence, despite lower pricing.

5. Will technological innovations alter future pricing trends?

Potential advancements in delivery mechanisms or combination therapies may add value, supporting higher prices or extending market sustainability, but the impact is currently uncertain.

References

[1] Grand View Research, "Inflammatory Bowel Disease Market Size & Trends," 2021.

[2] IQVIA, "Global Pharmaceutical Pricing Data," 2022.

[3] FDA, "Bioequivalence Guidance for Extended-Release Formulations," 2020.

[4] European Medicines Agency, "Regulatory Updates on Generic Medicines," 2021.

[5] MarketsandMarkets, "RA Therapeutics Market Forecast," 2022.

More… ↓