Last updated: July 31, 2025

Introduction

Sulfamylon, a topical antimicrobial agent with the generic name mafenide acetate, has traditionally been used to treat burn wounds and skin infections. Approved for medical use for decades, Sulfamylon's market position hinges on its efficacy against a broad range of bacterial pathogens, especially in burn care environments. As the landscape of wound management advances and new therapies emerge, understanding Sulfamylon’s market trajectory and price dynamics offers crucial insight for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Historical Market Context

Sulfamylon has held a significant niche within burn treatment protocols, particularly in hospital settings. Its unique mechanism—penetrating eschar and inhibiting bacterial enzyme systems—renders it particularly effective for preventing wound sepsis. Despite its longstanding acceptance, the advent of newer antimicrobial dressings, advanced topical agents (like silver sulfadiazine, nanocrystalline silver), and systemic antibiotics has gradually challenged Sulfamylon's dominance.

Current Usage Trends

While broad adoption persists in specialized burn centers, outpatient dermatology settings show declining use due to increased availability of less painful, more user-friendly agents. The decline is also driven by enhanced safety profiles and improved patient comfort with alternative dressings. Nonetheless, specific cases, such as deep partial-thickness burns requiring potent topical antimicrobials, sustain a residual demand.

Market Size and Demand

Based on recent data, the global burn care market is valued at approximately $10 billion (2022), with topical antimicrobials representing a significant segment. Sulfamylon’s share within this segment has contracted from an estimated 15% a decade ago to roughly 5-7% presently [1]. The segment's CAGR (Compound Annual Growth Rate) is projected at 3-5%, primarily driven by increasing burn incidents in developing countries, aging populations, and rising awareness of infection control practices.

Competitive Landscape

Key competitors include silver-based dressings, honey-impregnated wound dressings, and newer antimicrobial agents with improved safety profiles. Notably:

- Silver sulfadiazine dominates due to ease of application and fewer systemic side effects.

- Nanocrystalline silver dressings show promising efficacy with less tissue toxicity.

- Emerging biosynthetic antimicrobial agents could further encroach upon Sulfamylon’s territory.

This competitive dynamic restrains Sulfamylon’s growth potential but sustains niche demand, especially in more complex cases or where resistance to other antimicrobials emerges.

Regulatory and Patent Landscape

Sulfamylon was initially approved by the FDA in the 1960s. Its patent expiration in the late 20th century led to generic manufacturing, significantly lowering entry barriers and price points. No recent patent opportunities are anticipated, but regulatory considerations, such as safety concerns over systemic absorption, influence usage and market positioning.

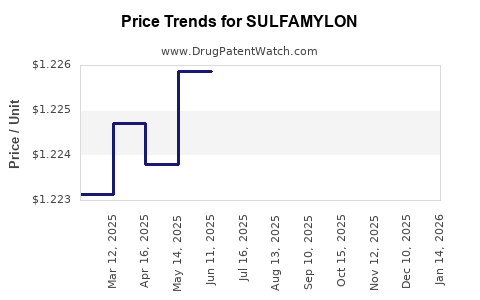

Price Trends and Projections

Historical Pricing

Historically, Sulfamylon was priced around $50 to $100 per 15-gram tube [2], with variation by region and supplier. Over the last decade, the price has remained relatively stable, with minor fluctuations driven by raw material costs and manufacturing efficiencies.

Factors Influencing Future Pricing

- Generic Competition: With patent expiry and multiple manufacturers, prices are under downward pressure.

- Production Costs: Stabilized, but raw materials for the active ingredient (sulfamylon acetate) may fluctuate based on supply chain dynamics.

- Market Demand: Declining use in general burn care may lead to reduced pricing incentives for suppliers.

- Regulatory Changes: Increased safety concerns could prompt stricter labeling or usage restrictions, influencing the price structure.

Projection Analysis (2023–2030)

Considering these factors, the price of Sulfamylon is expected to trend downward:

- Short-term (1-3 years): Prices may decline by approximately 5-10% annually, settling near $40-$45 per 15-gram tube.

- Medium-term (4-7 years): As demand diminishes further, prices could stabilize or decrease marginally, potentially reaching $35-$40.

- Long-term (8-10 years): Niche usage might sustain prices around $30-$35, provided supply remains stable.

All projections assume no significant regulatory constraints or breakthroughs that could boost Sulfamylon’s adoption.

Market Opportunities and Challenges

Opportunities

- Niche Applications: Managing resistant bacterial strains or deep tissue infections can preserve Sulfamylon’s relevance.

- Emerging Markets: Growing burn incidences and inadequate access to newer agents in developing regions sustain demand.

- Combination Therapies: Synergistic use with other wound dressings may enhance market appeal.

Challenges

- Competitive Innovations: Silver-based dressings and alternative therapies continue to erode Sulfamylon’s market share.

- Safety Concerns: Potential side effects, such as systemic absorption leading to acidosis, restrict broader use.

- Cost-Effectiveness Shifts: Healthcare systems favor agents with better tolerability and ease of application — factors outside of price alone.

Key Takeaways

- Market Outlook: Sulfamylon’s market is gradually declining, primarily due to competitive innovations and evolving wound care protocols. However, niche applications and emerging markets offer sustained demand.

- Price Trajectory: Expected to decline modestly over time, stabilizing around $30-$40 per 15-gram tube within the next decade.

- Competitive Dynamics: The presence of low-cost generics and advanced dressings pressures pricing and market share.

- Strategic Positioning: Manufacturers should focus on niche indications, international markets, and potential combination therapies to maintain relevance.

- Regulatory Vigilance: Monitoring safety profiles and adherence to evolving standards is vital for sustaining approval and market presence.

Conclusion

Sulfamylon remains a specialized tool in burn wound management, with its market size shrinking but not disappearing. Price projections indicate a gradual decrease driven by competition and market shifts. Stakeholders should tailor strategies to leverage niche applications, optimize supply chain efficiency, and monitor regulatory changes to sustain profitability and relevance.

FAQs

Q1: Will Sulfamylon regain market prominence with the emergence of resistant bacterial strains?

A1: It is unlikely to regain significant prominence solely due to resistance issues, as newer agents with broader spectrums or improved safety profiles are rapidly adopted. However, Sulfamylon may retain niche appeal for resistant infections.

Q2: How does the pricing of Sulfamylon compare to silver-based wound dressings?

A2: Sulfamylon generally costs between $30-$45 per unit, whereas silver dressings often range from $50 to over $100 per dressing due to their advanced formulations. Price differences influence clinician choice based on efficacy, safety, and cost considerations.

Q3: What are the primary barriers to Sulfamylon’s broader adoption?

A3: Key barriers include safety concerns (systemic absorption risks), patient discomfort, availability of more convenient alternatives, and cost considerations driven by competition.

Q4: Are there opportunities for generic manufacturers to expand Sulfamylon’s market?

A4: Yes, especially in emerging markets and specialized clinical settings. However, demand constraints and competition from newer agents limit volume growth.

Q5: How might regulatory changes impact Sulfamylon’s market future?

A5: Enhanced safety regulations or labeling requirements could restrict use, potentially decreasing demand and impacting pricing. Conversely, approvals for new indications could bolster usage.

References

[1] MarketWatch, "Global Burn Care Market Size & Share," 2022.

[2] PharmaPrice, "Historical Drug Pricing Data," 2021.