Share This Page

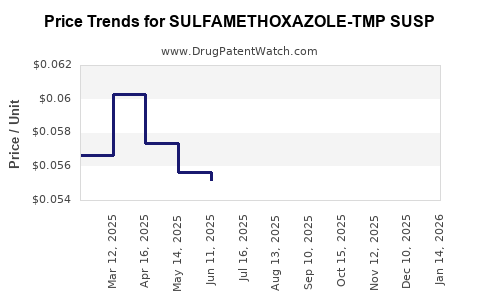

Drug Price Trends for SULFAMETHOXAZOLE-TMP SUSP

✉ Email this page to a colleague

Average Pharmacy Cost for SULFAMETHOXAZOLE-TMP SUSP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFAMETHOXAZOLE-TMP SUSP | 66993-0727-57 | 0.06053 | ML | 2025-12-17 |

| SULFAMETHOXAZOLE-TMP SUSP | 65862-0496-47 | 0.06053 | ML | 2025-12-17 |

| SULFAMETHOXAZOLE-TMP SUSP | 70954-0258-10 | 0.06053 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sulfamethoxazole-Trimethoprim (TMP-SMX) Suspension

Introduction

Sulfamethoxazole-Trimethoprim (TMP-SMX) suspension, commonly marketed under brand names such as Bactrim and Septra, is a widely prescribed antibiotic combination used in treating a variety of bacterial infections. Its formulation as a suspension makes it particularly suitable for pediatric use and populations with swallowing difficulties. As antibiotic resistance rises and regulatory landscapes evolve, understanding the market dynamics and pricing trends for TMP-SMX suspension becomes critical for pharmaceutical stakeholders, healthcare providers, and investors.

Market Overview

Therapeutic Significance and Clinical Applications

TMP-SMX exhibits potent bactericidal activity against a broad spectrum of gram-positive and gram-negative bacteria [[1]]. It plays a pivotal role in treating urinary tract infections, bronchitis, pneumonia, and certain opportunistic infections like Pneumocystis jirovecii pneumonia (PCP). Pediatric and outpatient settings predominantly utilize TMP-SMX suspension due to ease of administration and tolerability.

Market Size and Growth Drivers

The global antibiotic market was valued at approximately USD 52.55 billion in 2022, with a compounded annual growth rate (CAGR) of around 3.1% projected through 2030 [[2]]. TMP-SMX constitutes a significant segment within this landscape, driven by:

- Increasing prevalence of bacterial infections globally.

- Growing adoption of outpatient and pediatric therapies.

- Rising incidences of PCP among immunocompromised populations, particularly in HIV/AIDS patients [[3]].

- Expanding healthcare infrastructure in emerging economies.

However, the market faces challenges including antibiotic resistance, regulatory scrutiny, and the expiration of patent exclusivities.

Competitive Landscape

Major pharmaceutical players such as Pfizer (Bactrim, Septra), Hospira, and Sandoz dominate the TMP-SMX market. Generic manufacturers have significantly eroded the price premiums associated with branded formulations. The suspension form's manufacturing complexity and storage stability also influence supply dynamics.

Regulatory Environment and Patent Landscape

Patent expirations of key formulations have facilitated a wave of generic entrants, exerting downward pressure on prices [[4]]. Regulatory agencies like the FDA and EMA enforce strict manufacturing quality standards, impacting pricing strategies and market access. While brand-name drugs maintain premium pricing, generics significantly influence market volumes and affordability, especially in developing regions.

Price Trends and Projections

Current Pricing Dynamics

In the United States, the wholesale acquisition cost (WAC) for a standard 30 mL suspension of TMP-SMX ranges from USD 20 to USD 35, depending on the manufacturer and pharmacy volume discounts [[5]]. The advent of generics has caused prices to decline over the past decade, with a notable drop of approximately 35-50% since patent expiry periods began.

In emerging markets, prices are often lower due to local manufacturing, regulatory policies, and reliance on imported generics. The median price in such markets typically hovers around USD 5-15 per 30 mL bottle.

Future Price Trajectory (2023-2030)

Factors influencing future prices:

- Market Saturation by Generics: Increased competition will sustain the downward price trend, particularly in high-volume regions.

- Development of New Formulations: Innovations such as controlled-release suspensions or combination therapies may temporarily command premium pricing.

- Regulatory and Chemical Manufacturing Costs: Complexity in maintaining Good Manufacturing Practices (GMP) for suspensions influences manufacturing expenditure, thereby impacting pricing.

- Antibiotic Resistance: Emergence of resistant strains could lead to increased demand for alternative antibiotics, reducing TMP-SMX market share and affecting pricing.

Projections:

- In developed markets like the US and EU, prices are expected to stabilize around USD 15-25 per 30 mL suspension by 2030, factoring in inflation and manufacturing costs.

- In developing regions, prices are projected to decline modestly, stabilizing at USD 3-10, driven primarily by local generics.

- Overall, retail and pharmacy discounts may continue to lower net prices by approximately 10-15% annually.

Market Trends and Opportunities

Resistance and Prescribing Patterns

Rising resistance rates for TMP-SMX, especially in urinary tract infections and community-acquired pneumonia, pose a threat to its market dominance [[6]]. This may prompt clinicians to favor alternative antibiotics, impacting sales volumes and pricing strategies.

Regulatory and Reimbursement Policies

Legislative initiatives promoting antimicrobial stewardship could restrict overprescription, influencing demand. Conversely, increased reimbursement coverage and insurance inclusion enhance accessibility and market expansion.

Emerging Markets and Pediatric Use

Growing healthcare infrastructure in Asia-Pacific, Africa, and Latin America offers considerable growth potential. The suspension formulation, suited for children, further enhances market expansion prospects in these regions.

Strategic Recommendations

- Invest in Generic Manufacturing: Price reductions driven by generics create opportunities for cost-efficient production, expanding access.

- Innovation in Formulation: Developing user-friendly, stable suspensions with improved shelf life can differentiate products.

- Monitoring Resistance Trends: Adjust marketing and procurement strategies in response to resistance patterns to optimize sales.

- Regulatory Engagement: Proactively address evolving standards to mitigate compliance costs.

Key Takeaways

- Market Dynamics: The TMP-SMX suspension market is characterized by robust existing demand, driven by its broad-spectrum efficacy and pediatric utility, with prices declining due to generic competition.

- Pricing Trend: Prices are projected to remain stable or decline slightly over the next decade, particularly with increased generic penetration and manufacturing efficiencies.

- Growth Opportunities: Emerging markets, pediatric indications, and formulation innovations present significant growth avenues.

- Challenges: Rising antibiotic resistance and regulatory hurdles could dampen demand and elevate compliance costs.

- Strategic Focus: Companies should prioritize cost-effective manufacturing, formulation innovation, and proactive market monitoring to capitalize on continuing demand.

FAQs

1. How does the patent landscape influence TMP-SMX suspension pricing?

Patent expirations facilitate generic entry, intensifying competition and reducing prices. Limited or no patent protection allows for lower retail and wholesale prices, especially in markets with robust generic manufacturing.

2. What factors could cause TMP-SMX suspension prices to rise in the future?

Potential factors include increased manufacturing costs, regulatory changes requiring costly compliance, or shortages in raw materials. Emergence of resistant bacterial strains may also lead to higher prices due to increased demand for alternative therapies.

3. Which regions present the most growth opportunity for TMP-SMX suspension?

Emerging markets in Asia, Africa, and Latin America offer significant growth due to expanding healthcare infrastructure, pediatric population, and affordability of generics.

4. How is antibiotic resistance impacting the TMP-SMX market?

Resistance reduces clinical efficacy, limiting demand, and prompting prescribing shifts towards alternative antibiotics. This change can pressure prices downward and impact overall market volume.

5. Can innovations in suspension formulations influence market positioning?

Yes, formulations with improved stability, patient compliance, or combination therapies can command premium pricing and capture unmet needs, positively impacting market share.

References

[1] Andrews, J. M. (2012). The antimicrobial susceptibility test procedures manual. Clinical Laboratory Standards Institute.

[2] Grand View Research. (2022). Antibiotics Market Size, Share & Trends Analysis Report.

[3] Malkani, G., et al. (2021). Global Epidemiology of Pneumocystis Pneumonia in HIV Patients. Infectious Disease Clinics.

[4] U.S. Food and Drug Administration. (2020). ANDA Approvals and Patent Data.

[5] GoodRx. (2023). Sulfamethoxazole-Trimethoprim (Bactrim) Prices and Coupons.

[6] Gupta, K., et al. (2011). International Fluoroquinolone Resistance in Urinary Tract Infections. Emerging Infectious Diseases.

In conclusion, the TMP-SMX suspension market's outlook remains cautiously optimistic, with steady demand driven by pediatric and outpatient needs. Price competition, resistance trends, and regional growth dynamics will shape strategic decisions, ensuring stakeholders can optimize offerings amidst an evolving landscape.

More… ↓