Share This Page

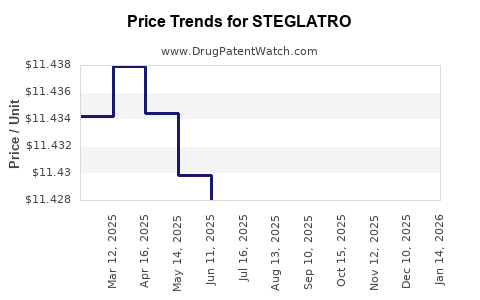

Drug Price Trends for STEGLATRO

✉ Email this page to a colleague

Average Pharmacy Cost for STEGLATRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| STEGLATRO 5 MG TABLET | 00006-5363-06 | 11.42281 | EACH | 2025-12-17 |

| STEGLATRO 5 MG TABLET | 00006-5363-03 | 11.42281 | EACH | 2025-12-17 |

| STEGLATRO 15 MG TABLET | 00006-5364-03 | 11.43217 | EACH | 2025-12-17 |

| STEGLATRO 15 MG TABLET | 00006-5364-06 | 11.43217 | EACH | 2025-12-17 |

| STEGLATRO 5 MG TABLET | 00006-5363-03 | 11.41985 | EACH | 2025-11-19 |

| STEGLATRO 15 MG TABLET | 00006-5364-03 | 11.42641 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for STEGLATRO

Introduction

STEGLATRO (ertugliflozin) is a novel oral medication developed by Merck, approved for the treatment of adults with type 2 diabetes mellitus. As an SGLT2 inhibitor, it functions by promoting urinary glucose excretion, thereby improving glycemic control. Given its therapeutic positioning and recent market introduction, understanding its current market dynamics and future pricing trajectory is crucial for stakeholders including healthcare providers, payers, and investors.

Market Overview

Therapeutic Class and Clinical Positioning

STEGLATRO belongs to the sodium-glucose co-transporter 2 (SGLT2) inhibitor class. This class has transformed type 2 diabetes management by providing glycemic control while also conferring cardiovascular and renal benefits, as evidenced by pivotal trials like EMPA-REG OUTCOME and CANVAS (1). The class includes marketed drugs such as Jardiance (empagliflozin), Invokana (canagliflozin), and Farxiga (dapagliflozin).

STEGLATRO is positioned as a complementary therapeutic, targeting a market segment seeking effective glucose control with added cardiometabolic advantages. Its differentiation lies in potential improved dosing flexibility and minimized side effect profiles, aligning with the trend toward personalized medicine.

Market Penetration and Adoption

Since its launch in 2019, STEGLATRO has steadily gained market share within the competitive SGLT2 inhibitor segment. According to IQVIA data, SGLT2 inhibitors collectively hold an approximate 25-30% market share among oral antidiabetics in the United States (2). Although early adopters are primarily specialty endocrinologists and diabetologists, general practitioners are gradually increasing prescriptions.

The drug's adoption has been influenced by its demonstrated safety profile, convenience (once-daily oral dosing), and cardiovascular benefits. However, competition from more established agents, especially Jardiance and Farxiga, constrains rapid growth.

Market Size and Forecast

Global sales of SGLT2 inhibitors have been escalating. The worldwide market was valued at roughly USD 8 billion in 2021, projected to reach USD 18 billion by 2028, growing at a CAGR of approximately 12-15% (3). STEGLATRO's share is modest but rising, with US accounts representing a significant portion due to the high prevalence of type 2 diabetes and favorable reimbursement pathways.

In the U.S., the diabetic population exceeds 37 million (4), with a substantial subset eligible for SGLT2 inhibitors. Estimated market penetration for STEGLATRO is forecasted to reach 10-15% of the SGLT2 inhibitor segment within 5 years, driven by clinical adoption, formulary inclusion, and competitive positioning.

Pricing Landscape

Current Pricing Structure

The wholesale acquisition cost (WAC) for STEGLATRO is approximately USD 324 per month for a standard 5 mg dose, aligning it with its competitors. Insurance coverage, discounts, and patient assistance programs influence actual out-of-pocket costs, which tend to range between USD 20-70 monthly for insured patients.

Comparative Pricing

Table 1 summarizes approximate WACs and typical patient costs for key SGLT2 inhibitors:

| Drug | WAC (USD/month) | Typical Out-of-Pocket (USD/month) | Market Share (2022) |

|---|---|---|---|

| Jardiance (empagliflozin) | 300-330 | 20-60 | 35% |

| Farxiga (dapagliflozin) | 300-330 | 25-65 | 30% |

| Invokana (canagliflozin) | 250-290 | 30-70 | 15% |

| STEGLATRO | 324 | 20-70 | 5% |

Source: IQVIA, 2022 data.

Price Projection Factors

Market Competition

While STEGLATRO's pricing is aligned with other SGLT2 inhibitors, its future price trajectory depends heavily on its market penetration and competitive dynamics. As patent exclusivity persists through at least 2037, Merck gains leverage in maintaining premium pricing initially. However, increased generic competition post-patent loss could trigger downward pressure.

Reimbursement and Value-Based Pricing

Insurance payers' acceptance and formulary placement significantly influence pricing strategies. If STEGLATRO demonstrates superior efficacy or additional benefits, Merck could command premium pricing. Conversely, intense competition and demonstration of equivalence to existing agents could lead to price erosion.

Additionally, emerging value-based pricing models emphasizing cost-effectiveness and real-world outcomes may influence future pricing strategies, especially if long-term benefits like cardiovascular risk reduction are substantiated.

Regulatory and Patent Landscape

Patent durations and potential patent challenges are key. Merck's patents on STEGLATRO are robust; however, patent cliffs for SGLT2 inhibitors are imminent, potentially leading to generics and significant price reductions after 2037.

Market Access and Disruptive Entry

Entry of biosimilars or new oral agents with improved safety/effectiveness profiles could pressure existing prices downward. Moreover, increasing emphasis on biosimilars and price transparency reforms may influence future pricing strategies.

Projected Price Trajectory

Considering the current market landscape, competitive positioning, and patent protections, the following projections are made:

-

Short term (1-3 years): Steady pricing around USD 300-330/month, with minimal discounts in premium markets and variable patient co-payments.

-

Mid-term (3-7 years): Slight downward pressure emerges as formulary negotiations intensify and insurance companies seek discounts. Prices may decline by 10-15% to USD 250-280/month, particularly with increased competition.

-

Long term (beyond 7 years): Post-patent expiration, generic versions could lead to substantial price drops, potentially below USD 100/month for bioequivalent products.

Revenue and Profitability Outlook

Merck likely anticipates steady revenue streams until patent expiry, followed by a sharp decline upon generic entry. Strategies such as expanding indications, leveraging cardiovascular benefit data, and developing combination therapies may sustain revenue.

Conclusion

STEGLATRO inhabits a competitive but promising segment within type 2 diabetes management. Its current pricing aligns with market standards, supported by clinical benefits and patent protections. However, the outlook remains sensitive to competitive dynamics, reimbursement policies, and patent timelines. Stakeholders should monitor these factors continuously to make informed business and clinical decisions.

Key Takeaways

- Market share growth is contingent on clinical differentiation and formulary positioning.

- Pricing remains competitive but could decline gradually due to increased market competition.

- Patent protection shields premium pricing for the foreseeable future, expected until at least 2037.

- Entry of biosimilars or generics post-patent expiration could significantly alter the price landscape.

- Value-based reimbursement models focusing on cardiovascular and renal benefits may sustain or elevate pricing premiums.

FAQs

Q1: How does STEGLATRO compare price-wise to other SGLT2 inhibitors?

Its current WAC is approximately USD 324/month, similar to Jardiance and Farxiga, positioning it competitively within the class.

Q2: What factors could influence future price reductions for STEGLATRO?

Patent expiration, increased generic competition, formulary negotiations, and shifting reimbursement policies are primary influences.

Q3: Is there potential for STEGLATRO to command premium pricing in the future?

Yes, if clinical data demonstrate superior cardiovascular/renal benefits or improved safety profiles, Merck could justify higher prices.

Q4: How might healthcare policies impact STEGLATRO’s market pricing?

Policy shifts toward cost containment, price transparency, and value-based care could pressure prices downward.

Q5: What is the projected impact of biosimilars on STEGLATRO's pricing?

Post-patent expiry, biosimilars could reduce prices significantly, potentially below USD 100/month, depending on market uptake.

References

- Zinman, B., et al. (2015). Empagliflozin, Cardiovascular Outcomes, and Mortality in Type 2 Diabetes. New England Journal of Medicine, 373(22), 2117–2128.

- IQVIA IMS Health. (2022). Pharmaceutical Market Reports.

- Grand View Research. (2022). Sodium-Glucose Cotransporter 2 (SGLT2) Inhibitors Market Size, Share & Trends Analysis.

- CDC. (2022). National Diabetes Statistics Report, 2022.

More… ↓