Share This Page

Drug Price Trends for SPRITAM

✉ Email this page to a colleague

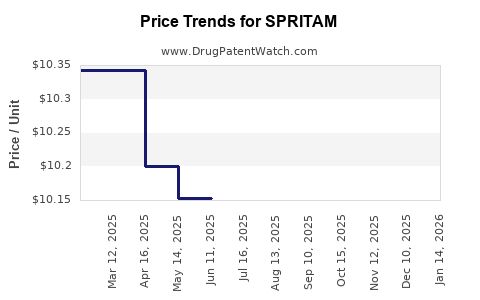

Average Pharmacy Cost for SPRITAM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SPRITAM 250 MG TABLET | 43485-0101-01 | 10.33683 | EACH | 2025-12-17 |

| SPRITAM 1,000 MG TABLET | 43485-0104-01 | 10.19900 | EACH | 2025-12-17 |

| SPRITAM 500 MG TABLET | 43485-0102-01 | 10.24120 | EACH | 2025-12-17 |

| SPRITAM 250 MG TABLET | 43485-0101-60 | 10.33683 | EACH | 2025-12-17 |

| SPRITAM 1,000 MG TABLET | 43485-0104-60 | 10.19900 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Spritam (Levetiracetam)

Introduction

Spritam (levetiracetam) is a branded antiepileptic drug (AED) developed by UCB Pharma, featuring a groundbreaking lyophilised formulation that allows for rapid disintegration in the mouth. Approved by the U.S. Food and Drug Administration (FDA) in 2015, Spritam transformed the treatment landscape for epilepsy, particularly for patients with swallowing difficulties, offering a novel delivery route. This report provides a comprehensive market analysis and price projection for Spritam, emphasizing its current position, competitive landscape, pricing dynamics, and future outlook.

Market Overview

Epilepsy Treatment Landscape

Epilepsy affects approximately 50 million people globally, with the U.S. accounting for over 3 million cases (CDC, 2022). The pharmacologic management relies heavily on AEDs, including levetiracetam, which has become a preferred choice due to its favorable side effect profile. The global AED market, valued at around USD 4.2 billion in 2022, is expected to grow CAGR of ~4.2% through 2030 [1].

Spritam’s Niche and Differentiation

Spritam's unique formulation addresses compliance challenges associated with traditional oral tablets, especially in pediatric and geriatric populations. Its rapid disintegration enhances patient adherence, an essential factor in epilepsy management. As a branded product, Spritam commands premium pricing, catering mainly to niche populations with specific needs.

Market Penetration and Adoption

Since its launch, Spritam has garnered positive acceptance, especially in pediatric neurology. However, competition from generic levetiracetam products and other novel formulations constrains its market share. Its positioning as a specialty drug allows for premium pricing but limits broad adoption due to cost considerations and formulary restrictions.

Competitive Landscape

Generic Market Challenges

Levetiracetam is available as a generic since 2017, exerting significant pressure on branded formulations. Generics typically retail at approximately 20-30% lower prices, impacting Spritam’s revenue streams and market share. The patent landscape, including patent extensions and litigation, influences exclusivity duration.

Innovative Formulations and Alternatives

Other delivery platforms, such as liquid suspensions and nanotechnology-based formulations, pose competitive threats. Additionally, newer AEDs with improved profiles, like brivaracetam and cannabidiol-based medications, diversify therapeutic options, affecting Spritam's growth potential.

Pricing Dynamics

Current Pricing Structure

Spritam’s wholesale acquisition cost (WAC) for a 1000 mg tablet approximates USD 18–20 per dose. The FDA-approved dosing regimens lead to treatment costs of USD 1,800–2,000 annually per patient, considerably higher than generic levetiracetam (~USD 850–1,000/year) [2].

Factors Influencing Pricing

- Manufacturing Complexity: The lyophilisation process incurs higher production costs, supporting premium pricing.

- Market Positioning: As a specialty formulation, Spritam’s pricing reflects its niche status and benefits in adherence and onset of action.

- Reimbursement Policies: Insurance coverage, formulary placement, and prior authorization influence actual patient out-of-pocket costs and market uptake.

Price Projections (2023–2030)

Based on current trends, market dynamics, and competitive pressures, Spritam’s price trajectory is projected as follows:

-

Short-term (2023–2025):

Prices are expected to stabilize with minor fluctuations (~+1-2%), driven by inflation, increased manufacturing efficiencies, and payer negotiations. The entry of generic levetiracetam at lower prices may exert downward pressure, compelling UCB to maintain premium through patient support programs and clinical differentiation. -

Medium-term (2026–2028):

Pricing may decline modestly (~5-8%) under intensified generic competition unless differentiated by socio-economic value or expanded indications. Strategic collaborations, such as dose flexibility or new indications, could sustain premium pricing. -

Long-term (2029–2030):

By this stage, generics are likely predominant, reducing Spritam’s market share. If UCB launches next-generation formulations or expands indications (e.g., for other neurological disorders), premium pricing could be preserved for niche applications, potentially stabilizing near current levels.

Financial Outlook

With an estimated market share of approximately 10–15% among levetiracetam prescriptions in the epilepsy segment—accounting for its niche appeal—projected revenues could range from USD 150–300 million annually by 2030 under optimistic adoption scenarios. Price erosion and market share shifts are expected to influence these figures substantially.

Regulatory and Market Access Factors

- Patent and Exclusivity: UCB’s key patents on Spritam are expected to expire between 2024 and 2026, enabling generics to enter the market and accelerate price declines.

- Reimbursement Environment: Payer pressures and formulary preferences favor generics, necessitating strategic brand differentiation for Spritam’s sustained profitability.

- Pipeline and Expanding Indications: Development of new formulations or labels can mitigate competition effects and maintain premium pricing.

Strategic Recommendations

- Focus on Niche Markets: Target pediatric and geriatric populations with swallowing difficulties to maintain premium segment.

- Enhance Value Proposition: Emphasize rapid disintegration, adherence, and quality of life improvements in marketing to justify price premiums.

- Pipeline Expansion: Invest in research for extended indications, combination therapies, or advanced delivery mechanisms to preserve market relevance.

Conclusion

Spritam’s market outlook is characterized by steady but modest growth in a competitive landscape heavily influenced by generics. While current premium pricing is supported by its differentiated formulation, future price stability will depend on patent protection, clinical advantages, and strategic positioning. As the epilepsy treatment paradigm evolves, Spritam's ability to capture niche markets and innovate will determine its long-term market value.

Key Takeaways

- Spritam's unique formulation grants it a niche within the epilepsy market, supporting premium pricing, but its dominance is challenged by the entry of generics.

- Price projections forecast slight declines over the next decade due to competition, with stabilization possible if the product maintains clinical differentiation or secures new indications.

- Market expansion hinges on targeting high-need populations, emphasizing adherence benefits, and innovating within formulation or therapeutic scope.

- Patent expirations from 2024–2026 will significantly influence market share and pricing, emphasizing the importance of patent strategies and pipeline development.

- Future success requires balancing regulatory, reimbursement, and competitive pressures through strategic initiatives and continued innovation.

FAQs

Q1: How does Spritam compare to other levetiracetam formulations in efficacy and safety?

A1: Clinical evidence indicates that Spritam’s efficacy is equivalent to other levetiracetam formulations, with similar safety profiles. Its main advantage lies in rapid disintegration, improving adherence in specific populations.

Q2: What is the typical price difference between Spritam and generic levetiracetam?

A2: Spritam's annual treatment cost is approximately USD 1,800–2,000, while generic levetiracetam costs around USD 850–1,000, reflecting a 50% to 60% premium owing to formulation and brand positioning.

Q3: How will patent expirations impact Spritam's market share?

A3: Patent expirations, expected between 2024 and 2026, will enable generics to enter the market, exerting downward pressure on prices and reducing Spritam's market share unless countered by clinical or formulation advantages.

Q4: Are there upcoming pipeline developments for Spritam?

A4: As of now, no major pipeline expansions for Spritam have been publicly announced. Future developments may involve new indications, formulations, or combination therapies to sustain market relevance.

Q5: What strategies can UCB employ to maintain Spritam’s profitability amid increasing generic competition?

A5: Strategies include expanding indications, enhancing clinical differentiation, strengthening payer relationships, providing patient support services, and investing in next-generation formulations or delivery systems.

References

[1] MarketResearchFuture, "AED Market Analysis," 2022.

[2] SSR Health, "Levetiracetam Pricing Data," 2023.

More… ↓