Share This Page

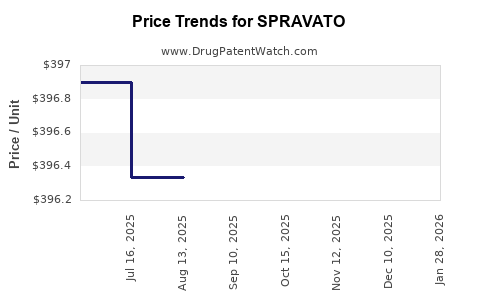

Drug Price Trends for SPRAVATO

✉ Email this page to a colleague

Average Pharmacy Cost for SPRAVATO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SPRAVATO 56 MG DOSE PACK | 50458-0028-02 | 397.29636 | EACH | 2025-12-17 |

| SPRAVATO 84 MG DOSE PACK | 50458-0028-03 | 397.81440 | EACH | 2025-12-17 |

| SPRAVATO 56 MG DOSE PACK | 50458-0028-02 | 397.06800 | EACH | 2025-11-19 |

| SPRAVATO 84 MG DOSE PACK | 50458-0028-03 | 397.73111 | EACH | 2025-11-19 |

| SPRAVATO 84 MG DOSE PACK | 50458-0028-03 | 399.10125 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SPRAVATO (Esketamine)

Introduction

SPRAVATO (esketamine) represents a pioneering treatment in the landscape of psychiatric therapeutics, particularly for treatment-resistant depression (TRD) and major depressive disorder (MDD). Approved by the U.S. Food and Drug Administration (FDA) in 2019, SPRAVATO has carved a niche as a nasal spray offering rapid symptom relief for a heavily underserved patient population. This analysis explores the current market dynamics, growth drivers, competitive landscape, pricing strategies, and future price projections for SPRAVATO.

Market Overview

Therapeutic Context and Patient Demographics

Depression remains a leading cause of disability globally, with an estimated 280 million individuals affected worldwide [1]. Approximately 30-40% of patients with depression are classified as treatment-resistant, underscoring the need for innovative therapeutics like SPRAVATO. The drug is predominantly indicated for adults with TRD, particularly those who have not responded to two or more antidepressant treatments.

Market Size and Forecast

The global antidepressant market was valued at approximately USD 16 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of around 4-6% through 2030 [2]. Within this landscape, esketamine’s segment, driven by the initial approval and subsequent adoption, is poised for significant expansion. The U.S. market remains the largest, owing to high prevalence, established clinical protocols, and reimbursement infrastructure.

Current Market Dynamics

Competitive Landscape

- Esketamine (SPRAVATO) is currently the only FDA-approved nasal spray specifically for TRD. It is marketed by Johnson & Johnson through its Janssen division.

- S-ketamine (Spravato’s enantiomer) signifies a shift toward rapid-acting antidepressants, with notable competition from experimental compounds in phase 3 trials (e.g., rapastinel, brexanolone).

- Off-label uses: Some clinicians explore esketamine for other indications such as bipolar depression and suicidal ideation.

Regulatory and Reimbursement Environment

The approval of SPRAVATO has been met with cautious optimism, tempered by cost concerns. Reimbursement via Medicare and private insurers remains critical, given the drug’s high price point. The treatment setting necessitates supervision at certified clinics, adding logistical and financial considerations to adoption.

Market Penetration

Adoption of SPRAVATO has been gradual, influenced by factors such as:

- Physician familiarity: As awareness increases, prescriber numbers are projected to rise.

- Guideline updates: Inclusion in clinical practice guidelines enhances legitimacy.

- Patient acceptance: Nasal administration and rapid efficacy are attractive.

However, barriers such as high costs, logistical challenges, and safety monitoring requirements limit broader distribution.

Pricing Strategies and Trends

Current Pricing

As of 2023, the list price for SPRAVATO in the U.S. is approximately USD 590 per nasal spray [3]. Treatment regimens typically involve administering two sprays twice weekly initially, decreasing frequency over time, which can lead to total costs exceeding USD 12,000 annually per patient.

Reimbursement Policies

Insurance coverage varies, with private insurers often covering most costs when administered at certified clinics. Medicaid and Medicare coverage are more complex, requiring prior authorization and demonstrating medical necessity.

Market Penetration Impact

High pricing has sparked debates around cost-effectiveness, especially amidst scrutinous healthcare payers. This influences physicians' prescribing behavior and affects patient access, particularly in publicly funded or underinsured populations.

Price Projections and Future Trends

Short-term Outlook (Next 1-3 Years)

- The current price levels are expected to remain stable, with minor adjustments reflecting inflation and manufacturing costs.

- Pricing could see a slight decrease upon broader adoption or if competition from generics or biosimilars emerges.

- Efforts to reduce total treatment costs may include dose optimization, bundle therapies, or insurance negotiations.

Mid- to Long-term Outlook (4-10 Years)

- Market expansion: As awareness grows, particularly outside the U.S., price levels may be influenced by competitive dynamics and health technology assessments (HTAs).

- Patent status and generics: Esketamine’s patent protection extends into the 2030s, delaying generic entry. Nonetheless, patents covering specific formulations or delivery mechanisms could be challenged or altered.

- Pricing pressures: The increasing emphasis on value-based healthcare may incentivize price reductions, especially as more affordable alternatives or biosimilars approach market entry.

- Reimbursement reforms: Public payers’ reimbursement policies might tighten, impacting net price and accessibility.

Potential Price Adjustment Scenarios

| Scenario | Likelihood | Details |

|---|---|---|

| Stable pricing | High | Continued market niche with limited generic threat; manufacturer maintains prices |

| Moderate decrease | Moderate | Competitive pressures, negotiations, and volume increases lead to price reductions |

| Significant price drop | Low | Entry of generics, biosimilars, or disruptive therapies could substantially lower prices |

Market Growth Drivers and Barriers

Drivers

- Rising prevalence of TRD and unmet patient needs

- Demonstrated rapid efficacy of esketamine

- Development of adjunctive or alternative delivery systems

- Broadening clinical indications including suicidal ideation and bipolar depression

- Increasing acceptance and inclusion in treatment guidelines

Barriers

- High treatment costs limiting access

- Administrative and logistic challenges in supervised administration

- Safety concerns including dissociation and transient hypertension

- Reimbursement uncertainties

- Competition from emerging rapid-acting antidepressants and neuromodulation therapies

Conclusion

The valuation and pricing trajectory of SPRAVATO hinge on multiple factors: clinical efficacy, market acceptance, regulatory landscape, reimbursement policies, and competitive dynamics. While the current price reflects its innovation status and clinical benefits, cost pressures and healthcare reforms might influence future adjustments. The drug’s market is poised for growth due to the persistent unmet need in TRD, although front-line adoption may remain incremental due to economic and logistical hurdles.

Key Takeaways

- Market Growth: SPRAVATO is positioned within a growing TRD segment, with global expansion potential, especially in developed markets.

- Pricing Stability: Near-term prices are likely to remain consistent, with potential moderate declines driven by increased competition and policy reforms.

- Cost-Effectiveness Challenges: High costs limit broader access, emphasizing the need for value-based pricing models.

- Reimbursement and Adoption: Insurance coverage and supervised administration requirements are critical determinants of market penetration.

- Future Outlook: Patent protections and potential biosimilar developments will influence pricing strategies over the next decade.

FAQs

1. What is the current market price of SPRAVATO?

The list price for SPRAVATO in the U.S. is approximately USD 590 per spray, translating into annual treatment costs exceeding USD 12,000 per patient.

2. How does SPRAVATO compare to traditional antidepressants in terms of cost?

SPRAVATO’s costs are significantly higher due to specialized administration and monitoring. It represents a premium treatment option for refractory cases, with perceived value rooted in rapid symptom relief.

3. Are there plans to reduce SPRAVATO prices?

While the manufacturer has not announced significant price reductions, future adjustments may occur due to increased competition, policy pressures, or biosimilar entry.

4. What is influencing the adoption rate of SPRAVATO?

Factors include clinical guideline endorsements, insurance reimbursement policies, logistical requirements, safety monitoring, and clinician familiarity.

5. Could biosimilars or generics impact SPRAVATO’s pricing?

Potentially, though patent protections extend into the 2030s, delaying generic entry, unless patent challenges succeed or formulations are modified.

References

[1] World Health Organization. Depression Fact Sheet. 2022.

[2] Grand View Research. Antidepressant Market Analysis, 2021.

[3] Johnson & Johnson. SPRAVATO Pricing and Reimbursement Information, 2023.

More… ↓