Last updated: July 27, 2025

Introduction

SPIRIVA, the brand name for tiotropium bromide, remains one of the most prescribed long-acting bronchodilators for chronic obstructive pulmonary disease (COPD) and asthma management. Originally developed by Boehringer Ingelheim, SPIRIVA has established itself as a significant fixture within the respiratory therapeutics market. This analysis evaluates current market dynamics, competitive landscape, regulatory influences, and price projections, providing strategic insights for stakeholders.

Therapeutic and Market Overview

Indications and Clinical Usage

TIOTROPIUM BROMIDE, marketed as SPIRIVA, primarily treats COPD, including emphysema and chronic bronchitis, and is also approved for maintenance therapy in asthma patients. Its mechanism involves M3 muscarinic receptor antagonism, resulting in prolonged bronchodilation. The drug's favorable safety profile and once-daily dosing enhance patient adherence.

Market Size and Trends

The global COPD therapeutics market was valued at approximately $17 billion in 2022 and is projected to grow at a CAGR of 4.3% through 2030 [1]. SPIRIVA holds a formidable market share, estimated at around $2.3 billion annually pre-pandemic. The increase in COPD prevalence, aging populations, and heightened awareness contribute to sustained demand.

Competitive Landscape

Key Competitors

- GSK's UMEC/VI (Ultibro Breezhaler)

- Novartis's Ultibro (glycopyrronium and indacaterol)

- AstraZeneca's Symbicort and Tudorza Pressair

- Generic tiotropium formulations (approved in many markets)

Biologic and inhalation device innovations impact market dynamics, with competition increasingly shifting towards combination therapies and convenience.

Patent and Exclusivity Status

Boehringer Ingelheim's patent protections for SPIRIVA expired in many jurisdictions by 2018-2020, allowing generics to enter markets, thus exerting downward pressure on pricing. However, in some regions, patent protection persists due to secondary patents and formulation exclusivity, sustaining premium pricing.

Regulatory Environment and Market Impacts

Patent Expiry and Generic Entry

Post-expiry, generic versions of tiotropium have entered several markets, intensifying price competition. The U.S. FDA approved multiple biosimilars and generics, which have gradually eroded SPIRIVA’s market share in price-sensitive segments. However, brand loyalty, device familiarity, and perceived efficacy sustain SPIRIVA’s premium position.

Reimbursement Policies and Pricing Controls

Healthcare systems such as Medicare and the European National Health Services regulate drug prices via negotiations and formulary inclusion. These policies influence retail pricing and profit margins, particularly in government-funded markets.

Pricing Analysis

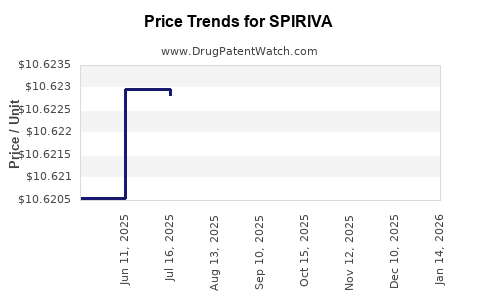

Current Pricing Trends

In the U.S., the list price of SPIRIVA inhalers ranges from $280 to $350 per inhaler pack (30-day supply). Insurance co-payments and pharmacy benefit managers (PBMs) substantially reduce out-of-pocket costs, but the wholesale acquisition cost (WAC) remains significant.

Impact of Generics and Biosimilars

Governments and payers have aggressively promoted generic substitution, resulting in prices dropping by 50-70% in some markets post-generic approval. Notably, in European markets, price reductions have been even more pronounced due to strict negotiations and reference pricing systems.

Future Price Projections

Looking ahead, several factors could influence SPIRIVA pricing:

- Generic Competition: As patents fully expire, generic tiotropium is expected to capture up to 80% market share, reducing average selling prices substantially.

- Manufacturing and Distribution Efficiency: Advances in inhaler device manufacturing could enable cost reductions, influencing pricing strategies.

- Reimbursement Reforms: International healthcare policies may further tighten drug price controls, putting continued downward pressure on prices.

Based on current trends, retail prices for branded SPIRIVA are projected to decline by 20-40% over the next 3-5 years in developed markets, primarily driven by generic competition and policy measures. Conversely, in markets where patents are maintained or where brand loyalty is strong, prices might stabilize with minimal reductions.

Market Opportunities and Challenges

Opportunities

- Expansion into Emerging Markets: Growing COPD prevalence and rising healthcare infrastructure in Asia-Pacific and Latin America represent significant growth avenues.

- Combination Therapies: Co-formulating tiotropium with other bronchodilators may command premium pricing and market share.

- Digital Health Integration: Incorporation of digital inhalers tracking adherence could differentiate products and justify premium pricing.

Challenges

- Pricing Erosion: Expiring patents pose the most immediate threat, potentially reducing revenues substantially.

- Generic Market Penetration: Increased availability of generics risks commoditizing the product.

- Regulatory Pressures: Legislative reforms targeting drug pricing could further diminish margins.

Price Projection Summary

| Market Region |

Current Price Range |

2025 Projection (Approximate) |

Key Influencing Factors |

| United States |

$280 - $350 |

$180 - $245 |

Patent expiration, generics, negotiated discounts |

| European Union |

€250 - €330 |

€150 - €210 |

Price regulation, biosimilar entry |

| Asia-Pacific |

$150 - $250 |

$120 - $200 |

Market expansion, local manufacturing, price sensitivity |

Strategic Implications

For pharmaceutical companies and healthcare policymakers, navigating the post-patent landscape demands balancing profitability with accessibility. Formulation innovation, effective branding, patient engagement, and strategic partnerships will be critical to sustain market relevance and profitability.

Key Takeaways

- The expiration of SPIRIVA’s patents is leading to significant price erosion, especially in mature markets.

- Generic tiotropium options are expected to capture predominant market share within the next 3-5 years, reducing average prices substantially.

- Despite imminent price pressures, opportunities exist in emerging markets, combination therapies, and digital health integrations.

- Policy interventions and regulation will continue to influence pricing strategies, necessitating agile commercial approaches.

- Stakeholders must diversify portfolios and innovate to maintain margins in a highly commoditized environment.

FAQs

1. How will generic competition impact SPIRIVA’s market share?

Generic tiotropium is expected to rapidly capture market share post-patent expiry, leading to substantial reductions in brand sales unless differentiation strategies are employed.

2. Are there biosimilar versions of SPIRIVA available?

While biosimilars are more common for biologics, generic inhaler formulations of tiotropium are increasingly available, especially in North America and Europe.

3. What factors influence the future pricing of inhaled COPD therapies?

Patent status, manufacturing costs, reimbursement policies, competition, and device innovation significantly impact pricing trajectories.

4. How do reimbursement policies affect SPIRIVA pricing?

Government negotiations and formulary placements influence the final patient cost and manufacturer's pricing strategies, often leading to discounts and rebates.

5. What strategies can pharma companies adopt to maintain profitability?

Investing in formulation innovation, expanding into emerging markets, developing combination therapies, and leveraging digital health solutions are key strategies.

References

- MarketsandMarkets. "COPD Therapeutics Market by Product, Route of Administration, and Region – Global Forecast to 2030." 2022.