Last updated: July 28, 2025

Introduction

Sotalol is a non-selective beta-adrenergic blocker with class III antiarrhythmic properties, primarily used to treat ventricular arrhythmias and prevent recurrent atrial fibrillation/flutter. It is marketed under various brand names, with generic versions increasingly dominating the landscape. Given its established clinical role and expanding indications, understanding the market dynamics and price evolution is crucial for pharmaceutical stakeholders, investors, and healthcare providers.

Current Market Landscape

Global Market Overview

The global sotalol market is characterized by a moderate but steady growth trajectory. As of 2023, the market size is estimated to be approximately USD 150 million, with projections indicating a compound annual growth rate (CAGR) of around 4–6% over the next five years. The growth is driven mainly by increased cardiovascular disease prevalence, aging populations, and growing acceptance of generic formulations.

Key Market Players

Major pharmaceutical companies involved in sotalol manufacturing include:

- Teva Pharmaceuticals: A dominant player offering a range of generic antiarrhythmic drugs.

- Mylan (now part of Viatris): Supplies extensive generic cardiovascular medications, including sotalol.

- Dr. Reddy's Laboratories: Focuses on cost-competitive generics for emerging markets.

- Lupin Ltd: Active in Asia and South America with generic formulations.

- Other Regional Manufacturers: Emerging players in Latin America, Eastern Europe, and Asia contribute to regional market variability.

Regulatory and Patent Environment

Sotalol's patent protections have largely expired, enabling generic manufacturers to capture market share. Regulatory pathways in regions like the U.S. (FDA approval) and Europe (EMA approval) have facilitated widespread availability. However, some markets still face regulatory hurdles concerning quality standards or approval processes, influencing market penetration.

Market Drivers and Barriers

Drivers:

- Rising Cardiovascular Disease Burden: Increased prevalence of arrhythmias globally necessitates effective antiarrhythmic therapies.

- Cost-Effective Treatment Options: Generics provide affordable alternatives, expanding access, especially in emerging markets.

- Expanding Indications: Research into off-label uses and broader antiarrhythmic applications may boost demand.

- Enhanced Clinical Guidelines: Incorporation of sotalol as a first-line or second-line agent in arrhythmia management protocols.

Barriers:

- Limited Clinical Use in Certain Populations: Concerns about proarrhythmic risks restrict usage in high-risk patients.

- Availability of Newer Agents: Introduction of alternative antiarrhythmics with improved safety profiles could impact market share.

- Regulatory Variability: Delays or restrictions in approval can limit regional access.

- Pricing Pressures: The prominence of generics fosters intense price competition, impacting profit margins.

Pricing Trends and Projections

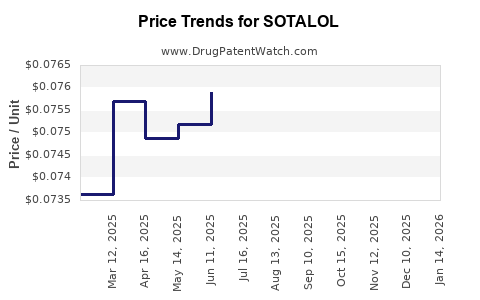

Historical Price Trends

Historically, sotalol pricing has experienced significant declines post-patent expiration. In the U.S., the average retail price per 100 mg tablet decreased from approximately USD 0.30 in 2010 to below USD 0.10 by 2022, reflecting generic market proliferation. Similar downward trends are noted globally, with price adjustments correlating to manufacturing costs, regulatory environments, and market competition.

Pricing Factors Influencing Future Trajectory

- Manufacturing Costs: Advances in synthesis and economies of scale are expected to further reduce production costs.

- Regulatory Approvals and Market Entry: Faster approvals for generics and biosimilars may intensify price competition.

- Market Penetration in Emerging Markets: Price sensitivity in low- and middle-income countries sustains low price points but limits profit margins.

- Supply Chain Dynamics: Disruptions or shortages could temporarily elevate prices but are unlikely to have sustained impacts.

Projected Price Range (2023–2028)

- Global Average Price per 100 mg Tablet: Expected to stabilize around USD 0.05–0.08, with regional disparities.

- Emerging Markets: Prices may range between USD 0.02–0.04 due to high competition and cost sensitivities.

- Developed Markets: Prices are projected to remain in the USD 0.06–0.10 range, slightly influenced by healthcare regulations and payer negotiations.

Overall, the trend indicates a continued decline or stabilization in sotalol prices, driven by extensive generic competition and technological advancements.

Future Market Opportunities and Challenges

Opportunities:

- Branded Generics and Biosimilars: Developing value-added versions could improve margins.

- Expanded Indications: Investigating additional arrhythmia subtypes or combination therapies.

- Digital Health Integration: Remote monitoring and adherence tools may enhance patient outcomes, expanding therapy use.

Challenges:

- Safety Concerns and Clinical Guidelines: Evolving evidence-based recommendations could restrict usage.

- Drug Shortages: Manufacturing issues may disrupt supply, impacting pricing and availability.

- Regulatory Changes: Stricter approval pathways might slow market expansion or increase compliance costs.

Key Takeaways

- The global sotalol market is primarily driven by generic formulations, with steady growth anticipated over the next five years.

- Price decline remains a dominant trend due to patent expirations, manufacturing efficiencies, and intense competition.

- Emerging markets offer significant growth potential driven by cost-sensitive healthcare systems, though margins are thin.

- Regulatory landscapes, safety profiles, and clinical use patterns critically influence both market share and pricing.

- Stakeholders should monitor clinical guideline updates, regulatory developments, and advancements in formulary preferences to optimize market positioning.

FAQs

1. What factors influence sotalol's market growth in emerging economies?

Market growth in emerging economies hinges on increasing cardiovascular disease prevalence, affordability of generics, expanding healthcare infrastructure, and regulatory approvals permitting wider access.

2. How will pricing evolve with new formulations or delivery methods?

Innovations such as extended-release formulations or combination therapies could command higher prices initially, but widespread adoption is dependent on clinical benefit demonstration and regulatory approval.

3. Are there any upcoming patent protections or exclusivities for sotalol?

Sotalol's patent protections have generally expired, with no significant exclusivities granted post-2010, favoring generic competition.

4. How does clinical safety data impact sotalol’s market and pricing?

Concerns about proarrhythmic risks and safety profiles influence prescribing patterns, formulary decisions, and reimbursement, indirectly affecting market demand and prices.

5. What role does healthcare policy play in shaping the sotalol market?

Policy decisions promoting generic drug use, drug reimbursement strategies, and clinical guidelines directly impact market access, utilization rates, and price structures.

References

- Market Research Future. "Global Antiarrhythmic Drugs Market Analysis." 2022.

- EvaluatePharma. "Prescription Drug Price Trends." 2023.

- FDA. "Generic Drug Approvals and Market Data." 2023.

- World Health Organization. "Global Burden of Cardiovascular Diseases." 2021.

- Industry Reports. "Post-Patent Revenue and Competitive Dynamics for Cardio Medications." 2022.

In conclusion, the sotalol market's future is characterized by sustained growth via generics, stabilized prices, and ongoing clinical evaluation. Stakeholders should strategically navigate regulatory nuances, pricing pressures, and evolving therapeutic landscapes to optimize market positioning and profitability.