Share This Page

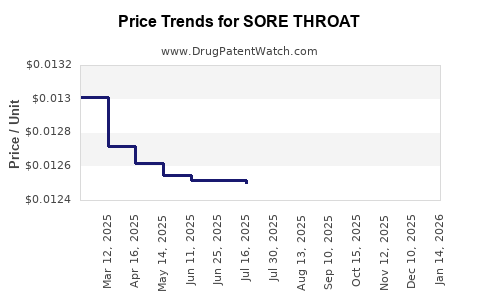

Drug Price Trends for SORE THROAT

✉ Email this page to a colleague

Average Pharmacy Cost for SORE THROAT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SORE THROAT 1.4% SPRAY | 00904-6305-21 | 0.01233 | ML | 2025-12-17 |

| SORE THROAT 1.4% SPRAY | 70000-0458-01 | 0.01233 | ML | 2025-12-17 |

| SORE THROAT 15-3.6 MG LOZENGE | 00904-6255-49 | 0.14610 | EACH | 2025-12-17 |

| SORE THROAT 1.4% SPRAY | 00904-6305-21 | 0.01248 | ML | 2025-11-19 |

| SORE THROAT 15-3.6 MG LOZENGE | 00904-6255-49 | 0.14701 | EACH | 2025-11-19 |

| SORE THROAT 1.4% SPRAY | 70000-0458-01 | 0.01248 | ML | 2025-11-19 |

| SORE THROAT 15-3.6 MG LOZENGE | 00904-6255-49 | 0.15197 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: Sore Throat Treatment

Introduction

Sore throat remedies, a critical segment within the over-the-counter (OTC) and prescription pharmaceutical markets, address common yet disruptive health concerns. The global market for sore throat treatments encompasses a broad range of products, including analgesics, antiseptics, lozenges, sprays, and prescribed antibiotics for bacterial infections. Understanding current market dynamics, competitive landscape, and future price trajectories is essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

Global Market Size and Growth Drivers

The sore throat treatment market is characterized by steady growth, driven by factors such as rising prevalence of respiratory illnesses, increased health awareness, aging populations, and expanding access to OTC medicines. Based on recent estimates, the global OTC cold and sore throat remedy market was valued at approximately USD 8 billion in 2021, with projections to reach USD 11 billion by 2027, exhibiting a compound annual growth rate (CAGR) of around 5-7% [1].

In the United States, sore throat treatments constitute a significant subcategory of the larger cold and cough remedy segment. The increasing burden of viral and bacterial throat infections, coupled with heightened health literacy, sustains demand. Moreover, the COVID-19 pandemic has amplified awareness around respiratory health, indirectly benefitting sore throat medication sales.

Segmentation

- OTC Products: Lozenges, sprays, gargles, and syrups dominate, with top-selling brands like Cepacol, Chloraseptic, and Halls.

- Prescription Medications: Antibiotics for bacterial pharyngitis, including penicillin and azithromycin, represent a smaller, yet crucial, segment.

- Innovative Formulations: Recent advancements include organic and natural remedies, targeting consumer preference for holistic health options.

Key Market Players and Competitive Landscape

Leading pharmaceutical companies such as Johnson & Johnson, GlaxoSmithKline, and Reckitt Benckiser hold substantial market shares. They invest heavily in product innovation, marketing strategies, and distribution channels to sustain competitive advantage. Emerging brands leverage natural, organic ingredients targeting health-conscious consumers.

The competitive landscape is also influenced by patent expirations, regulatory pathways, and the emergence of generic equivalents, which exert downward pressure on pricing. Additionally, private label products from supermarket chains increasingly offer lower-cost alternatives, intensifying price competition.

Regulatory Environment and Impact

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) regulate both OTC and prescription sore throat medications. Stringent guidelines influence product formulation, labeling, and approval pathways, affecting time-to-market and cost structures.

Post-pandemic, regulatory agencies have accelerated approval processes for certain OTC therapeutics, influencing market supply dynamics and pricing strategies.

Price Dynamics and Factors Influencing Pricing

Historical Price Trends

OTC sore throat products, particularly lozenges and sprays, have shown relative price stability but with modest annual increases aligned with inflation. The average retail price for a pack of sore throat lozenges ranges from USD 3 to USD 7, depending on brand and formulation. Prescription antibiotics for bacterial infections generally have higher costs, influenced by patent status and insurance reimbursements.

Price Influencers

- Production Costs: Raw material prices, especially active pharmaceutical ingredients (APIs), directly impact product pricing.

- Regulatory Costs: Compliance expenses influence final pricing structures.

- Market Competition: Brand differentiation and generic entry drive prices downward.

- Consumer Demand: Preference shifts towards natural remedies or premium products support premium pricing.

- Distribution Channels: Retail, pharmacy, online sales, and direct-to-consumer models affect pricing margins.

- Insurance and Reimbursement Policies: Insurance coverage lowers out-of-pocket expenses, impacting retail prices and profitability.

Price Projection Scenarios (2023-2030)

Given current market conditions, technological innovation, and regulatory environments, several projection scenarios materialize:

Moderate Growth Scenario

- Continued demand growth sustains stable prices with minimal inflation.

- OTC products' average price increases at 2-3% annually.

- Entry of generics maintains competitive pricing, with slight downward pressure.

- Premium natural and organic products maintain higher price points, counterbalancing reductions elsewhere.

Forecast: By 2030, retail prices for standard OTC sore throat lozenges are projected to reach USD 4.50–USD 8.50 per pack, reflecting a 20-30% cumulative increase from current levels.

Aggressive Innovation and Premiumization Scenario

- Novel delivery mechanisms (e.g., sustained-release lozenges, organic formulations) command higher prices.

- Consumer shift towards health-conscious, organic options enhances premium product viability.

- Regulatory simplification supports faster introduction of innovative products, further pushing prices upward.

Forecast: Premium formulations could see price points of USD 10–USD 15 per pack by 2030.

Downward Pressure and Market Saturation Scenario

- Market saturation and aggressive price competition from generics reduce prices.

- Innovation plateaus, and consumer price sensitivity increases.

- Regulatory constraints tighten, raising compliance costs, partially offsetting reductions.

Forecast: Average prices could plateau around USD 3.50–USD 5.50 per pack, with minimal growth or slight decline.

Regional Market Variations

- North America: Dominant market with higher per capita spending, estimated to account for >40% of global sales. Prices are relatively stable but influenced by patent expirations and health insurance policies.

- Europe: Similar trends but with higher regulation and emphasis on natural remedies; prices tend to be slightly higher due to quality standards.

- Asia-Pacific: Rapid growth driven by increasing urbanization and healthcare access, with lower price points due to market competition and local manufacturing.

Implications for Stakeholders

- Pharmaceutical Companies: Innovation and branding in natural, organic, or sustained-release formulations can justify premium pricing.

- Investors: Market stability and growth prospects favor brands with strong R&D pipelines, especially in natural remedies.

- Healthcare Providers: Educating patients on effective, evidence-based treatments can optimize resource utilization.

- Policymakers: Regulation must balance innovation incentives with affordability to ensure broad access.

Key Takeaways

- The global sore throat treatment market is expected to grow steadily, driven by demographic factors and health awareness.

- Price stability prevails in OTC segments, though premium formulations could command higher margins by 2030.

- Generic competition exerts downward pressure; innovation and consumer preferences for natural products offer differentiation.

- Regulatory considerations significantly influence pricing strategies, especially for new formulations.

- Regional variations necessitate tailored strategies, with North America leading in market size and pricing.

FAQs

1. What are the primary factors influencing sore throat remedy prices?

Raw material costs, regulatory expenses, competition, consumer preferences, and distribution channels primarily influence prices.

2. How will patent expirations impact sore throat treatment prices?

Patent expirations typically lead to generic entry, reducing prices and increasing market competition.

3. Are natural and organic sore throat products priced higher than conventional options?

Yes, premium natural and organic formulations often command higher price points due to quality perceptions and production costs.

4. What regional factors could affect future sore throat medication price trends?

Regulatory frameworks, healthcare infrastructure, consumer preferences, and economic conditions drive regional price variations.

5. What innovations could reshape the sore throat treatment market by 2030?

Sustained-release lozenges, organic ingredients, personalized medicine approaches, and digital health integration are potential disruptors.

References

- MarketsandMarkets. "Over-the-Counter (OTC) Cold and Cough Remedy Market," 2022.

More… ↓