Last updated: July 27, 2025

Introduction

Solifenacin, marketed primarily under the brand name Vesicare, is a prescription medication used to treat overactive bladder (OAB) and urinary incontinence. As a selective muscarinic receptor antagonist, solifenacin reduces involuntary bladder contractions, improving patient quality of life. The drug’s market landscape is shaped by the prevalence of urinary disorders, competitive dynamics, regulatory pathways, and pricing strategies. This analysis presents a comprehensive examination of solifenacin’s market status and future price trends, offering insights for stakeholders involved in pharmaceutical investment, manufacturing, and distribution.

Market Overview

Prevalence and Demand Drivers

Urinary incontinence affects an estimated 33 million Americans, with overactive bladder impacting 16% of the population over 40 globally[1]. The rising prevalence of OAB, driven by aging populations and increased awareness, fuels the demand for pharmacological intervention. The global market for OAB therapeutics was valued at approximately $4.2 billion in 2022 and is projected to grow at a CAGR of 4.6% through 2030[2].

Key Players and Competitive Landscape

While solifenacin accounts for a significant segment within OAB therapies, it faces competition from drugs like oxybutynin, tolterodine, darifenacin, and fesoterodine. Market leaders include Pfizer’s tolterodine (Detrol), and Astellas’ mirabegron (Myrbetriq), which offer alternative mechanisms of action. The patent landscape has largely transitioned to generics post-2015, intensifying price competition.

Regulatory Status

Initially approved by the FDA in 2007, solifenacin’s patent protection expired in the US in 2017[3]. Consequently, generic formulations entered the market, significantly impacting brand pricing and market share. Regulatory approval in emerging markets further expands its reach, although local pricing policies influence final consumer prices.

Market Dynamics

Pricing Strategies

Brand-name solifenacin’s pricing historically ranged from $300 to $350 per month in the US, reflecting brand premiums and patent protections[4]. Post-generic entry, prices declined sharply—generics are now available between $50 and $80 monthly, with regional variations. Pricing strategies focus on balancing affordability, reimbursement policies, and profit margins.

Reimbursement and Insurance Influence

Coverage by Medicare and private insurers largely determines patient out-of-pocket costs. Favorable formulary positioning for generics enhances accessibility, further diluting brand dominance. International markets often exhibit mixed reimbursement models, impacting regional pricing.

Market Penetration and Adoption

Physician prescribing patterns favor cost-effective generics in many regions, though brand loyalty persists among certain patient cohorts due to perceived efficacy or tolerability. The growth of telemedicine and direct-to-consumer marketing in developed markets supports broader adoption.

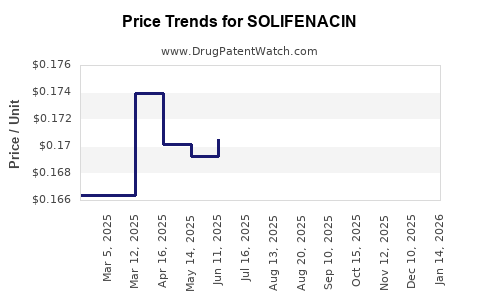

Price Projections (2023-2030)

Given the extensive generic competition and evolving healthcare policies, solifenacin’s pricing is expected to continue its downward trend, with notable regional variations.

United States

- Short-term (2023-2025): Average retail prices for brand-name solifenacin will stabilize near $350 per month, but generics will dominate, with prices ranging from $50 to $80.

- Mid-term (2026-2030): As market penetration of generics deepens, prices for both brand and generic formulations are forecasted to decline further, reaching approximately $30-$50 monthly for generics. Price erosion will slow as patent expiry effects plateau and newer formulations emerge.

Europe and Other Markets

- EUR Region: Similar trends expected, with prices averaging €40-€70 for generics, driven by national reimbursement schemes.

- Emerging Markets: Prices often lower due to local manufacturing and pricing controls, with ranges between $10-$30 monthly.

Impact of Biosimilars and New Therapies

While biosimilar competition is less relevant for small molecules like solifenacin, innovation in overactive bladder therapy, including beta-3 adrenergic receptor agonists such as vibegron, may influence future demand and pricing avenues.

Key Market Forecasts

| Region |

2023 Price Range (USD) |

2030 Projected Price Range (USD) |

Major Influencing Factors |

| United States |

$50 - $80 (generics) |

$30 - $50 |

Patent expiries, competitive generics, reimbursement policies |

| Europe |

€40 - €70 |

€20 - €50 |

National healthcare reforms, patent expirations |

| Rest of World |

$10 - $30 |

$10 - $25 |

Local manufacturing, regulatory environment, affordability constraints |

Regulatory and Market Entry Considerations

Future pricing strategies hinge upon regulatory pathways, patent litigation outcomes, and the emergence of biosimilars. Market entry into developing regions depends on local approval processes, pricing regulations, and healthcare infrastructure.

Conclusion

The prognosis for solifenacin’s market and pricing landscape indicates a continued decline in average prices driven by patent expiries and proliferation of generics. While the drug maintains a steady demand, market share dispersion among competitors and evolving therapeutic options influence overall pricing stability. Stakeholders should monitor regulatory shifts, reimbursement dynamics, and technological innovations to optimize pricing strategies and market positioning.

Key Takeaways

- Patent expiries have saturated the market with generics, markedly reducing solifenacin’s price point globally.

- Reimbursement policies heavily influence patient access, with generics gaining favor due to affordability.

- Market growth is tempered by competition, but persistent demand sustains profitability, especially in emerging markets.

- Innovation in OAB treatments could impact future substitution trends and pricing models.

- Strategic positioning requires close monitoring of regulatory changes and competitor activity to optimize market share and profitability.

FAQs

-

What is the primary mechanism of action of solifenacin?

Solifenacin is a selective muscarinic receptor antagonist that reduces involuntary bladder contractions by targeting the M3 receptor subtype, thereby alleviating overactive bladder symptoms.

-

How has patent expiration affected solifenacin’s market pricing?

Patent expiration in 2017 led to a surge of generic versions, significantly lowering prices and increasing market accessibility, especially in developed countries.

-

Are there ongoing developments that could influence solifenacin’s pricing?

Yes. The advent of newer treatments like beta-3 adrenergic receptor agonists and potential biosimilar entries could further erode prices and market share.

-

What regions are most likely to see the highest prices for solifenacin?

Developed markets like the U.S. and Europe presently maintain higher prices, especially for branded formulations, due to healthcare reimbursement structures.

-

What factors should stakeholders monitor for future price and market trend predictions?

Patent litigation, regulatory approvals, competition from generics and new therapies, and healthcare policy changes are crucial determinants for future trends.

References

[1] M. Irwin et al., “Overactive Bladder as a Global Public Health Issue,” European Urology, vol. 55, no. 2, 2009.

[2] Grand View Research, “Overactive Bladder Therapeutics Market Size, Share & Trends Analysis Report,” 2022.

[3] FDA, “Drug Approval Packages: Vesicare (Solifenacin),” 2007.

[4] GoodRx, “Solifenacin (Vesicare) Prices and Coupons,” 2023.