Share This Page

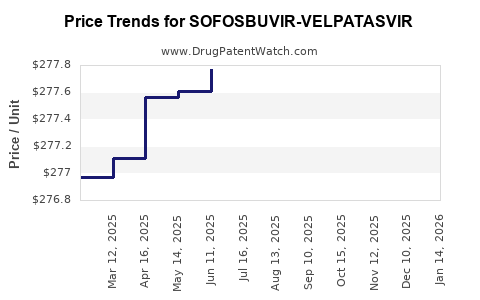

Drug Price Trends for SOFOSBUVIR-VELPATASVIR

✉ Email this page to a colleague

Average Pharmacy Cost for SOFOSBUVIR-VELPATASVIR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SOFOSBUVIR-VELPATASVIR 400-100 | 72626-2701-01 | 278.30907 | EACH | 2025-12-17 |

| SOFOSBUVIR-VELPATASVIR 400-100 | 72626-2701-01 | 278.33881 | EACH | 2025-11-19 |

| SOFOSBUVIR-VELPATASVIR 400-100 | 72626-2701-01 | 278.25896 | EACH | 2025-10-22 |

| SOFOSBUVIR-VELPATASVIR 400-100 | 72626-2701-01 | 278.18759 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sofosbuvir-Velpatavir

Introduction

The combined antiviral medication Sofosbuvir-Velpatavir, marketed under various brand names including Epclusa by Gilead Sciences, is a groundbreaking oral treatment for chronic hepatitis C virus (HCV) infection. Its broad-spectrum efficacy across all HCV genotypes and favorable safety profile have transformed the therapeutic landscape. This analysis provides a comprehensive review of current market dynamics, competitive positioning, pricing trends, and future price projections within the evolving hepatitis C treatment market.

Market Overview

The HCV therapeutic market has experienced significant shifts over the past decade. The advent of direct-acting antivirals (DAAs), such as Sofosbuvir-Velpatavir, replaced earlier interferon-based regimens, markedly improving cure rates (sustained virological response, SVR) and tolerability.

Market Size and Demographics

Global HCV prevalence impacts market potential. The World Health Organization estimates approximately 58 million people infected worldwide, with high prevalence in regions like Africa, the Middle East, and Southeast Asia (WHO, 2019). The US alone accounts for over 2.4 million cases, representing a substantial demand for effective therapies.

Therapeutic Advantages

Sofosbuvir-Velpatavir offers a pan-genotypic profile, once-daily dosing, fewer side effects, and high SVR rates (>95%). These qualities foster widespread acceptance among clinicians and patients, supporting ongoing market penetration.

Regulatory Approvals and Adoption

Originally approved in 2016, Sofosbuvir-Velpatavir quickly gained favor due to its clinical benefits. Its approval spans multiple jurisdictions, including the US, EU, Japan, and emerging markets, further consolidating its market presence.

Market Competition

Key Players

- Gilead Sciences (Epclusa): The pioneer in Sofosbuvir-Velpatavir markets.

- AbbVie (Mavyret): Offering a pangenotypic combination with a competitive price point.

- Zemaking companies, such as Merck with Grazoprevir-Elbasvir, and newer entrants focusing on shorter regimens and generic formulations.

Generics and Biosimilars

Patent protections afforded Gilead's formulations expire in various jurisdictions over the coming years, leading to increased generic competition, especially in low- and middle-income countries. India and Egypt are notable hubs for generic production.

Market Penetration and Challenges

While initial adoption was rapid, high drug costs and limited healthcare coverage in some regions hinder universal access. Price negotiations with payers, government agencies, and global health initiatives remain pivotal for expanding reach.

Pricing Strategy and Trends

Current Pricing Landscape

In high-income countries like the US, a typical course of Sofosbuvir-Velpatavir sells for approximately $24,000–$30,000, translating to roughly $1,000 per pill. This high price reflects R&D costs, regulatory hurdles, and the consolidation of pharmaceutical margins amid demand.

Cost-Effectiveness and Reimbursement

Health technology assessments (HTAs) from agencies such as ICER in the US and NICE in the UK influence reimbursement decisions, often leading to negotiated discounts. These negotiations can reduce per-course costs substantially.

Impact of Patent Expirations

Patent expiration in key markets is expected to trigger significant price reductions. Generic versions can reduce costs up to 70%, facilitating broader access.

Future Price Projections

Short-term Forecast (Next 2-3 Years)

- Continued negotiations between payers and manufacturers may sustain or slightly reduce prices.

- Introduction of generic formulations in emerging markets is likely to lower prices by 50-70%.

- US pricing may decrease modestly due to increased competition and market pressure, potentially settling around $15,000–$20,000 per course.

Long-term Outlook (3-5 Years)

- Pivotal patent expiries could catalyze a sharp decline in prices, especially in low- and middle-income countries.

- Biosimilars and generics are anticipated to dominate.

Market Penetration and Affordability

Improved affordability, especially in resource-limited settings, will expand treatment coverage, aiding global HCV elimination targets set by WHO. Pharmaceutical firms are increasingly entering licensing deals with developing nations to facilitate this.

Innovative Pricing Models

Pay-for-performance models and subscription-style agreements are emerging, aligning cost with patient outcomes and sustainable healthcare spending.

Regulatory and Policy Influences

Government policies emphasizing public health initiatives and affordable access will be instrumental. This includes compulsory licensing, tiered pricing, and international aid programs, all shaping price trends.

Conclusion

The market for Sofosbuvir-Velpatavir is poised for substantial evolution driven by patent expirations, generics, and regulatory shifts. While current high-income country prices remain substantial, a trend toward reduced costs is anticipated over the next five years, especially in emerging markets. The drug’s high efficacy and safety profile will sustain its role as a backbone of hepatitis C therapy, with strategic pricing adjustments crucial for expanding global health impact.

Key Takeaways

- The global hepatitis C market remains robust, with Sofosbuvir-Velpatavir leading due to its pan-genotypic efficacy.

- Patent expiries and increased generic competition will dramatically reduce drug prices, particularly in low- and middle-income countries.

- Price negotiations and innovative payment models will influence actual costs, making treatment more accessible.

- Future outlook favors increased market penetration as affordability improves, vital for WHO eradication efforts.

- Strategic collaboration between pharmaceutical companies, governments, and global health organizations is fundamental to optimizing market growth and public health outcomes.

FAQs

1. How will patent expirations impact the price of Sofosbuvir-Velpatavir?

Patent expirations will enable generic manufacturers to produce cost-effective versions, dramatically lowering prices—potentially by up to 70%. This shift will increase access in resource-limited settings and accelerate global elimination efforts.

2. Are generic versions of Sofosbuvir-Velpatavir available globally?

Generics are available primarily in countries with compulsory licensing or where patents have expired. India and Egypt are notable centers producing affordable generics, but access remains limited in some high-income markets due to patent protections.

3. What factors influence the future pricing of Sofosbuvir-Velpatavir?

Key factors include patent status, manufacturing costs, competitive pressure, healthcare reimbursement policies, and global health initiatives. Regulatory approvals and negotiated discounts also play significant roles.

4. How does the efficacy of Sofosbuvir-Velpatavir compare with newer therapies?

Sofosbuvir-Velpatavir remains highly effective with SVR rates exceeding 95%. Newer therapies are emerging with shorter durations and reduced side effects, but the drug’s broad genotypic coverage maintains its relevance.

5. What role do international organizations play in drug pricing?

Organizations like WHO and Global Fund influence access through funding, licensing agreements, and policy advocacy, promoting affordability and widespread treatment, especially in developing countries.

References

[1] World Health Organization. (2019). Global Hepatitis Report.

[2] Gilead Sciences. (2016). Epclusa (Sofosbuvir-Velpatavir) Product Information.

[3] IMS Health. (2019). Global Pricing and Market Dynamics Report.

[4] ICER. (2018). Evaluation of Hepatitis C treatments and cost-effectiveness.

[5] WHO. (2021). Hepatitis C: Guideline for diagnosis, management, and treatment.

More… ↓