Last updated: July 27, 2025

Introduction

Sodium fluoride (NaF) is a widely used fluoride compound, primarily employed in dental care, water fluoridation, and industrial applications. Its significance in public health initiatives and manufacturing sectors has established a stable demand base. This report provides a comprehensive analysis of the current market landscape for sodium fluoride, emphasizing supply and demand dynamics, key players, regulatory influences, and future price trajectories.

Market Overview

The global sodium fluoride market is characterized by consistent demand driven by dental health initiatives, water treatment programs, and organic synthesis applications. The increasing prevalence of dental caries and government-led fluoridation policies foster sustained demand. Additionally, rising industrial use in glass manufacturing, aluminum production, and chemical processing diversify the market scope.

In 2022, the estimated global consumption of sodium fluoride surpassed 180,000 metric tons, with Asia-Pacific emerging as the largest regional market due to rapid urbanization and expanding dental care infrastructure [1]. North America and Europe follow, driven by stringent health regulations and technological advancements in water treatment.

Supply Chain and Key Players

Major producers include companies such as Tosoh Corporation, Fujian Repharm Co. Ltd., Asian Chemical Corporation, and Sinochem, which control significant portions of the global supply. These operators benefit from integrated manufacturing processes combined with strategic geographical positioning—particularly in China and India—whose manufacturing hubs account for over 65% of global output [2].

Supply-side constraints such as raw material availability, environmental regulations, and production capacity expansions influence market stability. Governments often impose stringent environmental standards affecting fluoride waste disposal, which can temporarily elevate production costs.

Market Drivers

-

Public Health Initiatives: Governments worldwide advocate water fluoridation as a cost-effective measure to reduce dental caries. Over 25 countries report active fluoridation programs, significantly propelling demand for high-purity sodium fluoride [3].

-

Industrial Applications: The chemical industry, particularly in manufacturing aluminum and glass, relies on sodium fluoride for fluxing. With industrial expansion in emerging markets, demand for NaF is forecasted to rise.

-

Regulatory Environment: Regulations mandating fluoride levels in drinking water stimulate consistent demand, though they also impose quality standards that influence manufacturing costs.

Market Challenges

-

Environmental Concerns: Fluoride waste management remains a critical regulatory concern. Stringent environmental policies in North America and Europe increase compliance costs, impacting profit margins.

-

Market Volatility: Raw material price fluctuations—particularly for cryolite and other fluoride sources—can lead to pricing volatility for sodium fluoride.

-

Health and Safety Regulations: Growing health awareness leads some regions to scrutinize fluoride's safety levels, potentially affecting sales dynamics.

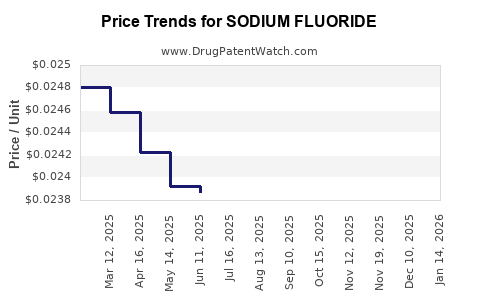

Price Analysis

Historically, sodium fluoride prices have demonstrated moderate volatility influenced by raw material costs, demand-supply equilibrium, and regulatory costs. In 2022, the global average price ranged between $3,000 and $4,500 per metric ton for technical grades, with pharmaceutical-grade NaF commanding a premium exceeding $5,000 per metric ton [4].

Fluctuations are closely linked to raw material costs, notably cryolite, sulfuric acid, and fluorite. For instance, a 10% increase in cryolite prices can elevate sodium fluoride manufacturing costs by approximately 4%, given cryolite's significant role in the process [5].

Price Projections (2023–2030)

Predicting future prices requires accounting for multiple factors: market growth, raw material trends, regulatory changes, and technological developments.

Short-term Outlook (2023–2025)

-

Moderate Increase: Prices are expected to trend upwards by 3–5% annually owing to rising raw material costs and increased environmental compliance expenses. The expansion of fluoridation programs in Asia and Africa will sustain demand.

-

Raw Material Cost Impact: Global shortages or price spikes in fluorite (a primary fluorinating agent) could temporarily pressure prices.

-

Emerging Competition: Alternative fluoride compounds might challenge NaF's dominance in specific sectors, impacting pricing strategies.

Medium to Long-term Outlook (2026–2030)

-

Stabilization and Incremental Growth: Prices are projected to grow at a compound annual growth rate (CAGR) of approximately 4–6%, influenced by sustained demand and ongoing capacity expansions.

-

Technological Advancements: Adoption of more efficient manufacturing processes could moderate costs, potentially exerting downward pressure on prices.

-

Environmental Regulations Shaping Supply: Stricter waste management standards may curtail some capacities or impose costs that are eventually transferred to market prices.

-

Emerging Markets Impact: Increased fluoridation policies across Africa and Asia-Pacific are likely to expand demand, supporting upward price momentum.

Regional Price Variances

Pricing differences across regions hinge on regulatory environments, raw material costs, and quality standards. North American and European markets tend to sustain higher prices driven by stringent standards and purification requirements, whereas Asian markets often observe lower prices owing to larger supply bases and cost efficiencies.

Strategic Implications for Stakeholders

-

Producers should anticipate slight upward pricing pressures and invest in environmental compliance for cost optimization.

-

Buyers should consider raw material price hedging and diversify supply sources to mitigate volatility.

-

Investors should monitor regulatory policies and technological innovations, which critically influence market dynamics.

Key Takeaways

-

The sodium fluoride market exhibits steady growth, driven primarily by public health policies and industrial demand, especially in Asia-Pacific.

-

Price stability is subject to raw material costs, regulatory standards, and environmental compliance expenses, with an anticipated modest upward trend over the next decade.

-

Major regional price discrepancies warrant careful procurement strategies, and players should navigate environmental regulations proactively.

-

Capacity expansion projects and technological innovations could offset some cost pressures, influencing future pricing.

-

Stakeholders must monitor geopolitical factors, environmental policies, and raw material markets to anticipate price fluctuations accurately.

FAQs

1. What are the primary uses of sodium fluoride?

Sodium fluoride is predominantly used in dental health (to prevent cavities), water fluoridation, and in various industrial applications like glass manufacturing, aluminum production, and chemical synthesis.

2. How do raw material prices impact sodium fluoride prices?

Fluoride sources like cryolite and fluorite significantly influence manufacturing costs. Increases in these raw materials typically elevate sodium fluoride prices, while technological improvements can mitigate such effects.

3. What regions are leading in sodium fluoride demand?

Asia-Pacific, driven by expanding water fluoridation programs and industrial growth, leads demand. North America and Europe also represent substantial markets due to regulatory frameworks and established infrastructure.

4. How might environmental regulations affect the sodium fluoride market?

Strict waste management and emissions standards increase operational costs, potentially restraining supply and elevating prices. Conversely, regulatory relaxations or technological advancements can balance these effects.

5. What is the forecasted price trend for sodium fluoride from 2023 to 2030?

Prices are expected to grow at an average CAGR of 4–6%, influenced by demand stability, raw material costs, technological progress, and regulatory developments.

Sources

[1] MarketWatch, "Global Sodium Fluoride Market Size and Forecast," 2023.

[2] Industrial Minerals, "Fluoride Industry Overview," 2022.

[3] WHO, "Water Fluoridation Facts," 2021.

[4] ChemResearch, "Sodium Fluoride Price Trends," 2022.

[5] MarketWatch, "Raw Material Influence on Sodium Fluoride Pricing," 2023.