Last updated: July 27, 2025

Introduction

Sodium chloride (NaCl), commonly known as salt, is a fundamental inorganic compound with diverse applications spanning pharmaceutical, industrial, food, and agricultural sectors. While ubiquitous as table salt, pharmaceutical-grade sodium chloride and specialized industrial variants command significant market interest due to their critical functions. This analysis examines the current market landscape, key factors influencing supply and demand, competitive dynamics, regulatory influences, and future price trajectories.

Market Overview

Global Market Size

The global sodium chloride market was valued at approximately USD 25 billion in 2022, with an anticipated compound annual growth rate (CAGR) of around 3% over the next five years [1]. The pharmaceutical segment, accounting for about 10-15% of total demand, emphasizes pharmaceutical-grade saline solutions, while industrial uses dominate the remainder.

Segment Breakdown

-

Pharmaceutical Grade: Utilized in intravenous therapies, dialysis, and intraocular solutions. The segment is driven by increasing healthcare demands and aging populations.

-

Industrial Grade: Used in chemical manufacturing (e.g., chlorine, caustic soda), water treatment, de-icing, and food processing.

-

Food and Agricultural Grade: Employed as a preservative and feed additive; though significant, this segment is less influential on raw material prices.

Key Market Drivers

-

Pharmaceutical Sector Expansion: Growing healthcare infrastructure, particularly in emerging economies, fuels demand for pharmaceutical-grade sodium chloride. Hospitals require saline solutions, which depend on high-purity NaCl.

-

Chemical Industry Growth: The chlor-alkali industry remains a primary consumer, with sodium chloride electrolyzed to produce chlorine, caustic soda, and hydrogen.

-

Infrastructure and Industrialization: Development projects, urbanization, and industrial expansion in Asia-Pacific and Africa elevate demand for industrial-grade salt.

-

Regulatory Standards: Stringent quality controls in pharmaceutical applications influence market dynamics, favoring high-purity supplies.

Supply Chain and Production Dynamics

Major Producers and Geographic Distribution

-

Countries: China, the United States, Germany, and India are leading producers. China alone supplies approximately 55% of global sodium chloride, largely originating from salt lakes and seawater evaporation processes [2].

-

Production Methods:

- Solar evaporation from seawater or salt lakes, prevalent in regions like China, the US (Great Salt Lake), and Australia.

- Mining of rock salt deposits, common in Europe and the US.

-

Supply Constraints: Variations in weather patterns impact evaporation rates and production stability. Environmental regulations and land use policies also influence output capacity.

Pricing Trends and Projections

Historical Price Movements

-

Prices for pharmaceutical-grade NaCl have historically ranged between USD 0.50 to USD 1.00 per kilogram, with industrial-grade salt costing less than USD 0.20 per kilogram due to lower purity requirements [3].

-

Price fluctuations in recent years have been modest but influenced by factors such as raw material costs, energy prices, and geopolitical tensions.

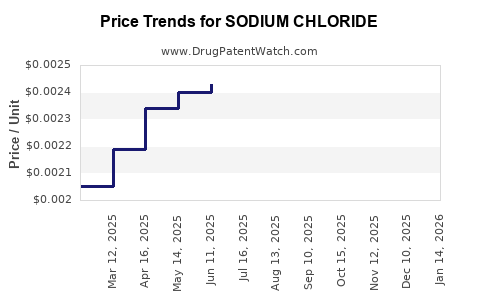

Current Market Prices (2023)

Price Drivers and Future Outlook

-

Energy Costs: Evaporation and mining processes are energy-intensive; rising electricity and fuel prices could elevate production costs.

-

Raw Material Costs: Salt feedstock availability and quality directly influence prices, especially for high-purity grades.

-

Environmental Regulations: Stricter environmental standards may increase manufacturing costs, leading to higher prices.

-

Supply Chain Disruptions: Geopolitical tensions, transportation constraints, and pandemics may cause volatility.

-

Predicted Trajectory: Prices are projected to increase modestly at a CAGR of approximately 2-3% through 2028, driven by inflationary pressures and regulatory compliance costs [1]. The pharmaceutical segment may see slightly higher stabilization due to steady healthcare demand.

Market Challenges and Opportunities

Challenges

-

Overproduction and Price Suppression: Excess capacity, particularly from China, can suppress prices.

-

Environmental & Regulatory Compliance: Increased costs associated with sustainable practices and regulatory standards.

-

Logistical Complexities: Transportation costs, especially for high-purity and specialty grades, impact final prices.

Opportunities

-

Emerging Markets: Rapid industrialization in Southeast Asia, Africa, and Latin America presents growth avenues.

-

Innovation in Purification: Advanced extraction and purification technologies can command premium prices.

-

Renewable Energy Integration: Using renewable energy sources for production may reduce costs and environmental impact.

Competitive Landscape

Major players include Cargill, Tata Chemicals, AkzoNobel, and Olin Corporation. These companies leverage economies of scale, vertical integration, and technological innovations to maintain market share.

Emerging regional producers focus on localized markets, often competing on price and quality. The market exhibits moderate consolidation, with strategic alliances and acquisitions shaping future competition.

Regulatory and Environmental Considerations

Increased emphasis on environmental sustainability impacts operational costs and product sourcing. Regulatory agencies like the U.S. FDA and European EMA enforce stringent standards for pharmaceutical-grade sodium chloride, influencing manufacturing practices and pricing structures.

Conclusion and Future Outlook

The sodium chloride market is characterized by steady demand aligned with global economic growth and industrialization, with notable segments driven by pharmaceutical and chemical industries. While raw material and energy costs are key factors influencing prices, regulatory trends and environmental policies will shape future supply dynamics.

Prices are expected to increase gradually, emphasizing the importance of strategic sourcing and technological advancements for market participants. The ongoing expansion in emerging economies offers substantial growth potential, particularly in industrial applications, though market volatility remains a consideration due to geopolitical and environmental factors.

Key Takeaways

- Steady Growth: Demand for pharmaceutical-grade sodium chloride remains resilient, bolstered by healthcare infrastructure expansion globally.

- Price Trends: Anticipate modest annual price increases (~2-3%), driven by energy costs, environmental regulations, and supply chain dynamics.

- Supply Concentration: China dominates production, with potential risks of over-dependence affecting global pricing and supply stability.

- Competitive Strategies: Companies investing in sustainable, cost-efficient production and high-purity processes will gain market advantage.

- Emerging Markets: Asia-Pacific and Africa represent promising growth markets due to rapid industrial and infrastructural development.

FAQs

1. What are the main uses of pharmaceutical-grade sodium chloride?

Pharmaceutical-grade sodium chloride is primarily used in saline solutions for intravenous therapy, dialysis, and other medical applications requiring high purity levels.

2. How does energy consumption impact sodium chloride prices?

Energy-intensive extraction and processing methods, such as evaporation and electrolysis, directly influence production costs; fluctuating energy prices can therefore impact market prices.

3. Which regions dominate sodium chloride production?

China leads global production, followed by the United States, Germany, and India. The majority of supply originates from seawater evaporation and salt mine mining.

4. Are environmental regulations driving up sodium chloride prices?

Yes. Stricter environmental standards increase operational costs through regulatory compliance, waste management, and sustainable practices, which can translate into higher prices.

5. What is the outlook for sodium chloride prices in the next five years?

Prices are expected to rise gradually, driven by inflation, energy costs, and regulatory compliance, with an estimated CAGR of 2-3% through 2028.

Sources:

[1] Market Research Future, "Salt Market Analysis," 2022.

[2] The Merck Index, 15th Edition, 2013.

[3] Transparency Market Research, "Sodium Chloride Market Forecast," 2020.