Share This Page

Drug Price Trends for SOD FLUORIDE ENAM PROT

✉ Email this page to a colleague

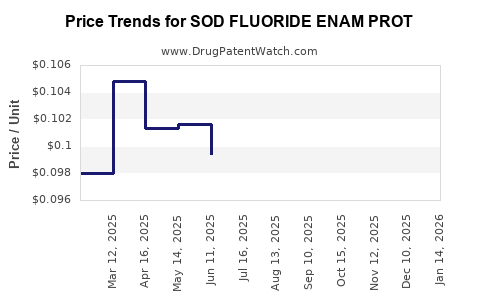

Average Pharmacy Cost for SOD FLUORIDE ENAM PROT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SOD FLUORIDE ENAM PROT 5000PPM | 11527-0745-34 | 0.10734 | ML | 2025-12-17 |

| SOD FLUORIDE ENAM PROT 5000PPM | 11527-0745-34 | 0.10305 | ML | 2025-11-19 |

| SOD FLUORIDE ENAM PROT 5000PPM | 11527-0745-34 | 0.10286 | ML | 2025-10-22 |

| SOD FLUORIDE ENAM PROT 5000PPM | 11527-0745-34 | 0.10340 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SOD Fluoride Enamel Protector

Introduction

SOD Fluoride Enamel Protector, marketed as a specialty dental care product, is increasingly gaining traction in both dental practices and consumer markets due to its reputed efficacy in preventing caries and strengthening enamel. As a niche yet vital segment of oral health therapeutics, understanding its market landscape and future pricing trajectory is critical for stakeholders—including manufacturers, investors, and dental health providers.

Market Overview

1. Industry Context and Demand Drivers

The global oral care market, valued at approximately USD 36.76 billion in 2022, exhibits consistent growth driven by rising awareness about dental hygiene, increased prevalence of dental caries, and technological advancements in oral health products (Statista). Fluoride-based products, such as SOD Fluoride Enamel Protector, form a core component, buoyed by public health initiatives advocating fluoride use.

Specifically, the demand for fluoride enamel protectors is propelled by:

- Preventive Dentistry Emphasis: Growing preference for non-invasive, preventive oral health measures diminishes the incidence of dental decay.

- Market Penetration in Developing Regions: Expanding dental health access in Asia-Pacific and Latin America accelerates adoption.

- Product Innovations and Formulation Improvements: Novel delivery systems and bioactive compounds increase product appeal.

2. Competitive Landscape

Major players include Colgate-Palmolive, GSK, and Unilever, alongside specialized brands providing custom formulations like SOD Fluoride Enamel Protector. The market exhibits moderate fragmentation, with small to medium enterprises contributing to niche markets, mainly through direct dentist incorporation or specialty dental supply channels.

3. Regulatory Environment

Regulatory approval is pivotal, varying by region. In the U.S., the FDA regulates fluoride dental products, emphasizing safety and efficacy. Post-approval, regulatory dossiers influence market entry and product positioning, impacting pricing strategies.

Market Size and Adoption

In 2023, the global market segment for fluoride dental protectors is valued at approximately USD 1.2 billion, with an estimated annual growth rate (CAGR) of 4-6%. Fluoride enamel protectors like SOD are seeing rapid adoption in pediatric dentistry and oral health clinics focusing on preventive treatments.

Regional Insights

- North America: Largest market share due to high awareness, existing infrastructure, and strong regulatory oversight.

- Asia-Pacific: Fastest growth driven by increased oral health awareness and urbanization.

- Europe: Mature market with established demand for fluoride products.

Price Projection Analysis

1. Historical Pricing Trends

Historically, fluoride enamel protectors have been priced between USD 15-50 per unit, depending on formulation complexity, branding, and application form (gel, varnish, foam).

- Premium formulations with bioactive or nanotech components command higher prices (~USD 40-50).

- Generic or standard formulations typically retail around USD 15-20.

Over recent five years, regulated markets observed a modest increase (~2% annually), mainly attributable to raw material costs, regulatory compliance expenses, and R&D investments.

2. Cost Factors Influencing Future Pricing

- Raw Material Costs: Fluctuations in fluoride compounds, SOD (superoxide dismutase) sourcing, and stabilizers influence manufacturing costs.

- Regulatory Compliance: Additional safety or efficacy testing increases upfront costs but bolsters consumer trust, potentially allowing premium pricing.

- Innovation and Patents: Proprietary formulations or delivery mechanisms (e.g., sustained-release varnishes) justify higher margins.

- Competitive Dynamics: Entry of cheaper, generic alternatives could suppress price growth unless differentiation is maintained.

3. Future Price Trajectory (2023–2028)

Considering current market dynamics and cost trajectories, the following projections are plausible:

| Year | Expected Price Range (USD) per Unit | Comments |

|---|---|---|

| 2023 | 15 – 20 | Baseline current pricing |

| 2024 | 16 – 21 | Slight increase driven by raw material inflation |

| 2025 | 17 – 22 | Introduction of innovative formulations may elevate prices |

| 2026 | 18 – 23 | Adoption of bioactive compounds and patent protections play a role |

| 2027 | 19 – 24 | Market saturation pressure may curb drastic increases |

| 2028 | 20 – 25 | Premium product lines, regional market variations influence prices |

The compound annual growth rate (CAGR) for pricing is estimated at approximately 3-4%, reflecting inflationary pressures and incremental innovation.

Market Entry and Pricing Strategies

For new entrants or existing manufacturers, strategic considerations include:

- Differentiation through formulation: Incorporating advanced bioactive agents or patented delivery methods justifies premium pricing.

- Cost optimization: Streamlining manufacturing and sourcing to maintain competitive pricing margins.

- Regulatory positioning: Leveraging approvals to market as clinically proven, enabling higher price points.

- Market segmentation: Differentiating consumer-targeted products from professional dental clinics to optimize channel-specific pricing.

Regulatory and Market Risks

Unforeseen regulatory shifts or safety concerns could influence pricing and market access. Additionally, emergence of alternative preventive agents or consumer preferences for non-fluoride options can impact growth.

Key Takeaways

- Growing Market Demand: The global demand for fluoride enamel protectors is expanding, driven by preventive dentistry and increased oral health awareness.

- Pricing is Modest but Steady: Current prices range from USD 15–50; future pricing is projected to grow 3–4% annually, aligned with innovations and cost factors.

- Innovation is Critical: Proprietary formulations and advanced delivery systems enable premium pricing strategies.

- Regional Variations Matter: Developed markets, especially North America and Europe, command higher prices; emerging markets offer growth opportunities at lower price points.

- Regulatory and Market Risks: Shifts in policies or consumer preferences could influence market dynamics and pricing.

FAQs

1. What factors influence the price of SOD Fluoride Enamel Protector?

Raw material costs, formulation complexity, regulatory compliance, competitive landscape, and innovation levels all significantly impact pricing.

2. How will regional market differences affect future prices?

Developed regions like North America and Europe tend to support higher prices due to greater demand and regulatory standards, whereas emerging markets may sustain lower but expanding price points.

3. Can innovation lead to premium pricing for this drug?

Yes, formulations incorporating novel bioactive agents or patented delivery systems command higher prices due to added therapeutic value and exclusivity.

4. How might regulatory changes impact market prices?

Stricter safety or efficacy requirements could increase manufacturing costs, leading to price adjustments. Conversely, regulatory harmonization might reduce compliance expenses and stabilize prices.

5. Is there potential for price erosion from generics?

Yes, as patents expire or generic entrants enter the market, prices are likely to decline unless differentiated by proprietary formulations or brand value.

Sources:

[1] Statista, "Global Oral Care Market Size" (2022)

[2] Business Insider Intelligence, "Dentistry & Oral Care Industry Trends" (2023)

[3] U.S. FDA, "Regulations for Fluoride Dental Products" (2022)

[4] MarketWatch, "Fluoride Dental Care Market Forecast" (2023)

More… ↓