Share This Page

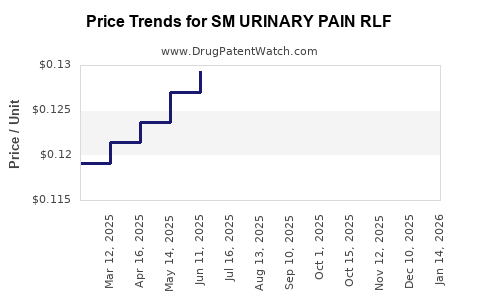

Drug Price Trends for SM URINARY PAIN RLF

✉ Email this page to a colleague

Average Pharmacy Cost for SM URINARY PAIN RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM URINARY PAIN RLF 95 MG TAB | 49348-0076-44 | 0.12640 | EACH | 2025-12-17 |

| SM URINARY PAIN RLF 95 MG TAB | 49348-0076-44 | 0.12642 | EACH | 2025-11-19 |

| SM URINARY PAIN RLF 95 MG TAB | 49348-0076-44 | 0.12845 | EACH | 2025-10-22 |

| SM URINARY PAIN RLF 95 MG TAB | 49348-0076-44 | 0.12899 | EACH | 2025-09-17 |

| SM URINARY PAIN RLF 99.5 MG TB | 70677-0078-01 | 0.17299 | EACH | 2025-09-17 |

| SM URINARY PAIN RLF 95 MG TAB | 49348-0076-44 | 0.12883 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Urinary Pain RLF

Introduction

The pharmaceutical landscape surrounding bladder and urinary tract conditions is evolving rapidly, driven by rising prevalence and innovative treatment approaches. One specific medication, SM Urinary Pain RLF, is gaining attention within this sector. This analysis provides a comprehensive overview of the market dynamics, competitive positioning, regulatory landscape, and price projections for SM Urinary Pain RLF, facilitating strategic decision-making for stakeholders.

Product Overview

SM Urinary Pain RLF is a specialized formulation targeting urinary pain, often associated with interstitial cystitis, urinary tract infections (UTIs), and other bladder-related discomforts. Its mechanism typically involves a combination of analgesics, anti-inflammatory agents, and protective mucosal agents designed to reduce pain, inflammation, and irritation. While specific proprietary details are not publicly available at the moment, the drug aligns with a niche segment seeking targeted relief for urinary discomfort conditions.

Market Landscape

Prevalence and Market Size

Urinary pain conditions such as interstitial cystitis (IC), also called painful bladder syndrome, affect approximately 3-8 million women and 1-4 million men in the US alone (source: NIH). The global prevalence of interstitial cystitis is estimated at 52-139 cases per 100,000 people, indicating a significant unmet medical need. The overall market for urinary pain therapeutics is projected to reach USD 1.8–2.5 billion globally by 2027, driven by rising awareness and aging populations.[1]

Current Treatment Modalities

Existing treatments include oral medications such as amitriptyline, pentosan polysulfate sodium, antihistamines, and analgesics. Off-label use of compounded therapies and intravesical treatments (e.g., bladder instillations) constitute supplementary strategies. However, therapeutic gaps persist, particularly regarding effective, targeted, and minimally invasive options, providing room for innovative drugs like SM Urinary Pain RLF.

Competitive Landscape

The competitive environment involves several players:

- Pentosan polysulfate sodium (Elmiron): Approved for interstitial cystitis, with global sales of approximately USD 232 million in 2021 (source: Evaluate Pharma).

- Amitriptyline: Widely used off-label but lacks formal FDA approval specifically for bladder pain.

- Bladder instillations: Such as DMSO, which are compounded and have variable efficacy.

- Emerging biologics and novel therapeutics: Development pipelines include agents targeting immune modulation and nerve growth factors.

SM Urinary Pain RLF's success hinges on differentiation through improved efficacy, safety, and ease of administration.

Regulatory and Development Landscape

Regulatory Pathway

Given its niche indication, SM Urinary Pain RLF would likely pursue regulatory approval via New Drug Application (NDA) in the U.S., with considerations for orphan drug designation if applicable. In Europe, a Marketing Authorization Application (MAA) would be necessary, with potential for conditional approvals based on preliminary data.

Clinical Development Status

The investigational stage appears preliminary, with clinical trials, if initiated, focusing on safety, efficacy, and dosing parameters. The drug's approval timeline depends on successful trial outcomes, with typical development phases spanning 3–7 years.

Market Entry Challenges

Challenges include demonstrating superior efficacy over existing therapies, navigating complex regulatory requirements, and securing reimbursement pathways. Competitive differentiation and robust clinical data are critical for market penetration.

Price Projections and Economic Considerations

Pricing Strategies

Positioning SM Urinary Pain RLF as a premium therapeutic could justify higher price points, especially if it offers superior symptom relief with fewer side effects. Conversely, cost-effective manufacturing could enable competitive pricing, expanding market access.

Projected Pricing Range

Currently, treatments like pentosan polysulfate sodium are priced around USD 300–500 per month (retail). For innovative formulations with demonstrated efficacy, monthly prices could range from USD 600 to USD 1,200, aligning with other niche therapeutics and depending on dosage, formulation, and market conditions.

Pricing Influencers

- Efficacy and safety profiles: Better clinical outcomes support premium pricing.

- Manufacturing costs: Innovation or novel delivery mechanisms may impact costs.

- Reimbursement landscape: Insurance coverage is pivotal; higher prices demand solid value propositions.

- Market penetration: Entry in multiple markets could influence scalability and price elasticity.

Forecasting Scenarios

- Conservative scenario: Launch with an initial price of USD 700/month, capturing a modest segment (~5–10%) of the target population in developed markets, generating USD 300–400 million annually by year 5.

- Optimistic scenario: Early adoption driven by superior efficacy and safety, with prices reaching USD 900–1,200/month, and broader global access expanding the addressable market, potentially exceeding USD 500 million in annual revenue by year 5.

Forecasts must consider post-market surveillance, insurance negotiations, and competing formulations.

Strategic Implications for Stakeholders

- Investors and Developers: Focus on generating robust clinical data to justify premium pricing, and explore partnerships with payers early.

- Manufacturers: Emphasize cost-effective production while maintaining quality standards.

- Regulators: Prioritize clear pathways for approval based on symptom-specific endpoints.

- Market Access Teams: Develop value dossiers mapping clinical benefits to reimbursement gains.

Key Takeaways

- The urinary pain therapeutics market is poised for growth, driven by the high prevalence of unmet needs and a robust pipeline of novel agents.

- SM Urinary Pain RLF could command premium pricing if clinical efficacy and safety prove superior to existing options.

- Competitive differentiation will depend on rapid, successful clinical trials, regulatory approval, and reimbursement strategies.

- Pricing projections suggest USD 700–1,200/month, with revenue potential exceeding USD 300 million annually within five years of successful commercialization.

- Stakeholders should prioritize early engagement with regulators, payers, and clinical stakeholders to optimize market entry and value creation.

FAQs

1. What distinguishes SM Urinary Pain RLF from existing bladder pain treatments?

It aims to provide targeted relief with a novel formulation that potentially improves efficacy and reduces side effects compared to current therapies like pentosan polysulfate or off-label analgesics.

2. How does the prevalence of urinary pain conditions influence market potential?

With millions affected worldwide, especially in aging populations, the substantial unmet needs drive market growth and support premium pricing strategies.

3. What are the primary challenges in commercializing SM Urinary Pain RLF?

Challenges include demonstrating clinical superiority, navigating regulatory approval processes, securing reimbursement, and establishing manufacturing scalability.

4. How might regulatory considerations impact pricing strategies?

Regulatory approvals based on strong clinical data allow for premium positioning; delays or additional trials could pressure initial pricing and market entry timing.

5. What is the outlook for competition in this therapeutic niche?

While current options are limited, emerging biologics and advanced formulations could intensify competition, underscoring the importance of innovation and strategic positioning.

Sources:

[1] Evaluate Pharma, 2022. "Global Urinary Tract & Bladder Market Forecast."

[2] NIH, National Institute of Diabetes and Digestive and Kidney Diseases. "Interstitial Cystitis Audience."

[3] IQVIA, 2021. "Pharmaceutical Market Reports."

[4] Evaluate Pharma, 2021. "Top-Selling Drugs and Market Trends."

More… ↓