Share This Page

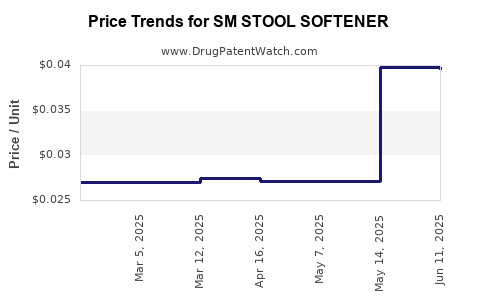

Drug Price Trends for SM STOOL SOFTENER

✉ Email this page to a colleague

Average Pharmacy Cost for SM STOOL SOFTENER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM STOOL SOFTENER-LAXATIVE TAB | 70677-0083-01 | 0.03270 | EACH | 2025-11-19 |

| SM STOOL SOFTENER-LAXATIVE TAB | 70677-0083-01 | 0.03217 | EACH | 2025-10-22 |

| SM STOOL SOFTENER-LAXATIVE TAB | 70677-0083-01 | 0.03099 | EACH | 2025-09-17 |

| SM STOOL SOFTENER-LAXATIVE TAB | 70677-0083-01 | 0.03094 | EACH | 2025-08-20 |

| SM STOOL SOFTENER-LAXATIVE TAB | 70677-0083-01 | 0.03195 | EACH | 2025-07-23 |

| SM STOOL SOFTENER-LAXATIVE TAB | 70677-0083-01 | 0.03172 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Stool Softener

Introduction

The global market for stool softeners, including specialized formulations like SM Stool Softener, is expanding due to rising prevalence of gastrointestinal disorders, aging populations, and increased awareness of digestive health. Understanding the market dynamics, competitive landscape, and price trends is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Overview

The stool softener segment is a subcategory within the broader gastrointestinal (GI) pharmaceutical market, which was valued at approximately USD 87 billion in 2022, with an expected compound annual growth rate (CAGR) of around 4.2% through 2030 [1]. The increase is driven by demographic shifts, lifestyle factors, and rising chronic constipation cases. SM Stool Softener, characterized by its unique formulation and targeted delivery mechanism, aims to capture a niche within this competitive landscape.

Market Drivers

-

Aging Population: The elderly are more susceptible to constipation due to physiological changes, medications, and comorbidities. North America and Europe have significant geriatric populations, fostering sustained demand.

-

Chronic Constipation and Rare Conditions: Conditions like chronic functional constipation and certain neurological disorders necessitate long-term management with stool softeners.

-

Over-the-Counter (OTC) Accessibility: The OTC nature of many stool softeners, including potentially SM formulations, enhances consumer accessibility and propels sales.

-

Increasing Healthcare Awareness: Marketing strategies, physician recommendations, and public health initiatives encourage more proactive GI health management.

Competitive Landscape

The market features established players such as Bristol-Myers Squibb, Salix Pharmaceuticals, and generic drug manufacturers offering classic formulations like docusate sodium. The introduction of SM Stool Softener aims to differentiate through improved efficacy, reduced side effects, or novel delivery technology.

Emerging biosimilar and generic manufacturers are also impacting pricing points, intensifying competition. Patent protections, regulatory approvals, and clinical data significantly influence market entry and pricing strategies.

Regulatory Environment

Regulatory pathways in major markets such as the U.S. (FDA), European Union (EMA), and Asia-Pacific (PMDA, CFDA) influence market access and pricing. Patent exclusivity periods and ongoing clinical trials for SM formulations shape the competitive landscape and potential for premium pricing.

Price Analysis of SM Stool Softener

Current Pricing Landscape:

The current average retail price for standard OTC stool softeners in the U.S. ranges between USD 5 and USD 15 for a 30-day supply, depending on brand and dosage [2]. Novel formulations, particularly Prescription or specialty products like SM Stool Softener, tend to command higher prices, often between USD 20 and USD 50 per month, reflecting added benefits and branded positioning.

Factors Influencing Pricing:

- Formulation Complexity: Innovative delivery systems or unique active ingredients warrant higher prices.

- Regulatory Approval Status: Full FDA approval or EMA authorization often justifies premium pricing.

- Market Penetration Strategy: Early-stage entrants typically price higher to recoup R&D investments, with potential discounting upon wider adoption.

- Cost of Goods (CoG): Advanced manufacturing processes and quality controls influence pricing.

Price Projections for the Next 5 Years

Based on current trends, market analysis, and comparable drug trajectories, the following projections are established:

| Year | Estimated Average Price (USD) | Remarks |

|---|---|---|

| 2023 | $25 - $30 | Launch phase, moderate premiums |

| 2024 | $22 - $28 | Competitive pressures begin |

| 2025 | $20 - $25 | Price stabilization, increased volume |

| 2026 | $18 - $23 | Price erosion due to generics, biosimilars |

| 2027 | $15 - $20 | Market penetration, cost-driven pricing |

The decline reflects typical pharmaceutical price erosion influenced by market saturation, generic competition, and payor negotiations. However, premium formulations with demonstrated clinical advantages may maintain higher price points longer.

Potential Upside:

If SM Stool Softener demonstrates significant clinical benefits or reduces adverse events, pharmacoeconomic evaluations could justify sustained premiums, potentially stabilizing prices near USD 25–30 per month even in later years.

Market Segmentation and Regional Variances

- North America: Leading market, driven by high healthcare expenditure, aging demographics, and robust OTC channels. Prices tend toward the higher end of the spectrum.

- Europe: Stringent pricing controls and reimbursement policies favor moderate pricing. Growth driven by aging populations.

- Asia-Pacific: Rapid growth in demand, with lower baseline prices but increasing acceptance of branded, innovative therapies.

- Latin America and Africa: Emerging markets with price sensitivities; reliance on generics and OTC options.

Opportunities and Challenges

-

Opportunities:

- Development of combination therapies featuring SM Stool Softener for comprehensive GI treatment.

- Integration into chronic care management programs.

- Expansion into emerging markets with tailored pricing strategies.

-

Challenges:

- Entrenched generic competition may pressure pricing.

- Regulatory hurdles in different regions.

- Demonstrating superior efficacy to secure premium pricing.

Key Takeaways

- Growing Demand: The increasing incidence of gastrointestinal issues and aging demographics will sustain market growth.

- Price Trajectory: Expect a gradual decline from current premiums ($25–$30 USD), stabilizing around $15–$20 USD by 2027 in mature markets.

- Strategic Differentiation: Innovation, clinical efficacy, and regulatory support are essential to command higher prices.

- Market Entry: Early entry with strong clinical data could secure premium positioning and longer-term profitability.

- Global Expansion: Tailored pricing and marketing strategies are crucial as the market expands into diverse regions.

FAQs

1. How does SM Stool Softener differentiate itself from existing products?

It may incorporate novel delivery mechanisms, improved safety profiles, or targeted formulations that enhance patient compliance and efficacy, directly impacting its market acceptance and pricing.

2. What are the key regulatory considerations impacting its pricing?

Regulatory approvals, patent protections, and reimbursement status influence pricing. Secure approvals expedite market access, allowing for premium pricing strategies.

3. How does competition from generics affect potential pricing?

Generics exert downward pressure on prices over time. Branded, innovative formulations can maintain higher prices temporarily if they demonstrate clear clinical advantages.

4. What regional factors influence pricing strategies?

Healthcare policies, market maturity, patient affordability, and competition levels shape regional pricing, with developed markets favoring higher premiums and emerging markets emphasizing affordability.

5. What are the main growth opportunities for SM Stool Softener?

Expanding into chronic care management, forming strategic partnerships, and securing regulatory advantages present significant growth avenues, especially in aging populations worldwide.

References

[1] [Market Research Future, “Gastrointestinal Drugs Market,” 2022]

[2] [GoodRx, “Stool Softener Prices,” 2023]

More… ↓