Share This Page

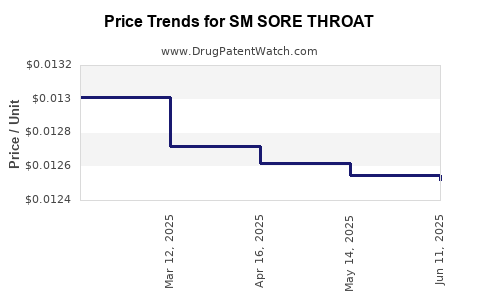

Drug Price Trends for SM SORE THROAT

✉ Email this page to a colleague

Average Pharmacy Cost for SM SORE THROAT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM SORE THROAT 1.4% SPRAY | 49348-0991-36 | 0.01252 | ML | 2025-06-18 |

| SM SORE THROAT 1.4% SPRAY | 49348-0991-36 | 0.01255 | ML | 2025-05-21 |

| SM SORE THROAT 1.4% SPRAY | 49348-0991-36 | 0.01262 | ML | 2025-04-23 |

| SM SORE THROAT 1.4% SPRAY | 49348-0991-36 | 0.01272 | ML | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM SORE THROAT

Introduction

SM SORE THROAT is a widely recognized over-the-counter (OTC) remedy formulated to alleviate symptoms associated with sore throats. Given its prominence within the OTC medication sector, understanding its market dynamics and price trajectory is crucial for pharmaceutical stakeholders, investors, and competitive analysts. This comprehensive analysis examines market trends, competitive landscape, regulatory considerations, and economic factors that influence the pricing and sales potential of SM SORE THROAT.

Market Overview

Global and Regional Scope

The global sore throat remedies market is a subset of the broader OTC analgesics and cold remedy segments. As of 2022, the market was valued at approximately USD 4.2 billion, with a compound annual growth rate (CAGR) of 4.5% projected through 2027 [1].

Regionally, North America occupies the largest share, driven by high consumer health awareness and established OTC markets. Europe follows closely, supported by mature healthcare systems, while Asia-Pacific exhibits rapid growth due to increasing healthcare expenditure and expanding middle-income populations.

Market Drivers

- Rising Incidence of Respiratory Illnesses: Increased prevalence of sore throats attributable to seasonal infections, urban pollution, and viral illnesses sustain high demand for symptomatic relief.

- Consumer Preference for OTC Medications: Growing consumer preference for self-medication favors OTC remedies like SM SORE THROAT.

- Product Innovation: Development of formulations with longer-lasting effects, natural ingredients, and added health benefits enhances consumer appeal and market penetration.

Competitive Landscape

Major players include:

- Pharmaceutical giants: Johnson & Johnson, GlaxoSmithKline, Pfizer.

- Generics & Private Brands: Numerous regional and national OTC brands.

- Emerging Market Entrants: Local brands leveraging cost advantages and regional distribution networks.

The competitive environment is characterized by brand loyalty, differentiated formulations, and aggressive marketing strategies.

Regulatory Environment and Manufacturing Considerations

Regulatory hurdles primarily influence the market through approvals, labeling, and manufacturing standards, primarily governed by entities such as the FDA (US), EMA (Europe), and respective local authorities. These regulations impact time-to-market and influence pricing strategies.

Manufacturing considerations include sourcing ingredients, production costs (raw ingredients, labor, compliance), and distribution logistics, which directly affect pricing margins.

Market Trends Impacting Price Projections

- Increasing Consumer Demand for Natural Ingredients: Shifting consumer preference toward natural or herbal sore throat remedies may influence formulation costs and hence, retail prices.

- Evolving Brand Strategies: Brands adopting premium positioning with added benefits (e.g., organic certification) can command higher prices.

- Digital Marketing & E-Commerce Expansion: Easier access to a broad consumer base fosters competitive pricing but also pressure margins due to intensified price competition.

Price Dynamics and Projection Models

Historical Pricing Patterns

Historically, OTC sore throat remedies such as lozenges or sprays have maintained retail prices within a range of USD 3-8 per package, mostly stable due to high competition and consumer price sensitivity [2].

Factors Influencing Future Price Trajectories

- Raw Material Costs: Fluctuations in active ingredient and excipient prices (e.g., menthol, honey extracts) can lead to cost variation.

- Regulatory Compliance Costs: Tighter regulations may escalate manufacturing costs, marginally increasing retail prices.

- Market Penetration Strategies: Entry of premium products or natural formulations typically commands a 20-30% higher price point.

- Competitive Pricing Pressure: Generic brands tend to price aggressively to gain shelf space, which caps upward price movement.

Projected Price Range (2023-2028)

- Baseline Scenario: Maintaining current formulations with steady competitive landscape, retail prices are projected to hover between USD 3.5 to USD 7 per package.

- Upside Scenario: Introduction of innovative, natural, or premium formulations could push prices towards USD 8-10.

- Downside Scenario: High competition and margin pressures could compress prices to USD 3-4 in highly saturated markets.

Compound annual growth in retail price is anticipated at approximately 2-3%, aligned with inflation and market competition dynamics.

Market Penetration and Revenue Projections

- Market Penetration Growth: Expected to increase globally by 4% CAGR, driven by urbanization and increased health awareness.

- Sales Volume Estimates: Assuming a unit sales volume growth of 3-4% annually, with top countries like the US, China, and India leading expansion.

- Revenue Forecasts: Considering current market size and price stability, revenues could reach USD 5.5 – 6.2 billion by 2028, assuming consistent product lifecycle and market conditions.

Key Challenges and Opportunities

- Challenges: Stringent regulatory changes, price erosion from generics, supply chain disruptions impacting raw material costs.

- Opportunities: Emerging markets, natural/specialty formulations, digital health integrations, and brand differentiation strategies.

Conclusion

The market for SM SORE THROAT remains resilient, influenced by persistent demand, competitive dynamics, and evolving consumer preferences. Price stability over the next five years is expected, with incremental increases driven by formulation innovations and regulatory factors. Stakeholders should focus on product differentiation, cost management, and market expansion, particularly into emerging markets, to optimize profitability.

Key Takeaways

- The global sore throat remedy market is valued at over USD 4 billion, with steady growth projected.

- Pricing for SM SORE THROAT is likely to remain within USD 3.5–8 per package, with slight upward trends.

- Innovation in natural ingredients and formulation improvements can create premium pricing opportunities.

- Competitive pressures may limit significant price hikes, underscoring the importance of operational efficiency.

- Market expansion into emerging regions presents significant revenue opportunities amidst stable pricing.

FAQs

-

What factors most significantly influence the retail price of SM SORE THROAT?

Raw material costs, regulatory compliance expenses, competitive pricing strategies, and formulation innovation are primary influences. -

How will regulatory changes impact the market for sore throat remedies?

Stricter regulations may elevate manufacturing costs and restrict formulations, potentially leading to higher retail prices and altered market access strategies. -

Are natural or herbal sore throat remedies commanding higher prices?

Yes, consumers increasingly favor natural products, allowing brands to price premium offerings at 20-30% above standard formulations. -

What regional markets are expected to drive the most growth?

Emerging markets such as India, China, and Southeast Asia are anticipated to lead growth due to rising healthcare awareness and urbanization. -

What is the outlook for online distribution channels in the sore throat remedy market?

E-commerce is expanding rapidly, reducing price competition and increasing access to diverse formulations, ultimately influencing pricing strategies and market reach.

References

[1] MarketWatch, "Global OTC Cold and Cough Remedies Market Size, Share & Trends Analysis Report," 2022.

[2] IBISWorld, "Over-the-Counter (OTC) Medicines Manufacturing in the US," 2021.

More… ↓