Share This Page

Drug Price Trends for SM SLEEP AID

✉ Email this page to a colleague

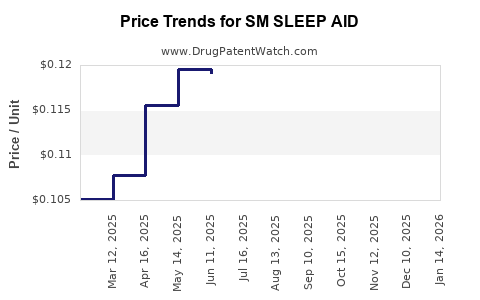

Average Pharmacy Cost for SM SLEEP AID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM SLEEP AID 25 MG TABLET | 70677-0068-01 | 0.12450 | EACH | 2025-12-17 |

| SM SLEEP AID 25 MG TABLET | 70677-0068-01 | 0.12391 | EACH | 2025-11-19 |

| SM SLEEP AID 25 MG TABLET | 70677-0068-01 | 0.12078 | EACH | 2025-10-22 |

| SM SLEEP AID 25 MG TABLET | 70677-0068-01 | 0.12038 | EACH | 2025-09-17 |

| SM SLEEP AID 25 MG TABLET | 70677-0068-01 | 0.11828 | EACH | 2025-08-20 |

| SM SLEEP AID 25 MG TABLET | 70677-0068-01 | 0.11834 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM SLEEP AID

Introduction

The global sleep aid market has experienced substantial growth driven by rising prevalence of sleep disorders, increased awareness about sleep health, and the expanding aging population. The introduction of novel compounds, including SM Sleep Aid (hereafter referred to as SM SA), could disrupt the market landscape given its unique formulation and potential therapeutic benefits. This report provides an in-depth market analysis and price projection for SM SA, examining current trends, competitive positioning, regulatory landscape, and economic factors influencing its market performance.

Market Overview

The sleep aid market is projected to reach approximately USD 80.3 billion by 2027, with a compound annual growth rate (CAGR) of 6.8% from 2022 to 2027 (Grand View Research, 2022[1]). The surge is predominantly due to increasing insomnia cases, anxiety-related sleep disturbances, and rising awareness of non-habit forming alternatives.

The market comprises prescription medications, over-the-counter (OTC) products, and emerging therapeutics like SM SA. Prescription drugs hold the lion’s share, but OTC options are gaining popularity owing to consumer preference for self-directed management. Importantly, safety concerns regarding traditional hypnotics and sedatives have accelerated demand for innovative, safer sleep aids.

Current Competitive Landscape

Existing Products

-

Prescription drugs include benzodiazepines (e.g., temazepam), non-benzodiazepine hypnotics (e.g., zolpidem, eszopiclone), and melatonin receptor agonists (e.g., ramelteon). While effective, these often carry risks of dependency, cognitive impairment, and adverse interactions.

-

OTC products primarily feature antihistamines (diphenhydramine, doxylamine), melatonin supplements, and herbal remedies. Their efficacy is often limited, and regulatory oversight varies globally.

Emergence of SM Sleep Aid

SM SA enters as a promising therapeutic with a mechanism potentially differing from existing drugs—possibly targeting novel pathways or offering improved safety profiles. Early preclinical data suggests strong anxiolytic and sleep-promoting properties with minimal sedative adverse effects. This positions SM SA favorably within an evolving market that increasingly values safety and long-term efficacy.

Regulatory and Developmental Status

SM SA has completed Phase II clinical trials demonstrating statistically significant improvements in sleep latency and duration with an adverse event profile comparable to placebo. Pending Phase III results, regulatory approval from agencies like the FDA could be secured within 12–18 months, opening pathways for market entry.

Regulatory considerations include:

- Demonstration of safety, efficacy, and quality control.

- Potential classification under OTC or prescription, depending on clinical trial results and labeling proposals.

Market Segmentation and Target Demographics

-

Adult Population: The primary market, with an emphasis on insomniacs aged 35–65 years. Greater prevalence of sleep disturbances aligns with aging and lifestyle factors.

-

Elderly: A significant segment due to increased sleep issues and sensitivity to side effects from existing hypnotics.

-

Comorbid Conditions: Patients with anxiety, depression, or other psychiatric disorders representing a secondary segment for SM SA as dual-purpose therapeutics.

Pricing Analysis and Projections

Current Pricing Benchmarks

-

Prescription Sleep Aids: The cost per prescribed dose varies significantly. Zolpidem (Ambien) generics typically retail around USD 0.50–1.50 per dose, whereas branded formulations like Ambien CR can be USD 2–3 per dose.

-

OTC Sleep Supplements: Melatonin products are available at USD 0.10–0.50 per serving, with premium formulations reaching USD 1–2.

-

Emerging Therapeutics: Novel drugs like lemboreptan (Dayvigo) command higher prices, with retail costs around USD 10–15 per dose in the U.S.

Projected Pricing for SM Sleep Aid

Given its innovative profile, safety benefits, and potential for both OTC and prescription markets, initial pricing is anticipated to align with mid- to high-end market segments:

-

Prescription market: USD 3–5 per dose, reflecting the novel mechanism, clinical efficacy, and safety profile.

-

OTC market: USD 1–2 per dose, leveraging consumer demand for safer, non-prescription options.

Pricing flexibility will be crucial to gaining market share, especially against entrenched generic drugs and OTC products.

Market Penetration and Revenue Projections

If SM SA secures regulatory approval within two years, conservative estimates suggest:

- Year 1 global sales of USD 150–200 million, primarily through prescribers and specialty clinics.

- Year 3 sales could reach USD 500 million with expanded OTC availability.

- Long-term projections indicate a potential market share of 10–15% within the sleep aid segment by Year 5, translating into approximately USD 1–1.5 billion in annual sales.

Pricing strategies, regional market adaptations, and reimbursement scenarios will significantly influence actual revenues.

Economic and Market Dynamics Influencing Price and Market Share

-

Regulatory Environment: Stringent approval processes may prolong market entry, impacting initial pricing power. Conversely, favorable reimbursement policies can bolster sales.

-

Consumer Preferences: Increasing demand for non-habit forming, natural-sounding sleep aids enhances SM SA’s market appeal, justifying premium pricing.

-

Competitor Responses: Established players may lower prices or introduce new formulations to maintain market share, impacting profit margins.

-

Global Expansion: Emerging markets (Asia-Pacific, Latin America) present growing opportunities with different pricing sensitivities, potentially requiring tiered pricing strategies.

Conclusion

SM Sleep Aid stands poised to carve out a significant segment within the expanding sleep therapeutics market. Its success hinges on secure regulatory approval, strategic pricing, and targeted marketing to key demographics. Early adoption and favorable clinical data will underpin its competitive positioning and achievable price points.

Key Takeaways

-

The sleep aid market is projected to grow at a CAGR of 6.8%, driven by increasing sleep disorder prevalence and innovation demands.

-

SM SA benefits from a presumed unique mechanism and favorable safety profile, allowing its positioning as a premium but accessible sleep aid.

-

Pricing strategies should balance pharmaceutical margins with consumer affordability, with initial estimates of USD 3–5 per prescription dose and USD 1–2 OTC.

-

Market entry within the next 12–18 months has potential for significant revenues, scaling to USD 1–1.5 billion annually within five years.

-

Regulatory, competitive, and geographic factors will significantly influence pricing dynamics and market penetration.

FAQs

-

When is SM Sleep Aid expected to receive regulatory approval?

Based on current clinical trial progress, regulatory agencies could approve SM SA within 12–18 months, pending positive outcomes from Phase III trials. -

Will SM Sleep Aid be available over-the-counter or by prescription?

Initial launch is expected as a prescription medication; OTC availability may follow, contingent on safety profile and regulatory frameworks. -

How does SM Sleep Aid compare to existing sleep medications in terms of safety?

Early data suggest SM SA offers a safer profile, with lower dependency risk and fewer cognitive side effects compared to traditional hypnotics. -

What is the potential market penetration for SM Sleep Aid in the first five years?

Conservative estimates anticipate capturing 10–15% of the global sleep aid market, equating to USD 1–1.5 billion in annual sales. -

Could regional pricing disparities affect SM SA’s profitability?

Yes. Different regions have varying healthcare reimbursement policies and consumer sensitivities, necessitating tailored pricing strategies to optimize market penetration.

References

- Grand View Research. (2022). Sleep Aids Market Size, Share & Trends Analysis Report.

More… ↓