Share This Page

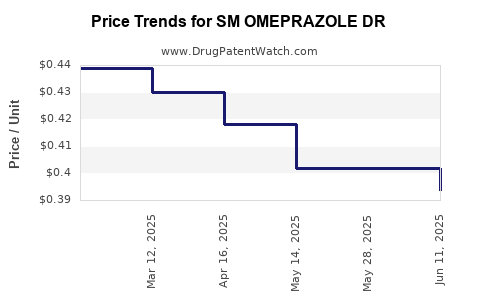

Drug Price Trends for SM OMEPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for SM OMEPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM OMEPRAZOLE DR 20 MG TABLET | 49348-0846-61 | 0.39373 | EACH | 2025-06-18 |

| SM OMEPRAZOLE DR 20 MG TABLET | 49348-0846-61 | 0.40167 | EACH | 2025-05-21 |

| SM OMEPRAZOLE DR 20 MG TABLET | 49348-0846-78 | 0.40167 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for SM Omeprazole DR

Introduction

SM Omeprazole DR (Delayed-Release) is a proton pump inhibitor (PPI) widely used in the treatment of gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. As a cornerstone in acid suppression therapy, its market dynamics are influenced by factors such as regulatory approvals, patent status, manufacturing trends, competitive landscape, and healthcare policies. This analysis evaluates current market conditions, future growth drivers, and price trajectories for SM Omeprazole DR.

Market Overview

Global Market Size and Trends

The global PPIs market was valued at approximately USD 15 billion in 2022, forecasted to reach USD 21 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6.2% [1]. Omeprazole, as one of the earliest PPIs introduced in the late 1980s, remains a dominant player, especially in generic formulations. The increasing prevalence of GERD—estimated to affect 20–30% of adults in North America and Europe—is expected to sustain demand for PPI therapies, including SM Omeprazole DR [2].

Competitive Landscape

The market is highly competitive, characterized by multiple generic manufacturers competing on price and formulation differentiation. Patent expirations in many regions have led to a surge in generic entries, driving down prices significantly. Notably, branded versions, such as Prilosec, and generics from companies like Teva, Mylan, and Sandoz dominate the landscape. The introduction of innovative delayed-release formulations aims to enhance patient adherence and drug stability, providing a competitive edge.

Regulatory & Patent Considerations

Most patents for omeprazole have expired globally, with patent protections mainly limited to specific formulations or delivery mechanisms. SM Omeprazole DR’s regulatory approval status varies by country, affecting market penetration and pricing strategies. In key markets like the U.S., the patent cliff has facilitated widespread generic access, exerting downward pressure on prices.

Market Drivers & Challenges

Drivers

- Rising Disease Prevalence: Increasing rates of GERD, peptic ulcers, and related conditions fuel demand.

- Generic Accessibility: Volume-driven market strategy with low-cost options broadening reach.

- Formulation Advancements: Delayed-release mechanisms improve efficacy and adherence, bolstering use.

- Healthcare Policies: Favorable reimbursement policies in developed countries support sustained demand.

Challenges

- Price Erosion: Intense competition leads to persistent price declines.

- Generic Market Saturation: Limited differentiation reduces potential profit margins.

- Emerging Alternatives: Novel drugs like potassium-competitive acid blockers (e.g., vonoprazan) threaten traditional PPI markets.

- Regulatory Hurdles: Variability in approval processes can delay new formulations' market entry.

Price Projections

Current Pricing Trends

Based on market data, the average retail price of a standard 20 mg omeprazole delayed-release capsule in the U.S. ranges from USD 0.15 to 0.25 per capsule for generics. Branded formulations may command USD 1.00 or more per capsule. Price erosion has been sharp—up to 70% reductions over the past decade—primarily driven by generics entering the market.

Short to Medium Term (1–3 Years)

- Price Stabilization: Expected as patent protections and formulation exclusivity wane, with prices for SM Omeprazole DR likely to hover around USD 0.10–0.20 per capsule for generics.

- Premium Formulations: Any proprietary delayed-release mechanisms with demonstrated improved outcomes might sustain slightly higher prices, potentially USD 0.25–0.35 per capsule.

Long-Term (3–5 Years)

- Further Decline: Anticipated under continued generic competition, with prices possibly dropping below USD 0.10 per capsule for standard formulations.

- Market Segmentation: Specialty formulations or combination drugs may retail at higher prices, supporting niche markets.

- Influence of New Therapies: Introduction of novel acid suppression drugs could suppress demand for traditional PPIs, exerting downward pressure on prices.

Future Market Dynamics

Innovation & Formulation Improvements

Innovations focusing on enhanced bioavailability, reduced side effects, and improved dosing schedules could sustain premium pricing for select formulations. The development of fixed-dose combinations (e.g., PPIs with other agents) could open new revenue streams.

Regulatory & Reimbursement Policies

With ongoing healthcare cost containment efforts, reimbursement policies favor generics, further cementing downward price trends. In emerging markets, price controls and government procurement strategies will influence local pricing.

Emerging Competition & Therapeutic Shifts

The rise of potassium-competitive acid blockers like vonoprazan, offering rapid onset and longer duration, may marginalize traditional PPIs, impacting overall market size and price levels.

Strategic Recommendations for Stakeholders

- Manufacturers: Invest in formulation differentiation and clinical evidence to maintain a competitive edge. Pursue patent protections for innovative delivery methods.

- Investors: Focus on markets with limited generic penetration or regions favoring branded therapies. Long-term profitability hinges on product innovation and strategic partnerships.

- Healthcare Providers: Emphasize evidence-based prescribing, consider cost-effective generics, and monitor emerging alternatives.

Key Takeaways

- The global SM Omeprazole DR market is characterized by intense price competition due to patent expirations and generic proliferation.

- Prices for standard formulations are expected to decline further, averaging below USD 0.10 per capsule within 3–5 years.

- Formulation innovations and niche drug delivery mechanisms could support higher pricing in select segments.

- Rising competition from novel acid suppressants threatens long-term market stability for traditional PPIs.

- Strategic focus on differentiation, clinical validation, and patent management remains crucial for sustained profitability.

FAQs

-

What factors influence the price of SM Omeprazole DR globally?

Patents, generic competition, manufacturing costs, regional regulations, and formulation innovations primarily drive pricing variability. -

How has patent expiration affected the market for SM Omeprazole DR?

Patent expirations have significantly increased generic entry, leading to substantial price declines and market saturation. -

Are there prospects for premium pricing in the future for SM Omeprazole DR?

Only if proprietary formulations demonstrate clear clinical advantages or offer improved patient adherence, enabling differentiation. -

What emerging therapies could impact the demand for SM Omeprazole DR?

Potassium-competitive acid blockers like vonoprazan and other novel acid suppressants could reduce reliance on traditional PPIs. -

How should investors approach the SM Omeprazole DR market?

Focus on regions with market barriers to generic entry, monitor regulatory developments, and consider companies investing in innovative formulations.

References

[1] Markets and Markets, "Proton Pump Inhibitors Market," 2022.

[2] Global Burden of Disease Study, "Prevalence of GERD," 2021.

More… ↓