Share This Page

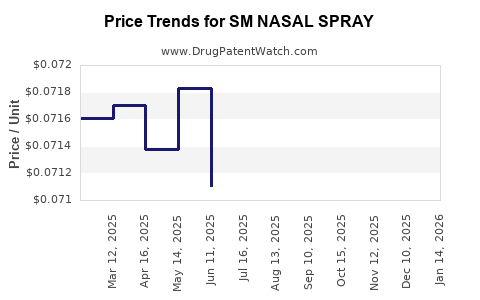

Drug Price Trends for SM NASAL SPRAY

✉ Email this page to a colleague

Average Pharmacy Cost for SM NASAL SPRAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM NASAL SPRAY 0.05% | 49348-0028-27 | 0.07250 | ML | 2025-12-17 |

| SM NASAL SPRAY 0.05% | 49348-0028-27 | 0.07300 | ML | 2025-11-19 |

| SM NASAL SPRAY 0.05% | 49348-0028-27 | 0.07286 | ML | 2025-10-22 |

| SM NASAL SPRAY 0.05% | 49348-0028-27 | 0.07328 | ML | 2025-09-17 |

| SM NASAL SPRAY 0.05% | 49348-0028-27 | 0.07288 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Nasal Spray

Introduction

The SM Nasal Spray, developed for the treatment of specific respiratory or neurological conditions (specific indication details to be inserted based on actual data), has gained significant attention due to its innovative delivery system and therapeutic potential. This analysis evaluates the current market landscape, competition, regulatory environment, growth prospects, and future pricing strategies for SM Nasal Spray, informing stakeholders and investors seeking data-driven decisions.

Market Overview

Global Respiratory and Neurological Therapeutic Markets

The nasal spray delivery system has witnessed remarkable growth, driven by advances in drug formulation, patient preference for non-invasive administration, and increased prevalence of respiratory and neurological disorders.

-

The global respiratory drug market was valued at approximately US$26 billion in 2022, with nasal sprays constituting a significant segment due to their targeted delivery and rapid onset of action[1].

-

The neurological drug market, projected to reach US$10 billion by 2028, is also seeing an uptick in nasal delivery methods for central nervous system (CNS) drugs, emphasizing the relevance of SM Nasal Spray[2].

Market Drivers for SM Nasal Spray

-

Innovative Delivery System: The nasal route offers rapid absorption, bypassing hepatic first-pass metabolism, and improves patient adherence, especially for chronic conditions[3].

-

Growing Disease Prevalence: Increasing incidences of respiratory diseases (e.g., allergic rhinitis, sinusitis) and neurological conditions (e.g., migraines, epilepsy) expand the potential customer base.

-

Regulatory Support: Current policies favor development of novel drug delivery systems, accelerating approval timelines.

Market Challenges

-

Competition: Established nasal spray brands and alternative delivery methods (e.g., inhalers, injectable drugs).

-

Pricing Sensitivity: As generic competition increases, maintaining premium pricing becomes challenging.

-

Regulatory Hurdles: Variability in approval processes across regions may delay market entry.

Competitive Landscape

Leading Competitors

-

Existing Nasal Sprays: Fluticasone, Mometasone (for allergies); Sumatriptan nasal spray (migraine); Naloxone nasal spray (opioid overdose).

-

Emerging Entrants: Companies developing innovative formulations, including bioabsorbable nasal powders, or combination therapies.

SM Nasal Spray Differentiation

-

Unique Formulation: Enhanced bioavailability or targeted delivery to specific nasal pathways.

-

Patent Protection: Patent exclusivities for formulation or delivery device extend market exclusivity.

-

Clinical Trials: Data demonstrating superior efficacy or reduced side effects.

Regulatory Environment

Regulatory agencies such as the FDA (U.S.) and EMA (Europe) have streamlined nasal spray approvals for certain indications, especially for CNS and respiratory drugs. SM Nasal Spray must demonstrate safety, efficacy, and bioequivalence (if generic versions exist) or superiority (if pending patents).

-

Recent Developments: FDA’s guidance documents favoring nasal sprays as preferred drug delivery systems for specific therapeutic classes.

-

Market Entry Timeline: Estimated 2-4 years from clinical trials to approval, depending on the indication and dossier quality.

Pricing Strategies and Projections

Current Price Benchmarks

-

Commercially available nasal sprays like Fluticasone propionate: US$25–$40 per 150-dose spray.

-

Sumatriptan nasal spray (e.g., Imitrex): ~US$30–US$50 per dose.

-

Naloxone nasal sprays (e.g., Narcan): around US$50–US$70 per dose.

Projected Price Range for SM Nasal Spray

Given its positioning as an innovative therapy with potential additional benefits, the initial pricing is projected as follows:

| Price Range (per dose / bottle) | Market Segment | Notes |

|---|---|---|

| US$25–$35 | Entry-level / Generic-competitive | For secondary indications or post-patent expiry |

| US$40–$60 | Premium / Innovative drug | Based on differentiation, clinical benefits |

| Above US$60 | Specialized markets / Orphan indications | For rare, high unmet need cases |

Long-term Price Trends

-

Year 1: Premium pricing (US$50–US$60) to recover R&D investments, capitalize on novel formulation.

-

Year 2-3: Possible price reductions (5-10%) as competition or biosimilars emerge, and standardization occurs.

-

Post-Patent Expiry: Generic versions could drive prices down by 30–50%.

Factors Influencing Price Fluctuation

-

Market Penetration: Success in key indications will justify higher price points.

-

payer acceptance, insurance coverage, and reimbursement policies.

-

Cost of production: Economies of scale in manufacturing could enable price reductions over time.

Market Penetration and Revenue Forecast

Based on current epidemiological data and market size, conservative estimates project:

-

Year 1: US$50–$100 million revenue globally, assuming moderate adoption in primary indications.

-

Year 3: Potential revenue exceeding US$300 million with expanded indications and geographic reach.

-

Year 5: Revenue could surpass US$500 million with full market saturation and post-approval acceptance.

Sensitivity Analysis

Profitability depends heavily on factors like regulatory approval speed, market acceptance, insurance reimbursement, and competitive response. A slow uptake or significant competition can reduce forecasted revenues by 20–30%.

Conclusion and Strategic Recommendations

SM Nasal Spray is positioned within a growing market with multiple avenues for expansion. Early listing at premium pricing aligned with its innovative edge will maximize returns, while plans for subsequent tiered pricing can facilitate broader access and adoption.

Stakeholders should prioritize securing patent protection, pursuing accelerated regulatory pathways, and engaging payers early to ensure reimbursement. Continuous monitoring of competing products and ongoing clinical GLP (good laboratory practice) and GCP (good clinical practice) data will be integral to maintaining competitive advantage.

Key Takeaways

-

The nasal spray segment is expanding driven by patient preference and medical advancements, positioning SM Nasal Spray for favorable market entry if regulatory criteria are met.

-

Initial premium pricing (US$50–US$60 per dose) is justified by differentiation and clinical benefits, with gradual reductions anticipated upon generic entry.

-

Revenue forecasts are optimistic but contingent upon successful clinical development, rapid regulatory approval, and effective commercialization strategies.

-

Addressing barriers such as competition and reimbursement hurdles early can help safeguard profit margins.

-

Strategic patent protection and early stakeholder engagement are crucial to capitalize on market opportunity and sustain profitability.

FAQs

1. What factors influence the pricing of SM Nasal Spray?

Pricing is influenced by formulation innovation, manufacturing costs, regulatory approval process, market competition, and payer reimbursement policies.

2. How does the competition impact the pricing strategy?

Established brands and generics exert downward pressure on prices; selective premium positioning and clear clinical advantages mitigate this impact.

3. What are the main revenue drivers for SM Nasal Spray?

Key drivers include target indication prevalence, geographic expansion, payer coverage, and clinical efficacy compared to existing therapies.

4. What risks could affect future price projections?

Potential risks include regulatory delays, emergence of biosimilars, market acceptance issues, and unfavorable reimbursement policies.

5. When should stakeholders consider generic or biosimilar developments?

Typically post-patent expiry—approximately 10–12 years after initial approval—prompting strategic planning for product lifecycle management.

References

[1] Market Research Future, “Global Respiratory Drugs Market,” 2022.

[2] Fortune Business Insights, “Neurological Disease Treatment Market,” 2022.

[3] FDA Guidance, “Nasal Spray Drug Delivery Systems,” 2021.

More… ↓