Share This Page

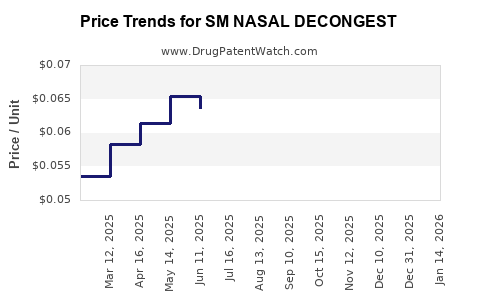

Drug Price Trends for SM NASAL DECONGEST

✉ Email this page to a colleague

Average Pharmacy Cost for SM NASAL DECONGEST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM NASAL DECONGEST 30 MG TAB | 70677-0005-03 | 0.05977 | EACH | 2025-12-17 |

| SM NASAL DECONGEST 30 MG TAB | 70677-0005-02 | 0.05977 | EACH | 2025-12-17 |

| SM NASAL DECONGEST ER 120 MG | 70677-0001-01 | 0.26341 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Nasal Decongestant

Introduction

The nasal decongestant market, particularly for products such as SM Nasal Decongestant, is experiencing dynamic growth driven by increasing prevalence of respiratory ailments, rising consumer demand for effective relief, and expanding distribution channels. This analysis examines the current market landscape, key drivers, competitive environment, regulatory factors, and projects future pricing trends for SM Nasal Decongestant.

Market Overview

Industry Landscape

The global nasal decongestant market was valued at approximately USD 4.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030 [1]. The rise correlates with increased respiratory complaints, notably among urban populations and aging demographics. Nasal decongestants, either in topical or oral forms, address symptoms associated with common cold, allergic rhinitis, sinusitis, and other upper respiratory conditions.

Product Specifics: SM Nasal Decongestant

While specific formulations may vary, SM Nasal Decongestant generally targets pharmaceutical markets with formulations containing active ingredients such as oxymetazoline or phenylephrine, offering rapid symptomatic relief. Its market penetration hinges on efficacy, safety profile, and regulatory approvals.

Market Drivers

- Growing Respiratory Illness Incidence: Increased cases of seasonal allergies, sinus infections, and COVID-19 sequelae have propelled demand.

- Consumer Preference for Fast-Acting Relief: Rapid symptom management makes nasal decongestants desirable.

- Expanding Distribution Channels: E-commerce platforms and retail pharmacies are broadening access.

- Product Innovation: Development of combination therapies and reduced side-effect formulations attract consumers.

- Regulatory Environment: Stringent regulations around ingredient safety influence market entry and product formulation.

Competitive Landscape

Leading pharmaceutical firms such as Johnson & Johnson, Bayer, GlaxoSmithKline, and local generics manufacturers dominate the market. Their strategies include product differentiation, marketing campaigns, and scalable manufacturing. Generic versions, including SM Nasal Decongestant, benefit from cost advantages and broad accessibility.

Notably, patent expirations for key decongestants across jurisdictions provide opportunities for generic entrants like SM Nasal Decongestant to capture market share.

Regulatory & Patent Dynamics

Regulatory agencies (FDA, EMA, etc.) enforce strict standards on nasal decongestants due to concerns about abuse potential (e.g., phenylephrine), cardiovascular risks, and safety. Patent protections for proprietary formulations typically last 20 years, but patent cliffs and exclusivity periods influence market entry timing and pricing.

For SM Nasal Decongestant, successful regulatory approval and patent stability are critical to sustain competitive advantage.

Price Analysis and Projections

Current Pricing Landscape

The average retail price for nasal decongestants in developed markets ranges from USD 4 to USD 12 per package, depending on formulation, brand recognition, and dosage. Generics and store brands often price at a 20–40% discount relative to branded counterparts.

In emerging markets, pricing strategies adapt to local purchasing power, with OTC nasal decongestants costing USD 2–5.

Factors Influencing Price Trends

- Regulatory Cost and Compliance: Stricter regulations may increase manufacturing costs, nudging prices upward.

- Market Penetration Strategy: Entry into low-income markets involves reduced pricing to boost volume.

- Ingredient Costs: Fluctuations in raw material prices, especially for active pharmaceutical ingredients (APIs), directly impact retail prices.

- Reimbursement and Insurance: In some regions, reimbursement policies may dampen retail prices or influence manufacturer pricing strategies.

- Competition and Patent Status: Entry of generics intensifies price competition, often leading to significant price reductions.

Future Price Projections (2023–2030)

Based on current trends and industry analyses:

- Developed Markets: Prices for SM Nasal Decongestant are projected to decline modestly at an annual rate of approximately 1-2%, driven by generic competition and manufacturing efficiencies, stabilizing around USD 3.50–USD 10 per package by 2030.

- Emerging Markets: Prices may see a slight increase of 1% annually, influenced by inflation, regulatory costs, and brand positioning, with retail prices reaching USD 2.50–USD 6 per unit.

Overall, the global average retail price is anticipated to decrease as generic options expand, but premium formulations (e.g., combination therapies or offering reduced side effects) could sustain higher price points in niche segments.

Market Entry and Pricing Strategies

- Value-Based Pricing: Emphasize efficacy, safety, and fast relief to justify premium pricing in mature markets.

- Cost Leadership: Compete on volume in price-sensitive regions by leveraging cost-efficient manufacturing for SM Nasal Decongestant.

- Brand Differentiation: Invest in marketing and clinical validation to command higher prices based on consumer trust.

- Regulatory Navigation: Ensuring fast approval paths and patent strategies can safeguard margins and influence pricing.

Risks and Challenges

- Regulatory Restrictions: Stringent controls may limit formulations or influence cost structures.

- Pricing Pressure: High competition, especially from generics, exerts downward pricing forces.

- Supply Chain Disruptions: Raw material shortages, geopolitical tensions, or manufacturing delays could impact pricing and availability.

- Consumer Safety Concerns: Adverse events or regulatory alerts about ingredients (e.g., phenylephrine) could reduce product desirability and pricing power.

Conclusion

The market for SM Nasal Decongestant is poised for steady growth aligned with the broader nasal decongestant sector. Price trajectories indicate a gradual decline in developed markets due to increased generic competition, with regional variations influenced by regulatory and economic factors. Companies that invest in product differentiation, regulatory compliance, and strategic pricing can optimize margins and market share over the next decade.

Key Takeaways

- The nasal decongestant market is projected to grow at a CAGR of 4.2% through 2030, driven by rising respiratory ailments.

- Pricing in advanced markets is expected to stabilize ~$3.50–$10 per unit; emerging markets may see modest increases.

- Market penetration hinges on regulatory approval, patent status, and competition from generics.

- Strategic differentiation, cost management, and compliance are pivotal to sustaining profitability.

- Ongoing innovation and regional pricing strategies will shape the future landscape of SM Nasal Decongestant.

FAQs

1. How does patent expiry influence the pricing of SM Nasal Decongestant?

Patent expiry generally leads to increased generic entry, intensifying price competition and reducing retail prices. Early patent protections enable companies to maintain premium pricing through brand recognition and formulations.

2. What are the regulatory challenges faced by nasal decongestant manufacturers?

Regulatory agencies scrutinize safety profiles, especially concerning ingredient misuse and side effects. Navigating these requirements requires comprehensive clinical data and compliance, impacting time-to-market and costs.

3. Which regions offer the most growth potential for SM Nasal Decongestant?

Emerging markets in Asia, Latin America, and Africa present significant growth opportunities due to rising urbanization, increasing health awareness, and expanding OTC distribution.

4. How do ingredient costs affect future pricing strategies?

Fluctuations in API costs directly influence manufacturing expenses. Manufacturers may pass these costs onto consumers or seek alternative sources, affecting the average retail price.

5. What role does consumer perception play in pricing?

Trust in brand efficacy and safety can justify higher prices. Consumer education and clinical validation influence perceptions and willingness to pay premium prices.

References

[1] MarketWatch, "Nasal Decongestants Market Size, Share & Trends Analysis," 2022.

More… ↓