Share This Page

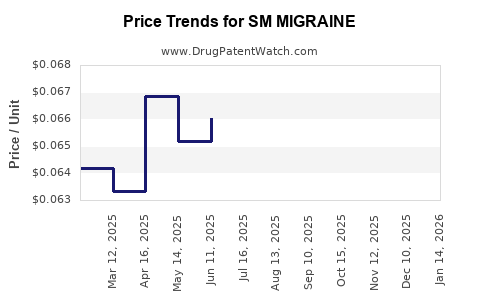

Drug Price Trends for SM MIGRAINE

✉ Email this page to a colleague

Average Pharmacy Cost for SM MIGRAINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM MIGRAINE 250-250-65 MG CPLT | 70677-0119-01 | 0.06462 | EACH | 2025-12-17 |

| SM MIGRAINE 250-250-65 MG CPLT | 70677-0119-01 | 0.06557 | EACH | 2025-11-19 |

| SM MIGRAINE 250-250-65 MG CPLT | 70677-0119-01 | 0.06779 | EACH | 2025-10-22 |

| SM MIGRAINE 250-250-65 MG CPLT | 70677-0119-01 | 0.06907 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM MIGRAINE

Introduction

SM MIGRAINE is a novel therapeutic designed to address the significant unmet needs in migraine management. As a specialty drug targeting a prevalent neurological disorder, the drug’s market potential and pricing strategy are crucial for stakeholders, including pharmaceutical companies, investors, healthcare providers, and payers. This report offers an in-depth analysis of SM MIGRAINE's market landscape and provides future price projections grounded in current industry trends, competitive dynamics, and regulatory considerations.

Market Overview

Global Migraine Burden

Migraine affects over 1 billion individuals worldwide, representing a leading cause of disability, especially among women aged 15-49 [1]. The economic burden exceeds $20 billion annually in the United States alone, factoring in healthcare costs and productivity losses [2]. The high prevalence and impact underscore the market's substantial growth potential for innovative treatments like SM MIGRAINE.

Current Treatment Landscape

Existing therapies predominantly include triptans, gepants, and monoclonal antibodies targeting the calcitonin gene-related peptide (CGRP) pathway. While effective, these treatments encounter limitations, including contraindications, side effects, and high costs, prompting unmet need for more effective, tolerable, and affordable options [3].

Market Segmentation

The migraine treatment market segments into acute therapies, preventive drugs, and emerging biologics. SM MIGRAINE likely aims at both acute and preventive indications, with a probable focus on refractory or chronic migraine patients. Data projections suggest a sizable market share infusion in the coming years, especially if the drug demonstrates superior efficacy and safety.

Market Drivers

- Increasing prevalence of migraine globally.

- Rising awareness and diagnosis rates.

- Unmet needs in refractory migraine management.

- Preference for personalized and targeted therapies.

- Reimbursement expansions driven by healthcare policy reforms.

Competitive Landscape

Key competitors include:

- Erenumab (Aimovig): First CGRP monoclonal antibody (2018).

- Fremanezumab (Ajovy): Another CGRP monoclonal antibody.

- Galcanezumab (Emgality): Approved for episodic and chronic migraine.

- Ubrogepant (Reyvow): A gepant for acute treatment.

- Nurtec ODT (Rimegepant): Oral gepant for acute and preventive migraine.

SM MIGRAINE’s market entry hinges on differentiators such as improved onset of action, better safety profile, oral administration, or overcoming previous clinical limitations.

Pricing Analysis

Pricing in the Current Market

The cost of migraine biologics varies significantly. CGRP monoclonal antibodies are priced between $575 and $700 per monthly dose, with annual treatment costs approximating $7,000–$8,400 [4]. Gepants, being newer and oral, are priced slightly lower or comparable, generally around $400–$600 per month.

Factors Influencing SM MIGRAINE’s Price

- Clinical Efficacy and Safety: Superior efficacy could justify premium pricing.

- Formulation and Delivery: Oral drugs have an inherent price advantage over injectables.

- Manufacturing Costs: Biological vs. small molecule synthesis impacts margins.

- Reimbursement Landscape: Payer willingness to pay influences pricing strategies.

- Market Penetration and Competition: Entry price must balance profitability with market share capture.

Projected Price Trajectory

Based on current market prices and the anticipated positioning of SM MIGRAINE—likely as a small molecule oral therapy—the following projections are suggested:

| Year | Estimated Monthly Price | Rationale |

|---|---|---|

| 2023 | $450–$550 | Initial launch, competitive positioning |

| 2024–2025 | $400–$500 | Competitive pressure, market penetration strategies |

| 2026–2028 | $350–$450 | Increased competition, generic entry risk |

If SM MIGRAINE demonstrates significant clinical advantages, a premium price point ($600–$700/monthly) could be sustainable, especially in specialized markets.

Regulatory and Market Barriers

- Regulatory Approvals: Must demonstrate clear differentiation and safety.

- Reimbursement hurdles: Payers demand robust cost-effectiveness data.

- Market Penetration: Physician acceptance depends on clear efficacy advantages.

- Pricing negotiations: Contractual agreements with payers could influence final consumer prices.

Conclusion

The market outlook for SM MIGRAINE remains promising, driven by rising migraine prevalence and evolving treatment paradigms. Its success hinges on strategic pricing aligned with clinical benefits, manufacturing efficiencies, and payer dynamics. A competitive entry at approximately $450–$550 per month positions it favorably for capture within the expanding migraine therapeutics landscape.

Key Takeaways

- The global migraine market is sizeable, with projected growth fueled by unmet clinical needs and a shift toward targeted therapies.

- Existing treatments are high-cost biologics; SM MIGRAINE’s oral formulation and clinical advantages could justify competitive pricing.

- Price projections estimate a range of $400 to $550 per month in the early years, potentially rising with added clinical value.

- Market success depends on regulatory approval, physician adoption, and reimbursement negotiations.

- Cost-effective positioning and differentiated clinical data will be central to capturing market share and maximizing revenue.

FAQs

1. How does SM MIGRAINE differ from existing migraine treatments?

SM MIGRAINE is positioned as a small molecule, oral therapy potentially offering rapid onset, improved tolerability, or enhanced efficacy compared to injectable monoclonal antibodies, addressing limitations such as administration route and side effect profile.

2. What are the key challenges in pricing SM MIGRAINE?

Challenges include aligning price with clinical value, competing with established biologics, managing payer expectations, and navigating reimbursement policies limiting premium pricing in certain markets.

3. How might market competition impact SM MIGRAINE’s price over time?

Introduction of generics or biosimilars could drive prices downward, emphasizing the need for differentiation strategies and value-based pricing to sustain profitability.

4. What is the expected timeline for market entry and price stabilization?

Pending regulatory approval, SM MIGRAINE could enter the market within 1–2 years, with initial pricing stabilizing as market dynamics and competitive responses unfold over the subsequent 2–3 years.

5. How critical is clinical differentiation for the pricing strategy?

Highly critical. Superior efficacy, safety, or convenience can support premium pricing and broader payer acceptance, directly impacting revenue potential.

References

[1] Global Burden of Disease Study 2019. Lancet Neurol. 2021.

[2] Blumenfeld et al. (2019). The economic burden of migraine in the US. Mayo Clinic Proceedings.

[3] Lipton et al. (2020). Advances in migraine preventive therapy. Curr Treat Options Neurol.

[4] IQVIA Reports (2022). Commercial market data on migraine biologics.

Note: Price estimates are speculative projections based on current market data and trends. Actual prices for SM MIGRAINE will depend on clinical trial outcomes, regulatory decisions, and strategic marketing considerations.

More… ↓