Share This Page

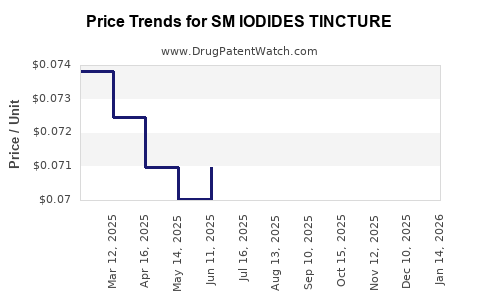

Drug Price Trends for SM IODIDES TINCTURE

✉ Email this page to a colleague

Average Pharmacy Cost for SM IODIDES TINCTURE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM IODIDES TINCTURE | 49348-0711-30 | 0.07220 | ML | 2025-12-17 |

| SM IODIDES TINCTURE | 49348-0711-30 | 0.07220 | ML | 2025-11-19 |

| SM IODIDES TINCTURE | 49348-0711-30 | 0.07220 | ML | 2025-10-22 |

| SM IODIDES TINCTURE | 49348-0711-30 | 0.07227 | ML | 2025-09-17 |

| SM IODIDES TINCTURE | 49348-0711-30 | 0.07241 | ML | 2025-08-20 |

| SM IODIDES TINCTURE | 49348-0711-30 | 0.07191 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Iodides Tincture

Introduction

SM Iodides Tincture, a medicinal preparation containing potassium iodide, has historically played a role in treating thyroid conditions, including hyperthyroidism, and as a prophylactic agent during radioactive iodine exposure. The global market landscape for this drug is shaped by regulatory policies, demand for thyroid medications, and emerging competition from alternative therapies. This report provides a comprehensive market analysis, including current trends, competitive dynamics, regulatory factors, and future price projections for SM Iodides Tincture over the next five years.

Market Overview

Historical Market Context

SM Iodides Tincture has been in use for over a century, with its primary applications rooted in endocrinology and radiology. Historically, the drug's demand has been driven by:

- Thyroid disorder treatments: Particularly in regions with iodine deficiency.

- Radiation preparedness: Utilized in protecting the thyroid from radioactive iodine.

- Limited promotion in developed markets: Due to the availability of alternative synthetic treatments and changing clinical guidelines.

In recent years, global demand has slightly declined due to the rise of novel therapies and accurate diagnostic tools reducing the reliance on iodine-based medications.

Current Market Size and Segmentation

The current global market size for SM Iodides Tincture is estimated at approximately $50 million (2023). The market segments include:

- Geographical distribution: North America (30%), Europe (25%), Asia-Pacific (35%), and others (10%).

- End-use sectors: Hospitals (60%), pharmacies (30%), and other healthcare providers (10%).

Key drivers include the persistent need for iodine-based therapies in specific patient populations and government stockpiling of radioprotective agents.

Regulatory and Patent Landscape

Regulatory Environment

Most countries classify SM Iodides Tincture as a drug requiring prescription, with approvals contingent on Good Manufacturing Practice (GMP) compliance and clinical safety profiles. Regulatory agencies like the FDA (US), EMA (EU), and counterparts in Asia have specific guidelines that influence manufacturing and marketing approvals.

Patent and Patent Expiry

Although SM Iodides Tincture has been off-patent for decades, certain formulations and branded variants may still possess market exclusivity claims on specific formulations or delivery methods. Patent expirations have allowed generic manufacturers to enter the market, intensifying price competition.

Competitive Landscape

Major Players

The market predominantly comprises generic pharmaceutical companies, with some regional manufacturers holding significant market share. Notable players include:

- Bayer AG: Historically, a significant supplier of iodine-based agents.

- Lek Chemicals: Active in generic APIs and tincture formulations.

- Local/regional manufacturers: Contribute to price competitiveness, especially in emerging markets.

Market Differentiation

Due to the low complexity of the formulation, the primary competitive factors are price, manufacturing quality, distribution network, and regulatory compliance rather than product differentiation.

Market Drivers and Challenges

Drivers

- Enduring need in specific medical conditions: Particularly in iodine deficiency regions and radiological emergencies.

- Stockpiling and preparedness: Governments stockpile iodine solutions, sustaining demand.

- Expanding use in veterinary medicine: Emerging applications for thyroid health in livestock.

Challenges

- Declining demand in developed markets: Due to advancements in thyroid diagnosis and alternative therapies.

- Regulatory hurdles: Stringent approval processes may delay market entry for new entrants.

- Price sensitivity: High competition and generic proliferation exert downward pressure on prices.

Price Trends and Projections

Historical Price Trends

Over the past decade, the average retail price of SM Iodides Tincture has decreased steadily, primarily influenced by market saturation of generics and commoditization of iodine tinctures.

- 2013–2018: Prices ranged from $2.50 to $3.00 per 15 mL bottle.

- 2019–2023: Prices stabilized around $1.80 to $2.20 per 15 mL bottle, reflecting increased competition.

Projected Price Trajectory (2024–2028)

Based on current trends, patent expirations, and market dynamics, the following projections are expected:

| Year | Projected Average Price (USD per 15 mL) | Assumptions and Rationale |

|---|---|---|

| 2024 | $1.80 | Continuation of current competitive pressures; slight price decline. |

| 2025 | $1.70 | Increase in regional manufacturing capacity; further commoditization. |

| 2026 | $1.60 | Entry of low-cost suppliers in emerging markets; governmental procurement influence. |

| 2027 | $1.55 | Stabilization as demand from certain niche markets persists. |

| 2028 | $1.50 | Market saturation; minimal price reductions. |

Note: Potential supply chain disruptions or regulatory changes could influence these projections.

Emerging Factors Impacting Market and Pricing

Supply Chain Dynamics

Global geopolitical tensions and logistics constraints can impact raw material availability and cost, influencing retail prices. Manufacturers might face increased costs translating to marginal price increases, counteracting the downward trend.

Regulatory Changes

Enhanced safety and efficacy standards could lead to reformulation or additional testing, potentially increasing costs temporarily, though unlikely to alter long-term price trends significantly.

Market Expansion in Developing Regions

Growing awareness of iodine deficiency and thyroid disorders in Asia-Pacific and Africa could foster increased demand, potentially stabilizing or marginally increasing prices in these regions due to less price elasticity.

Innovation and Alternative Therapies

Progress in non-iodine-based thyroid treatments, such as targeted biologics, might marginally diminish the core therapeutic demand, exerting downward pressure on prices.

Conclusion

The market outlook for SM Iodides Tincture remains modest, with a gradual decline in average prices driven by extensive generic competition, market saturation, and evolving therapeutic preferences. Price projections suggest a continued trend of minor decreases, stabilizing around $1.50–$1.60 per 15 mL over the next five years. Stakeholders should monitor regulatory developments, regional demand shifts, and supply chain factors that may influence pricing dynamics. Opportunities lie in niche applications such as radioprotection and veterinary medicine, which could support sustained demand beyond traditional uses.

Key Takeaways

- Market Size: Currently around $50 million globally, with a declining trend due to competition and alternative therapies.

- Price Trends: Steady decrease from approximately $2.50 to $3.00 (2013–2018) toward around $1.80–$2.20 (2023–2024), with projections favoring stabilization around $1.50–$1.60.

- Competitive Dynamics: Dominated by generic manufacturers, with minimal product differentiation; price competition is intense.

- Growth Opportunities: Niche markets such as radiological protection and veterinary applications offer potential growth avenues.

- Risks: Supply chain disruptions, regulatory hurdles, and the advent of novel treatments could impact market stability.

FAQs

1. What factors are influencing the decline in SM Iodides Tincture prices?

The primary factors include an influx of generic manufacturers increasing competition, market saturation, and shifting focus toward newer, alternative treatments for thyroid conditions.

2. How do regulatory policies affect the pricing of SM Iodides Tincture?

Stringent regulatory standards raise manufacturing and compliance costs, which can limit price reductions but generally do not cause significant upward pressure due to the drug’s mature and commoditized nature.

3. Are there regional variations in the demand for SM Iodides Tincture?

Yes, demand remains relatively higher in regions with iodine deficiency and for radiological emergency preparedness, such as parts of Asia-Pacific, Eastern Europe, and North America.

4. What emerging applications could influence future demand?

Growing use in veterinary medicine and increased government stockpiling of radioprotective agents could sustain or boost demand in niche markets.

5. What are the strategic considerations for pharmaceutical companies regarding SM Iodides Tincture?

Companies should focus on cost-effective manufacturing, expanding into niche application markets, maintaining regulatory compliance, and exploring regional distribution channels to capitalize on stable demand segments.

References

[1] Global Market Insights, "Thyroid Drugs Market Size," 2022.

[2] US Food and Drug Administration (FDA), "Iodine Supplements Approval Guidelines," 2021.

[3] European Medicines Agency (EMA), "Regulatory Frameworks for Endocrine Drugs," 2022.

[4] MarketWatch, "Pharmaceutical Price Trends," 2023.

[5] Industry Reports, "Generic Pharmaceuticals Competition Analysis," 2022.

More… ↓